Shaw 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012

Annual

Report

Table of contents

-

Page 1

2012 Annual Report -

Page 2

... Statements Notes to Consolidated Financial Statements Five Years in Review Shareholders' Information Corporate Information The Annual General Meeting of Shareholders will be held on January 9, 2013 at 11:00am (Mountain Time) at the Shaw Barlow Trail Building, 2400 - 32 Avenue NE, Calgary Alberta... -

Page 3

Shaw Communications Inc. 2012 Annual Report Exciting things are coming down the pipe at Shaw. As technology and content evolve - in this anytime, anywhere, at home or on-the-go world - we are helping Canadians make sense of it all. We put our customers first, work hard to earn their trust, and ... -

Page 4

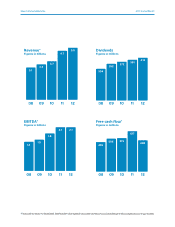

Shaw Communications Inc. 2012 Annual Report Revenue* Figures in billions 4.7 5.0 Dividends Figures in millions 391 416 3.7 3.4 3.1 304 352 372 08 09 10 11 12 08 09 10 11 12 EBITDA* Figures in billions 2.1 1.8 1.4 1.5 2.1 Free cash flow* Figures in millions 617 506 455 515 482 08... -

Page 5

... new specialty services - National Geographic Wild, Lifetime and H2 - and Global launched the first Mandarin language newscast produced by a national network in Canada. Using adaptive streaming technology through the satellite receiver, Shaw Direct launched a Video-On-Demand service and currently... -

Page 6

... Satellite capital infrastructure and approximately $30 million in Media. Free cash flow for the year was $482 million. We increased our dividend during 2012 by 6%, paying a total of $416 million. Our capital structure and healthy liquidity position support investment grade ratings. We enter 2013... -

Page 7

Shaw Communications Inc. REPORT TO SHAREHOLDERS August 31, 2012 OUR COMMUNITIES We are committed to giving back to the communities where we live and work and taking action to reduce our environmental impact. We support a wide variety of initiatives including those directed towards children and ... -

Page 8

... of the current date. These assumptions include, but are not limited to, general economic conditions, interest and exchange rates, technology deployment, content and equipment costs, industry structure, conditions and stability, government regulation and the integration of recent acquisitions. Many... -

Page 9

... environment in the markets in which Shaw operates and from the development of new markets for emerging technologies; industry trends and other changing conditions in the entertainment, information and communications industries; Shaw's ability to execute its strategic plans; opportunities that may... -

Page 10

...services (through Shaw Business), satellite direct-to-home services (through Shaw Direct) and engaging programming content (through Shaw Media). Shaw Media operates the second largest conventional television network in Canada, Global Television, and numerous specialty networks. It provides customers... -

Page 11

... to convert television analog tiers to digital (the Digital Network Upgrade "DNU"). This upgrade, which continued through 2012, is expected to significantly increase the capacity of the Shaw network and allow the Company to expand its Internet, HD and On Demand offerings. Shaw's investments in plant... -

Page 12

... purchase or rent. To its Digital subscribers, Shaw also offers On Demand viewing options, including Pay-Per-View ("PPV") and Video-on-Demand ("VOD") services. The PPV service allows customers to select and pay for specific programs which are available on various channels with different start times... -

Page 13

...to support new, cutting-edge broadband applications that require faster download speeds. Shaw operates two Internet data centres in Calgary, Alberta and several smaller regional centres. The data centres allow the Company to manage its Internet services exclusively, providing e-mail service directly... -

Page 14

... by the satellite. Shaw Direct and Satellite Services businesses share the satellite infrastructure distributing digital video and audio signals to different markets (residential and business), thereby allowing the Company to derive distinct revenue streams from different customers using a common... -

Page 15

... comprising the Company's Satellite Segment is set forth below. Shaw Direct Shaw Direct is one of three DTH satellite operators licensed by the CRTC to deliver digital subscription video and audio programming services from satellites directly to subscribers' homes and businesses. Shaw Direct began... -

