Sara Lee 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

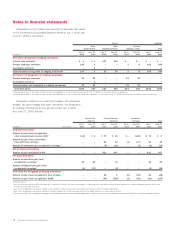

Notes to financial statements

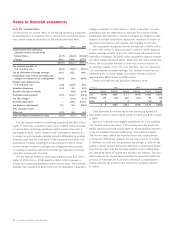

Multi-employer Plans The corporation participates in multi-employer

plans that provide defined benefits to certain employees covered by

collective bargaining agreements. Such plans are usually adminis-

tered by a board of trustees composed of the management of the

participating companies and labor representatives. The net pension

cost of these plans is equal to the annual contribution determined

in accordance with the provisions of negotiated labor contracts.

These contributions were $50 million in 2010, $49 million in 2009

and $48 million in 2008. Assets contributed to such plans are not

segregated or otherwise restricted to provide benefits only to the

employees of the corporation. The future cost of these plans is

dependent on a number of factors including the funded status of

the plans and the ability of the other participating companies to

meet ongoing funding obligations.

In addition to regular contributions, the corporation could be

obligated to pay additional contributions (known as complete or

partial withdrawal liabilities) if a multi-employer pension plan (MEPP)

has unfunded vested benefits. The corporation recognized a partial

withdrawal liability in 2010 of $22 million related to one collective

bargaining agreement, all of which was recognized in Selling, general

and administrative expenses in the Consolidated Statements of

Income. The corporation also recognized a partial withdrawal liability

of $31 million in 2009 as a result of the cessation of contributions

to a MEPP with respect to one collective bargaining unit. Of the total

charge to income in 2009, $13 million was recognized in Cost of

sales and $18 million was recognized in Selling, general and admin-

istrative expenses in the Consolidated Statements of Income. The

charges for both years was recognized in the results of the North

American Fresh Bakery segment.

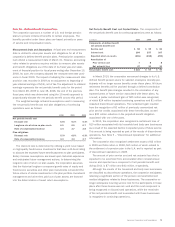

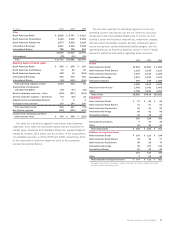

Note 17– Postretirement Health-Care and Life-Insurance Plans

The corporation provides health-care and life-insurance benefits

to certain retired employees and their covered dependents and

beneficiaries. Generally, employees who have attained age 55 and

have rendered 10 or more years of service are eligible for these

postretirement benefits. Certain retirees are required to contribute

to plans in order to maintain coverage.

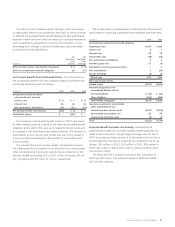

During 2009, the corporation entered into a new collective labor

agreement in the Netherlands which eliminated post retirement

health care benefits for certain employee groups, while also reduc-

ing benefits provided to others. The elimination of benefits resulted

in the recognition of a curtailment gain of $17 million, of which

$12 million impacted continuing operations, related to a portion

of the unamortized prior service cost credit which was reported

in accumulated other comprehensive income. The plan changes

also resulted in a $32 million reduction in the accumulated post

retirement benefit obligation with an offset to accumulated other

comprehensive income.

During the third quarter of 2009, the corporation approved a

change to its U.S. postretirement medical plan. Effective January 1,

2010 the corporation will no longer subsidize retiree medical cover-

age for U.S. salaried employees and retirees. After this date, retirees

will have access to medical coverage but will have to pay 100% of

the premium. This change resulted in the recognition of a negative

plan amendment which reduced the accumulated postretirement

benefit obligation by $50 million with an offset to unamortized prior

service cost in accumulated other comprehensive income.

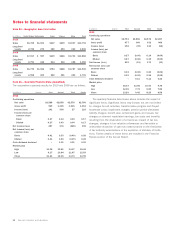

Measurement Date and Assumptions Beginning in 2009, a fiscal

year end measurement date is utilized to value plan assets and

obligations for the corporation’s postretirement health-care and life-

insurance plans pursuant to the new accounting rules. Previously,

the corporation used a March 31 measurement date. The impact

of adopting the new measurement date provision was recorded in

2009 as an adjustment to beginning of year retained earnings of

$(1) million, net of tax. The adjustment to retained earnings repre-

sents the net periodic benefit costs for the period from March 28,

2008 to June 28, 2008, the end of the previous fiscal year, which

was determined using the 15-month approach to proportionally

allocate the net periodic benefit cost to this period.

The weighted average actuarial assumptions used in measuring

the net periodic benefit cost and plan obligations for the three

years ending July 3, 2010 were:

2010 2009 2008

Net periodic benefit cost

Discount rate 6.3% 6.4% 5.7%

Plan obligations

Discount rate 5.1 6.3 6.4

Health-care cost trend assumed

for the next year 8.0 8.5 9.5

Rate to which the cost trend is

assumed to decline 5.0 5.0 5.5

Year that rate reaches the

ultimate trend rate 2016 2016 2015

82 Sara Lee Corporation and Subsidiaries