Sara Lee 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

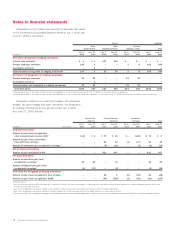

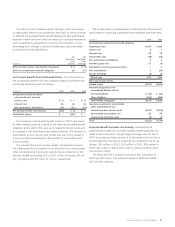

Level 1 assets were valued using market prices based on daily

net asset value (NAV) or prices available through a public stock

exchange. Level 2 assets were valued primarily using market prices,

derived from either an active market quoted price, which may require

adjustments to account for the attributes of the asset, or an inactive

market transaction. The corporation did not have any level 3 assets,

which would include assets for which values are determined by non-

observable inputs. See Note 15 - Financial Instruments for additional

information as to the fair value hierarchy.

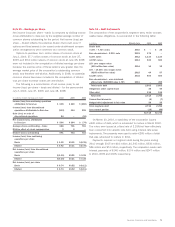

The percentage allocation of pension plan assets based on fair

value as of the respective year-end measurement dates is as follows:

2010 2009

Asset category

Equity securities 16% 24%

Debt securities 74 63

Real estate 33

Cash and other 710

Total 100% 100%

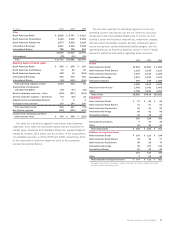

The overall investment objective is to manage the plan assets

so that they are sufficient to meet the plan’s future obligations while

maintaining adequate liquidity to meet current benefit payments and

operating expenses. The actual amount for which these obligations

will be settled depends on future events and actuarial assumptions.

These assumptions include the life expectancy of the plan participants

and salary inflation. The resulting estimated future obligations are

discounted using an interest rate curve that represents a return

that would be required from high quality corporate bonds. The corpo-

ration has adopted a liability driven investment (LDI) strategy and it

is in various stages of implementation of the strategy in each of its

largest pension plans. This strategy consists of investing in a portfolio

of assets whose performance is driven by the performance of the

associated pension liability. This means that plan assets managed

under an LDI strategy may underperform general market returns,

but should provide for lower volatility of funded status as its return

matches the pension liability movement. Over time, as pension

obligations become better funded, the corporation will further

de-risk its investments and increase the allocation to fixed income.

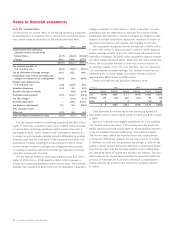

The asset allocation varies by plan and, on an aggregate fair

value basis, it is currently at 74% fixed income securities and 16%

equity securities. On a notional value basis, the plan assets include

investments in equity market futures which effectively moves the

asset allocation to the established targets of 70% fixed income and

21% equity. Fixed income securities can include, but are not limited

to, direct bond investments, pooled or indirect bond investments and

cash. Equity securities can include, but are not limited to, interna-

tional and domestic equities, real estate, commodities and private

equity. Derivative instruments may also be used in concert with either

fixed income or equity investments to achieve desired exposure

or to hedge certain risks. Derivative instruments can include, but

are not limited to, futures, options, swaps or swaptions. The assets

are managed by professional investment firms and performance

is evaluated against specific benchmarks. The responsibility for

the investment strategies typically lies with a committee and the

composition of the committee depends on plan jurisdiction.

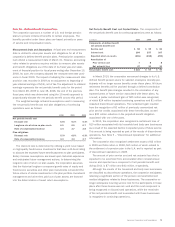

Pension assets at the 2010 and 2009 measurement dates do

not include any direct investment in the corporation’s debt or equity

securities. Substantially all pension benefit payments are made

from assets of the pension plans. Using foreign currency exchange

rates as of July 3, 2010 and expected future service, it is anticipated

that the future benefit payments will be as follows: $223 million in

2011, $225 million in 2012, $233 million in 2013, $238 million in

2014, $244 million in 2015 and $1,351 million from 2016 to 2020.

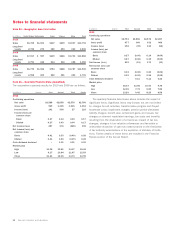

As part of a previously announced capital plan, the corporation

made a voluntary contribution of $200 million into its U.S. defined

benefit pension plans in the fourth quarter of 2010. At the present

time, the corporation expects to contribute approximately $110 million

of cash to its pension plans in 2011. During 2006, the corporation

entered into an agreement with the plan trustee to fully fund certain

U.K. pension obligations by 2015. The anticipated 2011 contribu-

tions reflect the amounts agreed upon with the trustees of these

U.K. plans. Subsequent to 2015, the corporation has agreed to

keep the U.K. plans fully funded in accordance with certain local

funding standards. The exact amount of cash contributions made to

pension plans in any year is dependent upon a number of factors

including minimum funding requirements in the jurisdictions in which

the company operates, the tax deductibility of amounts funded and

arrangements made with the trustees of certain foreign plans.

Defined Contribution Plans The corporation sponsors defined

contribution plans, which cover certain salaried and hourly employees.

The corporation’s cost is determined by the amount of contributions

it makes to these plans. The amounts charged to expense for contribu-

tions made to these defined contribution plans totaled $42 million

in 2010, $43 million in 2009 and $43 million in 2008.

Sara Lee Corporation and Subsidiaries 81