Shaw 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

(In $millions Cdn)

Increased operating income before amortization 76

Increased amortization (74)

Decreased interest expense 2

Change in other net costs and revenue(1) 183

Decreased income taxes 15

202

(1) Other net costs and revenue include gain on redemption of debt, CRTC benefit

obligations, business acquisition, integration and restructuring expenses, gain on

remeasurement of interests in equity investments, gain (loss) on derivative instruments,

accretion of long-term liabilities and provisions, foreign exchange gain on unhedged long-

term debt, equity income from associates and other gains as detailed in the Consolidated

Statements of Income.

SEGMENTED OPERATIONS REVIEW

CABLE

FINANCIAL HIGHLIGHTS

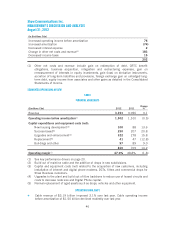

($millions Cdn) 2012 2011

Change

%

Revenue 3,193 3,096 3.1

Operating income before amortization(1) 1,502 1,510 (0.5)

Capital expenditures and equipment costs (net):

New housing development(2) 100 88 13.6

Success-based(3) 250 207 20.8

Upgrades and enhancement(4) 322 278 15.8

Replacement(5) 41 47 (12.8)

Buildings and other 97 89 9.0

810 709 14.2

Operating margin(1) 47.0% 48.8% (1.8)

(1) See key performance drivers on page 20.

(2) Build out of mainline cable and the addition of drops in new subdivisions.

(3) Capital and equipment costs (net) related to the acquisition of new customers, including

installation of internet and digital phone modems, DCTs, filters and commercial drops for

Shaw Business customers.

(4) Upgrades to the plant and build out of fibre backbone to reduce use of leased circuits and

costs to decrease node size and Digital Phone capital.

(5) Normal replacement of aged assets such as drops, vehicles and other equipment.

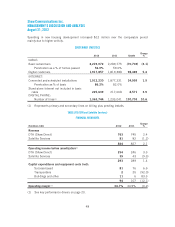

OPERATING HIGHLIGHTS

ŠCable revenue of $3.19 billion improved 3.1% over last year. Cable operating income

before amortization of $1.50 billion declined modestly over last year.

46