Sara Lee 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

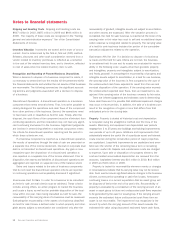

Notes to financial statements

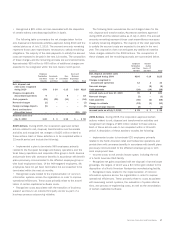

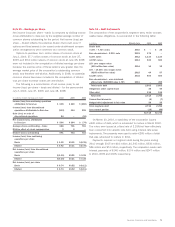

Note 3 – Intangible Assets and Goodwill

The primary components of the corporation’s intangible assets

reported in continuing operations and the related amortization

expense are as follows:

Accumulated Net Book

In millions Gross Amortization Value

2010

Intangible assets subject to amortization

Trademarks and brand names $÷«287 $106 $181

Customer relationships 412 249 163

Computer software 367 269 98

Other contractual agreements 19 11 8

$1,085 $635 450

Trademarks and brand names

not subject to amortization 54

Net book value of intangible assets $504

2009

Intangible assets subject to amortization

Trademarks and brand names $÷«295 $÷95 $200

Customer relationships 427 229 198

Computer software 299 177 122

Other contractual agreements 29 17 12

$1,050 $518 532

Trademarks and brand names

not subject to amortization 55

Net book value of intangible assets $587

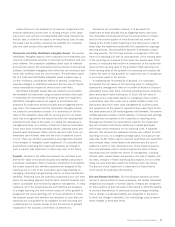

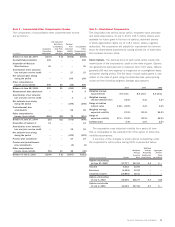

The year-over-year change in the value of trademarks and brand

names is primarily due to changes in foreign currency exchange rates.

The amortization expense reported in continuing operations for

intangible assets subject to amortization was $83 million in 2010,

$87 million in 2009 and $89 million in 2008. The estimated amor-

tization expense for the next five years, assuming no change in the

estimated useful lives of identifiable intangible assets or changes in

foreign exchange rates, is as follows: $74 million in 2011, $49 million

in 2012, $42 million in 2013, $34 million in 2014 and $20 million

in 2015. At July 3, 2010, the weighted average remaining useful life

for trademarks is 18 years; customer relationships is 17 years; com-

puter software is 3 years; and other contractual agreements is 7 years.

During 2009, the corporation recognized impairment charges

of $79 million related to certain trademarks associated with the

International Bakery segment. These charges are more fully described

in Note 4 to the Consolidated Financial Statements, “Impairment

Charges.” In 2009, trademarks of $8 million and customer relation-

ships and other contractual agreements of $3 million were recognized

with the acquisition of the Café Moka beverage business in Brazil.

During 2008, the corporation recognized impairment charges

of $13 million related to certain trademarks that are related to

the North American Retail segment. These charges are more fully

described in Note 4 to the Consolidated Financial Statements,

“Impairment Charges.”

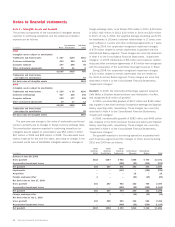

Goodwill In 2009, the International Beverage segment acquired

Café Moka, a Brazilian based producer and wholesaler of coffee,

and recognized $18 million of goodwill.

In 2009, non-deductible goodwill of $107 million and $124 million

was impaired in the North American foodservice beverage and Spanish

bakery reporting units, respectively. These charges are more fully

described in Note 4 to the Consolidated Financial Statements,

“Impairment Charges.”

In 2008, non-deductible goodwill of $382 million and $400 million

was impaired in the North American foodservice bakery and Spanish

bakery reporting units, respectively. These charges are more fully

described in Note 4 to the Consolidated Financial Statements,

“Impairment Charges.”

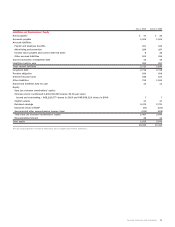

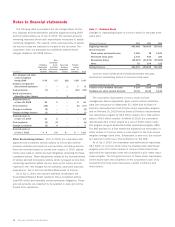

The goodwill reported in continuing operations associated with

each business segment and the changes in those amounts during

2010 and 2009 are as follows:

62 Sara Lee Corporation and Subsidiaries

North North North

American American American International International

In millions Retail Fresh Bakery Foodservice Beverage Bakery Total

Balance at June 28, 2008

Gross goodwill $102 $287 $«983 $355 $«744 $«2,471

Accumulated impairment losses – – (382) (92) (400) (874)

Net goodwill 102 287 601 263 344 1,597

Impairments – – (107) – (124) (231)

Acquisition –––18–18

Foreign exchange/other 1 – – (51) (39) (89)

Net book value at June 27, 2009

Gross goodwill 103 287 983 322 705 2,400

Accumulated impairment losses – – (489) (92) (524) (1,105)

Net goodwill 103 287 494 230 181 1,295

Foreign exchange/other – 1 – (16) (19) (34)

Net book value at July 3, 2010

Gross goodwill 103 288 983 306 686 2,366

Accumulated impairment losses – – (489) (92) (524) (1,105)

Net goodwill $103 $288 $«494 $214 $«162 $«1,261