Page 16

...Services redistributes television and radio signals via satellite to cable operators and other multi-channel system operators in Canada and the U.S., referred to as a satellite relay distribution undertaking ("SRDU"), and provides uplink and network management services for conventional and specialty... -

Page 17

... were equity accounted until October 27, 2010, at which time the balance sheet and results of operations were consolidated. The acquisition of Shaw's Media business included the Global Television Network ("Global") and a leading portfolio of Specialty services. Technology is driving change in the... -

Page 18

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2012 The following table sets forth all of the Specialty services in which the Company holds an interest: Specialty Services Operated % Equity Interest Showcase Slice History H2 HGTV Canada Food Network Canada Action Lifetime ... -

Page 19

... of designated electronic materials and, in some cases, pay a per-item fee. Such regulations have not had, and are not expected to have, a material effect on the Company's earnings or competitive position. (c) Foreign operations Shaw does not have material foreign assets or operations. Shaw Business... -

Page 20

... for new or increased fees through regulation Effective September 1, 2009, each licensed BDU was required to contribute 1.5% of its gross revenues derived from Broadcasting to the Local Programming Improvement Fund ("LPIF") to support local television stations operating in non-metropolitan markets... -

Page 21

... with other industry members and municipalities. Digital Phone, new media and Internet Regulation of the incumbent local exchange carriers ("ILECs"), competitors of Shaw's Digital Phone business, is now largely governed by the current Government's deregulatory initiatives. Specifically, in December... -

Page 22

... competitive phone providers such as Shaw. These changes resulted in a decrease in the percentage of contribution by the Corporation to fund local telephone service in high cost serving areas, and eliminated any subsidy that Shaw was receiving for providing telephone service in rural or remote areas... -

Page 23

... August 31, 2012 The Corporation completed the digital transition in all mandatory markets as of August 31, 2011. During 2012 the Corporation commenced converting transmitters in non-mandatory markets and expects to be complete in 2016. Vertical integration proceeding In view of increasing industry... -

Page 24

... operating income before amortization by revenue. Relative increases period over period in operating income before amortization and in operating margin are indicative of the Company's success in delivering valued products and services, and engaging programming content to its customers in a cost... -

Page 25

... uses free cash flow as a measure of the Company's ability to repay debt and return cash to shareholders. Consolidated free cash flow is calculated as follows: Year ended August 31, Change 2012 2011(2) % ($millions Cdn) Revenue Cable Satellite Media Intersegment eliminations Operating income... -

Page 26

.... Internet customers include all modems on billing plus pending installations and Digital Phone lines includes all phone lines on billing plus scheduled installations. All subscriber counts exclude complimentary accounts but include promotional accounts. Cable measures penetration for basic services... -

Page 27

...cable, Internet, Digital Phone and DTH customers includes subscriber service revenue when earned. The revenue is considered earned as the period of service relating to the customer billing elapses. The Company has multiple deliverable arrangements comprised of upfront fees (subscriber connection fee... -

Page 28

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2012 In conjunction with equipment revenue, the Company also incurs incremental direct costs which include equipment and related installation costs. These direct costs cannot be separated from the undelivered subscription ... -

Page 29

... principal areas: 1. Corporate departments such as engineering and information technology ("IT"): Engineering is primarily involved in overall planning and development of the cable/ Internet/Digital Phone infrastructure. Labour and overhead costs directly related to these activities are capitalized... -

Page 30

...licensing that allow access to homes and subscribers in a specific area that are identified on a business combination with respect to the acquisition of shares or assets of a BDU. Broadcast licenses in the media business are licenses to operate conventional and specialty services that are identified... -

Page 31

... non-unionized employees. The amounts reported in the financial statements relating to the defined benefit pension plans are determined using actuarial valuations that are based on several assumptions including the discount rate, rate of compensation increase and the expected return on plan assets... -

Page 32

... at the date of the financial statements and the amount can be reasonably estimated. Contractual and other commercial obligations primarily relate to network fees, program rights and operating lease agreements for use of transmission facilities, including maintenance of satellite transponders and... -

