Sara Lee 2010 Annual Report Download - page 77

Download and view the complete annual report

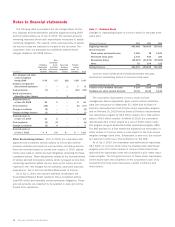

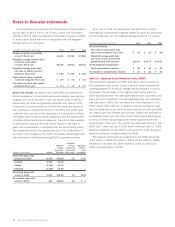

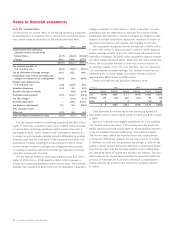

Please find page 77 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 15 – Financial Instruments

Background Information The corporation uses derivative financial

instruments, including forward exchange, futures, options and swap

contracts, to manage its exposures to foreign exchange, commodity

prices and interest rate risks. The use of these derivative financial

instruments modifies the exposure of these risks with the intent

to reduce the risk or cost to the corporation. The corporation does

not use derivatives for trading or speculative purposes and is not

a party to leveraged derivatives.

The corporation recognizes all derivative instruments as either

assets or liabilities at fair value in the consolidated balance sheet.

The corporation uses either hedge accounting or mark-to-market

accounting for its derivative instruments. For derivatives that qualify

for hedge accounting, the corporation designates these derivatives

as fair value, cash flow or net investment hedges by formally docu-

menting the hedge relationships, including identification of the

hedging instruments and the hedged items, as well as its risk

management objectives and strategies for undertaking the hedge

transaction. The process includes linking derivatives that are

designated as hedges of specific assets, liabilities, firm commit-

ments or forecasted transactions.

As noted above, the corporation uses derivative financial

instruments to manage some of its exposure to commodity prices.

A commodity derivative not declared a hedge in accordance with

the accounting rules related to derivative instruments and hedging

activities is accounted for under mark-to-market accounting with

changes in fair value recorded in the Consolidated Statements of

Income. The corporation includes these unrealized mark-to-market

gains and losses in general corporate expenses until the derivative

instrument is settled. At that time, the cumulative gain or loss

previously recorded in general corporate expenses for the derivative

instrument will be reclassified into the business segment’s results.

On the date the derivative is entered into, the corporation

designates the derivative as one of the following types of hedging

instruments and accounts for the derivative as follows:

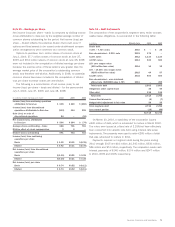

Fair Value Hedge A hedge of a recognized asset or liability or an

unrecognized firm commitment is declared as a fair value hedge

which qualifies for hedge accounting. For fair value hedges, both

the effective and ineffective portions of the changes in the fair

value of the derivative, along with the gain or loss on the hedged

item that is attributable to the hedged risk, are recorded in earnings

and are reported in the Consolidated Statements of Income on

the same line as the hedged item.

Cash Flow Hedge A hedge of a forecasted transaction, firm

commitment or of the variability of cash flows to be received or

paid related to a recognized asset or liability is declared a cash

flow hedge. Cash flow hedges qualify for hedge accounting. The

effective portion of the change in the fair value of the derivative

that is declared as a cash flow hedge is recorded in accumulated

other comprehensive income (within common stockholders’ equity)

and later reclassified to the income statement at the same time

the underlying hedged item impacts the income statement. In addi-

tion, both the fair value of changes excluded from the corporation’s

effectiveness assessments and the ineffective portion of the

changes in the fair value of derivatives used as cash flow hedges

are reported in Selling, general and administrative expenses in

the Consolidated Statements of Income.

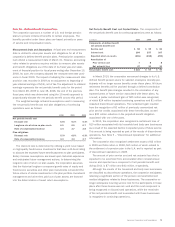

At July 3, 2010 the maximum maturity date of any cash flow

hedge was approximately two years, principally related to two cross

currency swaps that mature in 2012 and 2013. The corporation

expects to reclassify into earnings during the next twelve months

net gains from Accumulated Other Comprehensive Income of approx-

imately $1 million at the time the underlying hedged transaction is

recognized in the Consolidated Statement of Income.

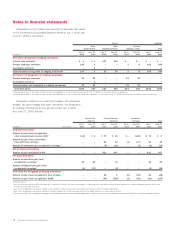

Net Investment Hedge A hedge of the exposure of changes in the

underlying foreign currency denominated subsidiary net assets is

declared as a net investment hedge. Net investment hedges qualify

for hedge accounting. Net investment hedges can include either

derivative or non-derivative instruments such as, non-U.S. dollar

financing transactions or non-U.S. dollar assets or liabilities, includ-

ing intercompany loans. The effective portion of the change in the

fair value of net investment hedges is recorded in the cumulative

translation adjustment account within common stockholders’ equity.

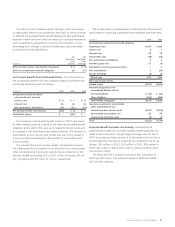

At July 3, 2010 and June 27, 2009, the U.S. dollar equivalent of

intercompany loans and forward exchange contracts designated as

net investment hedges was $4.5 billion and $3.2 billion, respec-

tively. The corporation increased its net investment hedges in the

third quarter of 2010 in order to offset the euro exposure associ-

ated with €1.6 billion of proceeds anticipated to be generated by

the divestiture of its air care and body care businesses.

Mark-to-Market Hedge A derivative that does not qualify for hedge

accounting in one of the categories above is accounted for under

mark-to-market accounting and referred to as a mark-to-market

hedge. Changes in the fair value of a mark-to-market hedge are

recognized in the Consolidated Statements of Income to act as an

economic hedge against the changes in the values of another item

or transaction. Changes in the fair value of derivatives classified as

mark-to-market hedges are reported in earnings in either the “Cost

of sales” or “Selling, general and administrative expenses” lines of

the Consolidated Statements of Income where the change in value

of the underlying transaction is recorded.

Sara Lee Corporation and Subsidiaries 75