Shaw 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

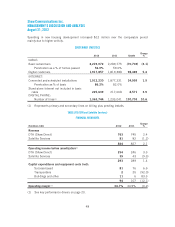

Amortization of deferred equipment revenue and deferred equipment costs increased in 2012

due to the sales mix of equipment and changes in customer pricing on certain equipment.

Amortization of property, plant and equipment, intangibles and other increased over the comparable

period as the amortization of new expenditures and inclusion of the Media division for the full twelve

months in the current year exceeded the impact of assets that became fully depreciated.

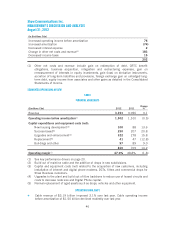

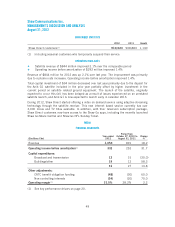

Amortization of financing costs and Interest expense

(In $millions Cdn) 2012 2011

Change

%

Amortization of financing costs – long-term debt 54 25.0

Interest expense 330 332 (0.6)

Other income and expenses

(In $millions Cdn) 2012 2011

Increase

(decrease)

in income

Gain on redemption of debt –33 (33)

CRTC benefit obligations (2) (139) 137

Business acquisition, integration and restructuring costs –(91) 91

Gain on remeasurement of interests in equity investments 6–6

Gain (loss) on derivative instruments 1(22) 23

Accretion of long-term liabilities and provisions (14) (15) 1

Foreign exchange gain on unhedged long-term debt –17 (17)

Equity income from associates –14 (14)

Other gains –11 (11)

The gain on redemption of debt is in respect of the Media 13.5% senior unsecured notes. As a

result of a change of control triggered on the acquisition of the Media business an offer to

purchase all of the US $338 million 13.5% senior unsecured notes at a cash price equal to

101% was required. An aggregate US $52 million face amount, having an aggregate accrued

value of US $56 million, was tendered under the offer and purchased by the Company for

cancellation. Also during 2011, the Company redeemed the remaining outstanding US $260

million face amount, having an aggregate accrued valued of US $282 million, at 106.75% as

set out under the terms of the indenture. As a result, the Company recorded a gain of $33

million which resulted from recognizing the remaining unamortized acquisition date fair value

adjustment of $57 million partially offset by the 1% repurchase and 6.75% redemption

premiums totaling $19 million and $5 million in respect of the write-off of the embedded

derivative instrument associated with the early prepayment option.

As part of the CRTC decisions approving the acquisition of Mystery and The Cave during the

current year and the Media acquisition in the prior year, the Company is required to contribute

approximately $2 million and $180 million in new benefits to the Canadian broadcasting

system over seven years. Most of this contribution will be used to create new programming on

Shaw Media services, construct digital transmission towers and provide a satellite solution for

OTA viewers whose local television stations do not convert to digital. The fair value of the

obligations of $2 million and $139 million was determined by discounting future net cash flows

using appropriate discount rates and have been recorded in the income statement.

43