Page 33

... the current year the Company paid network fees and provided uplink of television signals to these channels. Key management personnel Key management personnel consist of the Board of Directors and the most senior executive team that have the authority and responsibility for directing and controlling... -

Page 34

..., the Company had early adopted the new accounting standards for business combinations, consolidation and non-controlling interests effective September 1, 2010, which are aligned with IFRS 3 Business Combinations and IAS 27 Consolidated and Separate Financial Statements. (b) Employee benefits IFRS... -

Page 35

... inclusion rate results in a reduction in the deferred income tax liability related to these assets at transition and also results in a decrease to goodwill and deferred income tax liability and increase to non-controlling interests in respect of the Media business acquisition in fiscal 2011. Under... -

Page 36

... an exhaustive list of all potential issues that could affect the financial results of the Company. The principal risks relate to Competition and technological change, including change in regulatory regime Economic conditions Interest rates, foreign exchange rates, and capital markets Litigation... -

Page 37

... position through investments in infrastructure, technology, programming and customer service, there can be no assurance that these investments will be sufficient to maintain Shaw's market share or performance in the future. CABLE TELEVISION AND DTH Shaw's cable television and DTH systems currently... -

Page 38

... developments may negatively affect the business and prospects of Shaw's Digital Phone. INTERNET INFRASTRUCTURE Through Shaw Business, Shaw competes with other telecommunications carriers in providing high-speed broadband communications services (data and video transport and Internet connectivity... -

Page 39

...for new or increased fees. Changes in the regulatory regime may adversely affect the operations and performance of the Company. ii) Economic conditions Canada's economy is affected by uncertainty in global financial and equity markets and slowdowns in global economic growth. Advertising revenues are... -

Page 40

... Services business. The Company has also secured a dedicated payload (16 transponders plus 5 spares) on Telesat's soon to be launched Anik G1 satellite (projected in service date in early calendar 2013). The Company owns certain transponders on Anik F2 and has long-term capacity service agreements... -

Page 41

... and operating results. The Company protects its network through a number of measures including physical security, ongoing maintenance and placement of insurance on its network equipment and data centers. The Company self-insures the plant in the cable and Internet distribution system as the cost of... -

Page 42

... Board of Directors. At the current approved dividend amount, the Company would pay approximately $430 million in common share dividends during 2013 (before taking into account the Company's dividend reinvestment plan ("DRIP"), see further details on page 53). While the Company expects to generate... -

Page 43

... included employee related costs, mainly related to bringing the new customer service centres on line, as well as higher marketing, sales and programming costs. The fourth quarters of 2011 and 2012 were both impacted by the cyclical nature of the Media business with lower advertising revenues in... -

Page 44

... trend of quarterly revenue and operating income before amortization: Growth in subscriber statistics as follows: 2012 Subscriber Statistics First Second Third Fourth First 2011 Second Third Fourth Basic cable customers Digital customers Internet customers Digital Phone lines DTH customers (22,768... -

Page 45

...Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2012 III. RESULTS OF OPERATIONS OVERVIEW OF FISCAL 2012 CONSOLIDATED RESULTS Change 2012 2011 % % (In $millions Cdn except per share amounts) 2012 2011 2010(3) Operations: Revenue 4,998 4,741 3,718 5.4 27.5 (1) Operating income... -

Page 46

... of Shaw's products and services through a unique technology experience of interactive displays along with hands on training and technical support. In October 2010 Shaw completed its acquisition of the broadcasting business of Canwest including CW Media, the company that owned the specialty channels... -

Page 47

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2012 Amortization of deferred equipment revenue and deferred equipment costs increased in 2012 due to the sales mix of equipment and changes in customer pricing on certain equipment. Amortization of property, plant and ... -

Page 48

... costs to effect the acquisition, such as professional fees paid to lawyers and consultants. The integration and restructuring costs relate to integrating the new business and increasing organizational effectiveness for future growth as well as package costs for the former CEO. In March 2011 Shaw... -

Page 49

... in 2012 compared to $559 million in 2011. The year-over-year changes are summarized in the table below. Net income from continuing operations increased $202 million over the prior year. The current year benefitted from a reduction in net other costs of $183 million, improved operating income before... -

