Sara Lee 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial review

28 Sara Lee Corporation and Subsidiaries

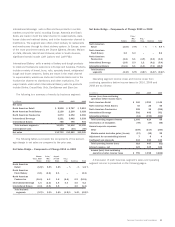

Income (Loss) from Discontinued Operations before Income Taxes

Net sales for discontinued operations were $2.1 billion in 2010,

compared to $2.0 billion in the prior year, a 6.3% increase. The

sales growth was primarily driven by strength in the insecticides,

shoe care and body care core categories, as well as the additional

53rd week and favorable foreign currency exchange rates. On a

constant currency basis and excluding the impact of the 53rd week,

net sales increased 2.4%. Pretax income in 2010 was $254 million,

an increase of $9 million or 3.0% compared to 2009. The increase

was driven by higher net sales, positive manufacturing results and

favorable foreign currency exchange rates, which were partially offset

by higher significant charges, MAP spending and other SG&A costs.

Pretax income in 2010 was also benefited by $33 million due to the

cessation of depreciation and amortization in accordance with the

accounting rules for assets held for sale. Discontinued operations

reported a loss of $199 million in fiscal 2010, due to $453 million

of income tax expense. The increase in tax expense was related

to the deemed repatriation of overseas earnings, attributable to

the existing overseas cash and book value of the International

Household and Body Care businesses.

Net sales for discontinued operations were $2.0 billion in fiscal

2009, compared to $2.5 billion in the prior year, a 20.0% decrease.

The sales decline was primarily driven by the unfavorable impacts

of foreign currency exchange rates and the impact of the divestiture

of the Mexican meats business in fiscal 2008. On a constant currency

basis and excluding the impact of divestitures, net sales decreased

$40 million or 2.0%. Pretax income in 2009 was $245 million, a

decrease of $72 million or 22.4% compared to fiscal 2008. The

decrease was driven by lower unit volumes and higher raw material

and manufacturing costs, which were partially offset by lower MAP

expenses and savings from continuous improvement programs.

Discontinued operations reported net income of $155 million in

fiscal 2009 as compared to $236 million in 2008. The decrease

was primarily related to the decline in pretax income noted above.

The operating results of discontinued operations in 2008

include a $15 million charge related to the settlement of a pension

plan in the U.K. associated with the European Branded Apparel busi-

ness. Further details regarding this charge can be found in Note 5 to

the Consolidated Financial Statements, “Discontinued Operations.”

Gain (Loss) on Sale of Discontinued Operations

In 2010, the

corporation completed the disposition of its insecticide business in

India, which had been part of the household and body care business,

and recognized a pretax gain of $150 million and an after tax gain

of $78 million. In 2008, the corporation completed the disposition

of its Mexican meats business and recognized a pretax loss of

$23 million and after tax loss of $24 million. Further details regard-

ing these transactions are included in Note 4 to the Consolidated

Financial Statements, “Discontinued Operations.”

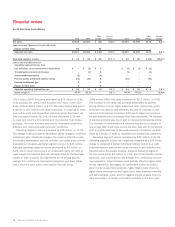

Consolidated Net Income and Diluted Earnings Per Share (EPS)

Net income was $527 million in 2010, an increase of $147 million

over the prior year. The increase in net income was due to a $417 mil-

lion increase in income from continuing operations as a result of a

reduction in after tax impairment charges on a year-over-year basis

partially offset by a $270 million reduction in income from discontin-

ued operations due to the tax provision related to the repatriation of

foreign earnings. Net income was $380 million in 2009 as compared

to a net loss of $64 million in 2008. The increase in net income

was due to a $538 million reduction in after tax impairment charges

on a year-over-year basis.

The net income (loss) attributable to Sara Lee was income of

$506 million in 2010 and $364 million in 2009 and a net loss of

$79 million in 2008.

Diluted EPS were $0.73 in 2010 as compared to $0.52 in 2009.

Diluted EPS was a net loss of $0.11 in 2008. The diluted EPS in

each succeeding year was favorably impacted by lower average

shares outstanding due to an ongoing share repurchase program.

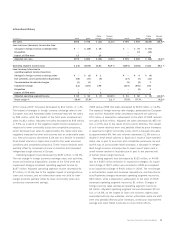

Operating Results by Business Segment

The corporation’s structure is currently organized around five business

segments, which are described below.

North American Retail

sells a variety of packaged meat and frozen

bakery products to retail customers in North America. It also includes

the

Senseo

retail coffee business in the U.S. Products include hot

dogs and corn dogs, breakfast sausages, breakfast convenience

items which include sandwiches and bowls, smoked and dinner

sausages, premium deli and luncheon meats, bacon, cooked hams

and frozen pies, cakes, cheesecakes and other desserts. The major

brands include

Hillshire Farm, Ball Park, Jimmy Dean, Sara Lee

and

State Fair

.

North American Fresh Bakery

sells a wide variety of fresh bakery

products to retail and institutional customers in North America

including bread, buns, bagels, rolls, muffins, specialty bread and

cakes. The major brands include

Sara Lee, Earth Grains, Colonial,

Rainbo, Holsum, IronKids, Mother’s, Sunbeam, Sun-Maid, San Luis

Sourdough

and

Heiner’s

, some of which are used under licensing

arrangements.

North American Foodservice

sells a variety of meat, bakery and

beverage products to foodservice customers in North America

including hot dogs and corn dogs, breakfast sausages and sand-

wiches, smoked and dinner sausages, premium deli and luncheon

meats, bacon, cooked and dry hams, beef, turkey, bread, pastry,

bagels, rolls, muffins, frozen pies, cakes, cheesecakes, roast &

ground and liquid coffee, cappuccinos, lattes and hot and iced teas.

The segment also sells refrigerated dough products to certain

customers. Sales are made in the foodservice channel to distributors,

restaurants, hospitals and other large institutions and in the retail

channel, sales are made to supermarkets and national chains.