Sara Lee 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

86 Sara Lee Corporation and Subsidiaries

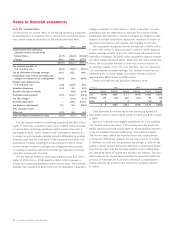

As expected, in October 2009, the Spanish tax administration

upheld the challenge made by its local field examination against

tax positions taken by the corporation’s Spanish subsidiaries. In

November 2009, the corporation filed an appeal against this claim

with the Spanish Tax Court. In April 2010, the Spanish Chief Inspector

upheld a portion of the claim raised by the Spanish tax authorities,

which the corporation will appeal. The corporation believes it is ade-

quately reserved for the claim upheld by the Spanish Chief Inspector.

However, in order to continue its appeal, the corporation was required

to obtain a bank guarantee in May 2010 of $80 million as security

against all allegations. The corporation continues to dispute the

challenge and will continue to have further proceedings with the

Spanish tax authorities regarding this issue.

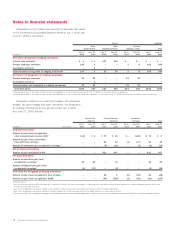

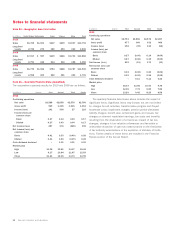

The following table presents a reconciliation of the beginning

and ending amount of unrecognized tax benefits for the years

ended July 3, 2010, June 27, 2009 and June 28, 2008.

July 3, June 27, June 28,

In millions Year ended 2010 2009 2008

Unrecognized tax benefits

Beginning of year balance $«547 $591 $580

Increases based on current

period tax positions 34 28 85

Increases based on prior

period tax positions 39 22 15

Decreases based on prior

period tax positions (32) (30) (32)

Decreases related to settlements

with tax authorities (164) (10) (47)

Decreases related to a lapse of

applicable statute of limitation (25) (7) (46)

Foreign currency translation adjustment (32) (47) 36

End of year balance $«367 $547 $591

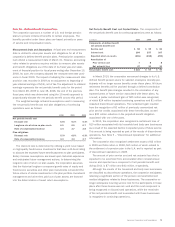

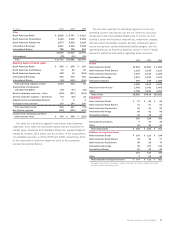

Note 19 – Business Segment Information

The following are the corporation’s five business segments and the

types of products and services from which each reportable segment

derives its revenues.

•North American Retail sells a variety of packaged meat and

frozen bakery products to retail customers in North America and

includes the corporation’s U.S.

Senseo

retail coffee business.

•North American Fresh Bakery sells a variety of fresh bakery

products to retail customers in North America.

•North American Foodservice sells a variety of meats, bakery,

and beverage products to foodservice customers in North America

such as broad-line foodservice distributors, restaurants, hospitals

and other large institutions.

•International Beverage sells coffee and tea products in major

markets around the world, including Europe, Australia and Brazil.

•International Bakery sells a variety of bakery and dough prod-

ucts to retail and foodservice customers in Europe and Australia.

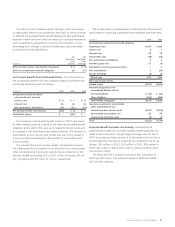

The corporation’s management uses operating segment income,

which is defined as operating income before general corporate

expenses and amortization of trademarks and customer relation-

ship intangibles, to evaluate segment performance and allocate

resources. Management believes it is appropriate to disclose this

measure to help investors analyze the business performance and

trends of the various business segments. Interest and other debt

expense, as well as income tax expense, are centrally managed, and

accordingly, such items are not presented by segment since they are

not included in the measure of segment profitability reviewed by

management. The accounting policies of the segments are the

same as those described in Note 2 to the Consolidated Financial

Statements, “Summary of Significant Accounting Policies.”

The corporation incurs various information technology (IT)

and human resource (HR) costs related to its business segments.

The IT costs include amortization of software used directly by the

business segments, intranet website management costs, systems

support, maintenance and project costs. The HR costs include ben-

efits administration, organizational development, labor relations and

recruiting costs incurred by the corporate human resource function

on behalf of the business segments. Prior to 2010, these costs

were included in Other general corporate expenses. Beginning in

2010, the corporation now includes these IT and HR costs in the

operating results of the business segments. The reason for this

change is that the integration of our operations over the past sev-

eral years has resulted in more centralized services, which in many

cases are conducted directly for the benefit of the business seg-

ments. Management believes these costs should be reflected in

operating segment income in order to provide better information

regarding the actual results of the business segment. Business

segment information for 2009 and 2008 has been revised to be

consistent with the new basis of presentation.