Page 50

...equipment costs (net) related to the acquisition of new customers, including installation of internet and digital phone modems, DCTs, filters and commercial drops for Shaw Business customers. Upgrades to the plant and build out of fibre backbone to reduce use of leased circuits and costs to decrease... -

Page 51

... subscribers decreased 70,703. Cable revenue for 2012 of $3.19 billion improved 3.1% over the prior year. Rate increases and customer growth in Internet and Digital Phone, including Business growth, partially offset by lower Basic cable subscribers, accounted for the improvement. Operating income... -

Page 52

... 31, 2012 Spending in new housing development increased $12 million over the comparable period mainly due to higher activity. SUBSCRIBER STATISTICS 2012 2011 Growth Change % CABLE: Basic subscribers Penetration as a % of homes passed Digital customers INTERNET: Connected and scheduled installations... -

Page 53

...Direct started offering a video on demand service using adaptive streaming technology through the satellite receiver. This new internet based service currently has over 3,000 movie and TV titles available. In addition, with their television subscription package, Shaw Direct customers now have access... -

Page 54

..., 2011, Media revenues were down 2% reflecting softness in the advertising market as a result of continued economic uncertainty. Operating income before amortization increased 2%, as lower programming costs in 2012 more than offset the reduced advertising revenues. During the year, Global delivered... -

Page 55

... the actuarial losses recorded on employee benefit plans. V. CONSOLIDATED CASH FLOW ANALYSIS Operating activities (In $millions Cdn) 2012 2011 Change % Funds flow from continuing operations Net decrease (increase) in non-cash working capital balances related to continuing operations 1,299 18 1,317... -

Page 56

... as increased current income taxes, program rights purchases and CRTC benefit obligation funding in the current year. The net change in non-cash working capital balances related to continuing operations fluctuated over the comparative period due to fluctuations in accounts receivable and the timing... -

Page 57

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2012 To allow for timely access to capital markets, the Company filed a short form base shelf prospectus with securities regulators in Canada and the U.S. on November 18, 2010. The shelf prospectus allows for the issue of up to... -

Page 58

... in respect of program rights. VII. ADDITIONAL INFORMATION Additional information relating to Shaw, including the Company's Annual Information Form dated November 29, 2012, can be found on SEDAR at www.sedar.com. VIII. COMPLIANCE WITH NYSE CORPORATE GOVERNANCE LISTING STANDARDS Disclosure of... -

Page 59

... Shaw's disclosure controls and procedures and internal control over financial reporting. As at August 31, 2012, the Company's management, together with its Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the design and operation of each of the Company... -

Page 60

...FINANCIAL REPORTING November 29, 2012 MANAGEMENT'S RESPONSIBILITY FOR FINANCIAL REPORTING The accompanying consolidated financial statements of Shaw Communications Inc. and all the information in this annual report are the responsibility of management and have been approved by the Board of Directors... -

Page 61

...the Treadway Commission. Based on this evaluation, management concluded that the Company's system of internal control over financial reporting was effective as at August 31, 2012. [Signed] [Signed] Brad Shaw Chief Executive Officer Steve Wilson Senior Vice President and Chief Financial Officer 57 -

Page 62

... audited the accompanying consolidated financial statements of Shaw Communications Inc., which comprise the consolidated statements of financial position as at August 31, 2012 and 2011, and September 1, 2010, and the consolidated statements of comprehensive income, changes in equity and cash flows... -

Page 63

...Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated November 29, 2012 expressed an unqualified opinion on Shaw Communications Inc's internal control over financial reporting. Calgary, Canada November 29, 2012 Chartered Accountants... -

Page 64

... ON INTERNAL CONTROLS UNDER STANDARDS OF THE PUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD (UNITED STATES) To the Shareholders of Shaw Communications Inc. We have audited Shaw Communications Inc.'s internal control over financial reporting as at August 31, 2012, based on the criteria established in... -

