Sara Lee 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

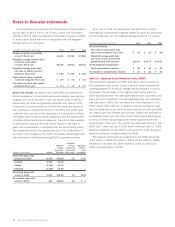

Notes to financial statements

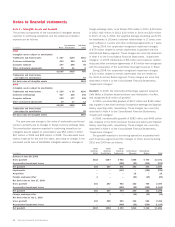

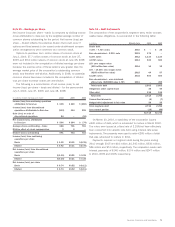

North American Foodservice Property and Goodwill

In 2008, the

corporation received a non-binding offer for its U.S. direct store

delivery foodservice beverage business (DSD) which was part of the

North American Foodservice segment. Utilizing the net purchase price,

which was less than the carrying value, the corporation conducted

an impairment review of DSD and recognized a pretax impairment

charge of $49 million in the fourth quarter of 2008, of which $38 mil-

lion related to property and $11 million related to goodwill. The

remaining assets of this business were classified as held for sale

at the end of 2008. During 2009, the corporation completed the

disposition of the DSD business and received $42 million.

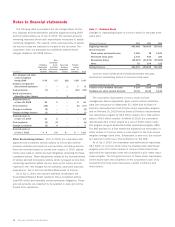

Note 5 – Discontinued Operations

In 2010, the corporation received binding offers for the sale of

its global body care and European detergents businesses for

€1.275 billion; its air care business for €320 million; and its non-

Indian insecticides business for €154 million. These proposed

transactions are subject to certain customary closing conditions

and regulatory approvals. Together these businesses represent over

70% of the net sales of the international household and body care

businesses. The corporation is also actively marketing for sale its

remaining household and body care businesses and, as a result, the

businesses that formerly comprised the International Household and

Body Care segment – air care, body care, shoe care and insecticides –

are classified as discontinued operations and are presented in a

separate line in the Consolidated Statements of Income for all periods

presented. The assets and liabilities of these businesses to be

sold meet the accounting criteria to be classified as held for sale

and have been aggregated and reported on separate lines of the

Consolidated Balance Sheets for all periods presented.

In 2010, the corporation disposed of its Godrej Sara Lee joint

venture, an insecticide business in India, which had been part of the

household and body care businesses. The corporation completed

the disposition of its air care business in July 2010 and anticipates

closing on the sale of the body care, European detergents, and

insecticides business during calendar 2010. In 2008, the corporation

disposed of its Mexican Meats operations, and realized a loss from

its European Branded Apparel business which was sold in 2006.

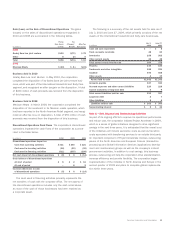

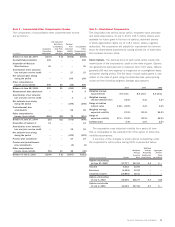

Results of Discontinued Operations The amounts in the tables

below reflect the operating results of the businesses reported as

discontinued operations. The amounts of any gains or losses related

to the disposal of these discontinued operations are excluded.

Pretax

Income Income

In millions Net Sales (Loss) (Loss)

2010

International Household

and Body Care businesses $2,126 $254 $(199)

2009

International Household

and Body Care businesses $2,000 $245 $«155

2008

International Household

and Body Care businesses $2,264 $330 $«250

European Branded Apparel – (15) (15)

Mexican Meats 23821

Total $2,502 $317 $«236

A full year of results for the Godrej Sara Lee joint venture business

was not included in 2010 as the business was sold in the fourth

quarter of 2010; and a full year of results for the Mexican meats

business was not included in 2008 as the business was sold in the

third quarter of 2008.

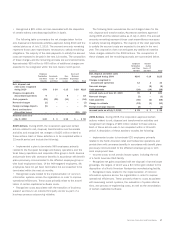

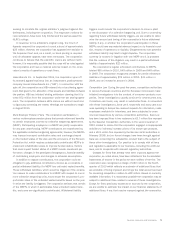

As a result of the planned disposition of the body care, European

detergents and air care businesses, the corporation anticipates a

significant reduction in the expected years of future service for the

employees associated with a defined benefit pension plan in the

Netherlands. Although the business dispositions have not as yet

been completed, a pretax curtailment loss of $10 million was recog-

nized because the loss was both probable and reasonably estimable.

The curtailment loss, which relates to the previously unamortized

prior service cost associated with this benefit plan, was recognized

in the results of discontinued operations.

The $453 million tax expense related to the results of the

discontinued operations reported in 2010 includes the following

significant tax amounts: i) a $428 million tax charge related to the

company’s third quarter decision to no longer reinvest overseas

earnings attributable to overseas cash and the net assets of the

household and body care businesses; ii) a $40 million tax benefit

related to the reversal of a tax valuation allowance on United Kingdom

net operating loss carryforwards as a result of the anticipated gain

from the household and body care business dispositions; and iii) a

$22 million tax benefit related to the anticipated utilization of U.S.

capital loss carryforwards available to offset the capital gain result-

ing from the household and body care business dispositions.

In 2008, the $15 million charge associated with the European

Branded Apparel business, which was sold in 2006, related to the

settlement of a pension plan in the U.K.

64 Sara Lee Corporation and Subsidiaries