Shaw 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2012

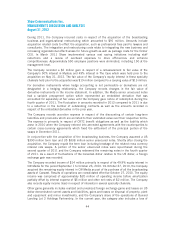

OPERATING HIGHLIGHTS

Revenue and operating income before amortization for the year were $1.05 billion and $332

million, respectively, compared to $891 million and $252 million for the prior year period from

October 27, 2010 to August 31, 2011. For informational purposes, on a comparative basis to

the full twelve months ended August 31, 2011, Media revenues were down 2% reflecting

softness in the advertising market as a result of continued economic uncertainty. Operating

income before amortization increased 2%, as lower programming costs in 2012 more than

offset the reduced advertising revenues.

During the year, Global delivered solid programming results led by the strength of Big Brother,

Hotel Hell and Rookie Blue. The Media specialty portfolio also led in the channel rankings in

the adult 25-54 category, with 4 of the Top 10 analog services, including History as the top

entertainment network in Canada, and 5 of the Top 10 digital services, with National

Geographic as the leading digital channel. During late 2012 Shaw Media launched Lifetime,

H2 and National Geographic Wild.

In News, Global is in the number one position in all three major western markets with ratings

up for the majority of all news programs. Global Toronto News Hour moved into the number two

position and the station also delivered solid audience growth in the News Hour Final. The West

Block with Tom Clark continued to perform well, beginning its second season as Canada’s most

watched political talk show.

The conventional fall programming premiered throughout the month of September with a solid

returning line-up and new drama programming including Vegas, Chicago Fire, Last Resort and

Elementary. Shaw Media also added several new comedies to the fall schedule including Go On

and Guys With Kids.

Capital investment continued on various projects and included upgrading production

equipment, infrastructure and facility investments.

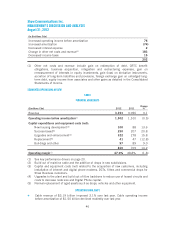

IV. FINANCIAL POSITION

Total assets at August 31, 2012 were $12.7 billion compared to $12.6 billion at August 31,

2011. Following is a discussion of significant changes in the consolidated statement of

financial position since August 31, 2011.

Current assets declined $31 million primarily due to decreases in cash of $16 million, assets

held for sale of $15 million, and accounts receivable of $10 million, the total of which was

partially offset by increased inventories of $5 million and other current assets of $7 million.

Cash decreased as the cash outlay for investing and financing activities exceeded the funds

provided by operations. Assets held for sale decreased as the sale of the wireless assets was

completed during the first quarter and accounts receivable declined due to timing of collection

of miscellaneous receivables. Inventories were higher due to timing of equipment purchases

while other current assets were up primarily as a result of increases in program rights.

Property, plant and equipment increased $42 million as current year capital investment

exceeded amortization and the asset write-down related to the electrical fire and resulting water

damage at Shaw Court.

Other long-term assets were up $73 million primarily due to an increase in deferred equipment

costs and related customer equipment financing receivables.

50