Page 65

... statements of financial position of Shaw Communications Inc. as at August 31, 2012 and 2011, and September 1, 2010, and the consolidated statements of comprehensive income, changes in equity and cash flows for the years ended August 31, 2012 and 2011, and our report dated November 29, 2012... -

Page 66

Shaw Communications Inc. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION [millions of Canadian dollars] August 31, 2012 $ August 31, September 1, 2011 2010 $ $ [note 31] [note 31] ASSETS Current Cash Accounts receivable [note 4] Inventories [note 5] Other current assets [note 6] Derivative ... -

Page 67

... 9] Property, plant and equipment, intangibles and other [notes 8, 9, 10 and 15] Operating income Amortization of financing costs - long-term debt [note 13] Interest expense [notes 13 and 24] Gain on redemption of debt [note 13] CRTC benefit obligations [note 3] Business acquisition, integration and... -

Page 68

Shaw Communications Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years ended August 31 [millions of Canadian dollars] 2012 $ 2011 $ [note 31] Net income Other comprehensive income (loss) [note 20] Change in unrealized fair value of derivatives designated as cash flow hedges Adjustment for ... -

Page 69

... dollars] Total Total equity Balance as at September 1, 2010 Business acquisition Net income Other comprehensive loss Comprehensive income (loss) Dividends Dividend reinvestment plan Issue of preferred shares Share issue costs (net of taxes) Shares issued under stock option plan Share-based... -

Page 70

Shaw Communications Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS Years ended August 31 [millions of Canadian dollars] 2012 $ 2011 $ OPERATING ACTIVITIES [note 29] Funds flow from continuing operations Net decrease (increase) in non-cash working capital balances related to continuing operations ... -

Page 71

...] 1. CORPORATE INFORMATION Shaw Communications Inc. (the "Company") is a diversified Canadian communications company whose core operating business is providing broadband cable television services, Internet, Digital Phone and telecommunications services ("Cable"); Direct-to-home ("DTH") satellite... -

Page 72

...Current assets Program rights Property, plant and equipment Current liabilities Long-term debt Proportionate share of net assets 8 - 16 24 1 20 3 2012 $ 12 1 16 29 1 21 7 2011 $ Revenue Operating, general and administrative expenses Amortization Interest Other gains Proportionate share of income... -

Page 73

... of Canadian dollars except share and per share amounts] related subscription revenue. Upfront fees charged to customers do not constitute separate units of accounting, therefore these revenue streams are assessed as an integrated package. (i) Revenue Revenue from cable, Internet, Digital Phone and... -

Page 74

... Estimated useful life Cable and telecommunications distribution system Digital cable terminals and modems Satellite audio, video and data network equipment and DTH receiving equipment Transmitters, broadcasting and communication equipment Buildings Data processing Other The Company reviews the... -

Page 75

... statement of financial position between current and noncurrent based on expected life at time of acquisition. Software that is not an integral part of the related hardware is classified as an intangible asset. Internally developed software assets are recorded at historical cost and include direct... -

Page 76

... of related expenditures, the passage of time and for revisions to the timing of the cash flows. Changes in the obligation due to the passage of time are recorded as accretion of long-term liabilities and provisions in the income statement. Provisions Provisions are recognized when the Company has... -

Page 77

... The Company has access to a government program which supports local programming produced by conventional television stations. In addition, the Company receives tax credits primarily related to its research and development activities. Government financial assistance is recognized when management has... -

Page 78

...cross-currency interest rate exchange agreements, foreign currency forward purchase contracts and bond forward contracts. All derivative financial instruments are recorded at fair value in the statement of financial position. Where permissible, the Company accounts for these financial instruments as... -

Page 79

...market data. Employee benefits The Company accrues its obligations and related costs under its employee benefit plans, net of plan assets. The cost of pensions and other retirement benefits earned by certain employees is actuarially determined using the projected benefit method pro-rated on service... -

Page 80

...stock option plan for directors, officers, employees and consultants to the Company. The options to purchase shares must be issued at not less than the fair value at the date of grant. Any consideration paid on the exercise of stock options, together with any contributed surplus recorded at the date... -

