Shaw 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

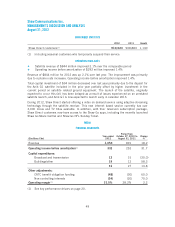

During 2011, the Company incurred costs in respect of the acquisition of the broadcasting

business and organizational restructuring which amounted to $91 million. Amounts include

acquisition related costs to effect the acquisition, such as professional fees paid to lawyers and

consultants. The integration and restructuring costs relate to integrating the new business and

increasing organizational effectiveness for future growth as well as package costs for the former

CEO. In March 2011 Shaw implemented various cost saving initiatives including staff

reductions and a review of overhead expenses to drive efficiencies and enhance

competitiveness. Approximately 550 employee positions were eliminated, including 150 at the

management level.

The Company recorded a $6 million gain in respect of a remeasurement to fair value of the

Company’s 50% interest in Mystery and 49% interest in The Cave which were held prior to the

acquisition on May 31, 2012. The fair value of the Company’s equity interest in these specialty

channels held prior to the acquisition was $19 million compared to a carrying value of $13 million.

For derivative instruments where hedge accounting is not permissible or derivatives are not

designated in a hedging relationship, the Company records changes in the fair value of

derivative instruments in the income statement. In addition, the Media senior unsecured notes

had a variable prepayment option which represented an embedded derivative that was

accounted for separately at fair value until the Company gave notice of redemption during the

fourth quarter of 2011. The fluctuation in amounts recorded in 2012 compared to 2011 is due

to a reduction in the number of outstanding contracts as well as the amounts recorded in

respect of the embedded derivative in the prior year.

The Company records accretion expense in respect of the discounting of certain long-term

liabilities and provisions which are accreted to their estimated value over their respective terms.

The expense is primarily in respect of CRTC benefit obligations as well as the liability which

arose in 2010 when the Company entered into amended agreements with the counterparties to

certain cross-currency agreements which fixed the settlement of the principal portion of the

swaps in December 2011.

In conjunction with the acquisition of the broadcasting business, the Company assumed a US

$390 million term loan and US $338 million senior unsecured notes. Shortly after closing the

acquisition, the Company repaid the term loan including breakage of the related cross currency

interest rate swaps. A portion of the senior unsecured notes were repurchased during the

second quarter of 2011 and the Company redeemed the remaining notes in the fourth quarter

of 2011. As a result of fluctuations of the Canadian dollar relative to the US dollar, a foreign

exchange gain was recorded.

The Company recorded income of $14 million primarily in respect of its 49.9% equity interest in

CW Media for the period September 1 to October 26, 2010. On October 27, 2010, the Company

acquired the remaining equity interest in CW Media as part of its purchase of all the broadcasting

assets of Canwest. Results of operations are consolidated effective October 27, 2010. The equity

income was comprised of approximately $20 million of operating income before amortization

partially offset by interest expense of $5 million and other net costs of $2 million. The Company

also records equity income (loss) in respect of interests in several specialty channels.

Other gains generally includes realized and unrealized foreign exchange gains and losses on US

dollar denominated current assets and liabilities, gains and losses on disposal of property, plant

and equipment and minor investments, and the Company’s share of the operations of Burrard

Landing Lot 2 Holdings Partnership. In the current year, the category also includes a loss of

44