Shaw 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2012 and 2011

[all amounts in millions of Canadian dollars except share and per share amounts]

evolution of wireless technologies, the capital required to build a competitive network and

recent changes in the wireless competitive environment. As a result, the Company decided to

discontinue any further construction of its traditional wireless network. Accordingly, the assets

were measured at the lower of carrying amount and estimated fair value less costs to sell

resulting in a write-down of $112 and classification of $16 as assets held for sale. The

Company has determined the carrying value of the wireless spectrum licenses continues to be

appropriate and intends to hold these assets while it reviews all options.

The results of operations and related cash flows have been reported as discontinued operations.

The loss from discontinued operations in 2012 and 2011 is comprised of the following:

2012

$

2011

$

Operating expenditures –7

Amortization –1

Write-down of assets –112

Income tax recovery –(31)

Loss from discontinued operations –89

The cash flows used in discontinued operations in 2012 and 2011 is comprised of the

following:

2012

$

2011

$

Cash used in operating activities –11

Cash used in investing activities 3137

Decrease in cash from discontinued operations 3148

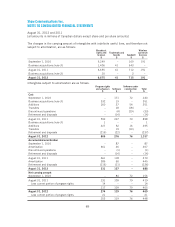

4. ACCOUNTS RECEIVABLE

2012

$

2011

$

September 1,

2010

$

Subscriber and trade receivables 436 425 210

Due from related parties [note 27] 111

Miscellaneous receivables 24 46 4

461 472 215

Less allowance for doubtful accounts (28) (29) (19)

433 443 196

Included in operating, general and administrative expenses is a provision for doubtful accounts

of $30 (2011 – $34).

84