Page 81

..., plant and equipment. These estimates of useful lives involve significant judgement. In determining these estimates, the Company takes into account industry trends and company-specific factors, including changing technologies and expectations for the in-service period of these assets. Management... -

Page 82

... approach. Recent market transactions are taken into account, when available. The key assumptions used to determine the recoverable amounts, including a sensitivity analysis, are included in note 10. (v) Employee benefit plans The amounts reported in the financial statements relating to the defined... -

Page 83

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] (ii) Broadcast rights and licenses and spectrum licenses - indefinite-life assessment The Company's businesses are dependent ... -

Page 84

...these specialty channels on the acquisition date was $19. The transaction is accounted for using the acquisition method and as a result of remeasuring these equity interests to fair value, the Company recorded a gain of $6 in the income statement. If the acquisition had occurred on September 1, 2011... -

Page 85

... $9 related to transaction costs which are included in business acquisition, integration and restructuring expenses in the income statement. On May 3, 2010 the Company announced that it had entered into agreements to acquire 100% of the broadcasting businesses of Canwest Global Communications Corp... -

Page 86

...$180 in new benefits to the Canadian broadcasting system over the next seven years. Most of this contribution will be used to create new programming on Canwest services, construct digital transmission towers and provide a satellite solution for over-the-air viewers whose local television stations do... -

Page 87

... FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] (1) The Company acquired a remaining tax indemnity amount of $21 as part of the acquisition. The indemnity arose in 2007 as part of Canwest's acquisition of Specialty... -

Page 88

... FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] evolution of wireless technologies, the capital required to build a competitive network and recent changes in the wireless competitive environment. As a result, the Company... -

Page 89

..., 2010, the CRTC approved the transaction and the Company closed the purchase on October 27, 2010 (see note 3). During 2012, the Company recorded equity income of $nil in respect of its non-controlling interests in several specialty channels which were acquired as part of the Media acquisition (2011... -

Page 90

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] The Company's interest in the assets, liabilities and results of operations of investments in associates accounted for using ... -

Page 91

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] 8. PROPERTY, PLANT AND EQUIPMENT Satellite audio, video and Digital data Transmitters, cable network broadcasting, Cable and... -

Page 92

... $232 (2011 - $206) and was recorded as amortization of deferred equipment costs and other amortization. 10. INTANGIBLES AND GOODWILL Carrying amount September 1, 2011 2010 $ $ 2012 $ Broadcast rights and licenses Cable systems DTH and satellite services Television broadcasting Program rights and... -

Page 93

... amortization are as follows: Program rights Software under and advances Software construction $ $ $ Total $ Cost September 1, 2010 Business acquisitions [note 3] Additions Transfers Discontinued operations Retirement and disposals August 31, 2011 Business acquisitions [note 3] Additions Transfers... -

Page 94

...Estimated decline in recoverable amount Terminal value 0.5 times decrease in terminal operating income before 1% increase in 1% decrease in amortization discount rate terminal growth rate multiple Cable systems DTH and satellite services Media Wireless 6% 6% 4% 30% 3% 2% n/a n/a 3% 3% 4% 37% 90 -

Page 95

...millions of Canadian dollars except share and per share amounts] 11. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES 2012 $ 2011 $ September 1, 2010 $ Trade Program rights CRTC benefit obligations Accrued liabilities Accrued network fees Interest and dividends Related parties [note 27] Current portion of... -

Page 96

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] 13. LONG-TERM DEBT 2012 2011 September 1, 2010 Long-term debt at amortized cost(1) $ Long-term Adjustment Long-term Long-... -

Page 97

.../working space in Vancouver, BC. In the fall of 2004, the commercial construction of the building was completed and at that time, the Partnership issued ten year secured mortgage bonds in respect of the commercial component of the Shaw Tower. The bonds bear interest at 6.31% compounded semi-annually... -

Page 98

...in the Media business acquisition Interest income - short-term (net) Capitalized interest 334 2 - (3) (3) 330 341 2 (8) (3) - 332 14. OTHER LONG-TERM LIABILITIES 2012 $ 2011 $ September 1, 2010 $ Pension liabilities [note 26] Amended cross-currency interest rate agreements [note 28] CRTC benefit... -

Page 99

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] 15. DEFERRED CREDITS 2012 $ 2011 $ September 1, 2010 $ IRU prepayments Equipment revenue Connection fee and installation ... -

Page 100

... dollars except share and per share amounts] Changes in Class A Share capital and Class B Non-Voting Share capital in 2012 and 2011 are as follows: Class A Shares Number $ Class B Non-Voting Shares Number $ September 1, 2010 Stock option exercises Dividend reinvestment plan August 31, 2011 Stock... -

Page 101

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] The changes in options are as follows: 2012 Weighted average exercise price $ 2011 Weighted average exercise price $ Number ... -

Page 102

... per share amounts] During 2012, $2 was recorded as compensation expense (2011 - $1) and at August 31, 2012, the carrying value of the liability was $3 (2011 - $1). Deferred share unit plan The Company has a DSU plan for its Board of Directors whereby directors can elect to receive their annual cash... -

Page 103

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] 18. EARNINGS PER SHARE Earnings per share calculations are as follows: 2012 2011 Numerator for basic and diluted earnings ... -

Page 104

...preferred shares and holders will be entitled to receive cumulative quarterly dividends, as and when declared by the Company's Board of Directors, at a rate set quarterly equal to the then current three-month Government of Canada Treasury Bill yield plus 2.00%. Dividend reinvestment plan The Company... -

Page 105

... of the following: 2012 $ 2011 $ September 1, 2010 $ Fair value of derivatives Actuarial losses on employee benefit plans (1) (92) (93) 1 (30) (29) 9 - 9 21. OPERATING, GENERAL AND ADMINISTRATIVE EXPENSES 2012 $ 2011 $ Employee salaries and benefits Purchases of goods and services 835 2,036... -

Page 106

... 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] Landing Lot 2 Holdings Partnership. During the current year, the category also includes a loss of $26 related to the electrical fire and resulting water damage at the Company's head office in Calgary... -

Page 107

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] Significant changes recognized to deferred income tax assets (liabilities) are as follows: Property, plant Broadcast and ... -

Page 108

...: 2012 $ 2011 $ Current statutory income tax rate Income tax expense at current statutory rates Net increase (decrease) in taxes resulting from: Effect of tax rate changes Recognition of previously unrecognized deferred tax assets Originating temporary differences recorded at future tax rates... -

Page 109

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] 24. BUSINESS SEGMENT INFORMATION The Company's operating segments are Cable, Media, DTH and Satellite Services, all of which ... -

Page 110

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] 2011 Satellite Cable $ Revenue Operating income before amortization Operating income as % of revenue Interest(1) Burrard ... -

Page 111

... 2013. As part of the CRTC decisions approving the acquisition of the broadcasting businesses in 2012 and 2011, the Company is required to contribute approximately $182 in new benefits to the Canadian broadcasting system over seven years. The obligations have been recorded in the income statement... -

Page 112

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] Indemnities Many agreements related to acquisitions and dispositions of business assets include indemnification provisions ... -

Page 113

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] Employees are not required to contribute to this plan and there are no minimum required employer contributions under the plan.... -

Page 114

... below shows the change in the benefit obligations, change in fair value of plan assets and the funded status of these defined benefit plans. 2012 $ 2011 $ Accrued benefit obligation, beginning of year Media business acquisition Current service cost Interest cost Employee contributions Actuarial... -

Page 115

...obligation 2012 % 2011 % Discount rate Rate of compensation increase 4.67 3.50 2012 % 5.75 4.00 2011 % Benefit cost for the year Discount rate Expected return on plan assets Rate of compensation increase 5.75 5.25 4.00 5.65 6.70 3.70 A one percentage point decrease in the discount rate would... -

Page 116

... Company assumed post employment benefits plans that provide post retirement health and life insurance coverage. 2012 $ 2011 $ Accrued benefit obligation, beginning of year Media business acquisition Current service cost Interest cost Plan amendment Actuarial loss Payment of benefits to employees... -

Page 117

..., 2011 September 1, 2010 Shaw Cablesystems Limited Shaw Cablesystems G.P. Mountain Cablevision Limited Shaw Telecom Inc. Shaw Telecom G.P. Shaw Satellite Services Inc. Star Choice Television Network Incorporated Shaw Satellite G.P. Shaw Media Inc. Shaw Television Limited Partnership Key management... -

Page 118

... expense of key management personnel is as follows: 2012 $ 2011 $ Short-term employee benefits Post-employment pension benefits Retirement benefits Share-based compensation 32 (23) - 3 12 35 21 26 5 87 Transactions The Company paid $3 (2011 - $4) for direct sales agent, marketing, installation... -

Page 119

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] Specialty Channels The Company holds interests in a number of specialty television channels which are subject to either joint... -

Page 120

... by valuation techniques using inputs based on observable market data, either directly or indirectly, other than quoted prices. Derivative financial instruments held at August 31, 2012 have maturity dates throughout fiscal 2013. As at August 31, 2012 and 2011 and September 1, 2010, US currency... -

Page 121

... 2012 the Company had forward contracts to purchase US $75 over a period of 12 months commencing in September 2012 at an average exchange rate of 0.9998 Cdn in respect of capital expenditures and equipment costs. As part of the broadcasting business acquisition in 2011, the Company assumed US dollar... -

Page 122

... as the number of days the subscriber account is past due, whether or not the customer continues to receive service, the Company's past collection history and changes in business circumstances. As at August 31, 2012, $111 (August 31, 2011 - $121; September 1, 2010 - $79) of accounts receivable is... -

Page 123

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] The Company's undiscounted contractual maturities as at August 31, 2012 are as follows: Accounts payable and accrued ... -

Page 124

... FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] (ii) Changes in non-cash working capital balances related to continuing operations include the following: 2012 $ 2011 $ Accounts receivable Other current assets Accounts... -

Page 125

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] The Company defines capital as comprising all components of shareholders' equity (other than non-controlling interests and ... -

Page 126

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] restatement of all business combinations that occurred prior to the date of transition. The Company has elected to not restate... -

Page 127

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] Reconciliation of Canadian GAAP to IFRS A. Consolidated statements of financial position as at September 1, 2010 and August 31... -

Page 128

...: Deferred equipment revenue Deferred equipment costs Property, plant and equipment, intangibles and other Operating income Amortization of financing costs - long-term debt Interest expense Gain on redemption of debt CRTC benefit obligation Business acquisition, integration and restructuring... -

Page 129

... inclusion rate results in a reduction in the deferred income tax liability related to these assets at transition and also results in a decrease to goodwill and deferred income tax liability and increase to non-controlling interests in respect of the Media business acquisition in fiscal 2011. Under... -

Page 130

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2012 and 2011 [all amounts in millions of Canadian dollars except share and per share amounts] (v) Constructive obligation Under IFRS, constructive obligations must be recognized when certain criteria are met. These have ... -

Page 131

Shaw Communications Inc. FIVE YEARS IN REVIEW August 31, 2012 IFRS 2012 IFRS 2011 Canadian GAAP 2010(3) Canadian GAAP 2009(3) Canadian GAAP 2008(3) ($millions except per share amounts) Revenue Cable DTH Satellite Media Intersegment Operating income before amortization(1) Cable DTH Satellite Media ... -

Page 132

...Preferred Shares are listed on the Toronto Stock Exchange under the symbol SJR.PR.A. Trading Range of Class B Non-Voting Shares on the Toronto Stock Exchange Quarter High Close Low Close Total Volume September 1, 2011 to August 31, 2012 First Second Third Fourth Closing price, August 31, 2012 Share... -

Page 133

...www.shaw.ca Information concerning Shaw's compliance with the corporate governance listing standards of the New York Stock Exchange is available in the investors section on Shaw's website, www.shaw.ca INTERNET HOME PAGE Shaw's Annual Report, Annual Information Form, Quarterly Reports, Press Releases... -

Page 134