Sara Lee 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

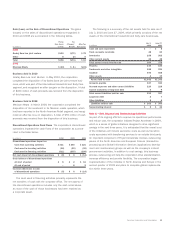

As of July 3, 2010, the corporation had $32 million of total

unrecognized compensation expense related to stock unit plans that

will be recognized over the weighted average period of 1.71 years.

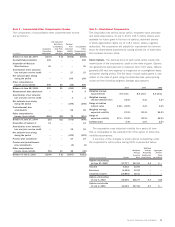

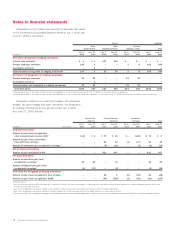

In millions except per share data 2010 2009 2008

Stock Unit Awards

Fair value of share-based units

that vested during the fiscal year $÷÷«35 $÷÷«12 $÷÷«29

Weighted average grant date

fair value of share based units

granted during the fiscal year $10.06 $13.73 $16.32

All Stock-Based Compensation

Total compensation expense $÷÷«35 $÷÷«41 $÷÷«38

Tax benefit on compensation expense $÷÷«13 $÷÷«12 $÷÷«10

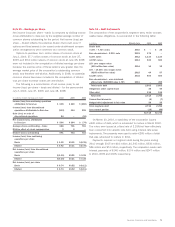

Note 10 – Employee Stock Ownership Plans (ESOP)

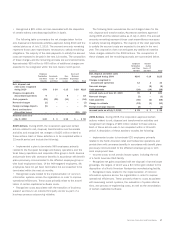

The corporation maintains an ESOP that holds common stock of

the corporation that is used to fund a portion of the corporation’s

matching program for its 401(k) savings plan for domestic non-union

employees. The purchase of the original stock by the Sara Lee

ESOP was funded both with debt guaranteed by the corporation and

loans from the corporation. The debt guaranteed by the corporation

was fully paid in 2004, and only loans from the corporation to the

ESOP remain. Each year, the corporation makes contributions that,

with the dividends on the common stock held by the Sara Lee ESOP,

are used to pay loan interest and principal. Shares are allocated to

participants based upon the ratio of the current year’s debt service

to the sum of the total principal and interest payments over the

remaining life of the loan. The number of unallocated shares in the

ESOP was 7 million at July 3, 2010 and 8 million at June 27, 2009.

Expense recognition for the ESOP is accounted for under the grand-

fathered provisions contained within US GAAP.

The expense for the 401(k) recognized by the ESOP amounted

to $7 million in 2010, $5 million in 2009 and $7 million in 2008.

Payments to the Sara Lee ESOP were $11 million in 2010 and

2009, and $16 million in 2008.

The corporation received cash from the exercise of stock options

during 2010 of $13.2 million. As of July 3, 2010, the corporation

had $6 million of total unrecognized compensation expense related

to stock option plans that will be recognized over the weighted

average period of 1.09 years.

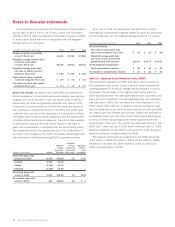

In millions except per share data 2010 2009 2008

Number of options exercisable

at end of fiscal year 13,121 22,721 27,665

Weighted average exercise price

of options exercisable

at end of fiscal year $17.66 $18.13 $18.61

Weighted average grant date

fair value of options granted

during the fiscal year $÷1.88 $÷2.67 $÷4.36

Total intrinsic value of options

exercised during the fiscal year $÷÷0.9 $÷÷0.0 $÷÷1.0

Fair value of options that vested

during the fiscal year $÷÷6.3 $÷÷2.0 $÷÷3.0

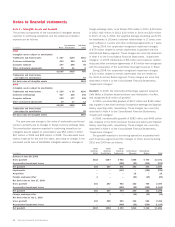

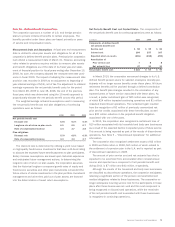

Stock Unit Awards Restricted stock units (RSUs) are granted to

certain employees to incent performance and retention over periods

ranging from one to five years. Upon the achievement of defined

parameters, the RSUs are generally converted into shares of the

corporation’s common stock on a one-for-one basis and issued to

the employees. A substantial portion of all RSUs vest solely upon

continued future service to the corporation. A small portion of RSUs

vest based upon continued future employment and the achievement

of certain defined performance measures. The cost of these awards

is determined using the fair value of the shares on the date of

grant, and compensation is recognized over the period during which

the employees provide the requisite service to the corporation. A

summary of the changes in the stock unit awards outstanding under

the corporation’s benefit plans during 2010 is presented below:

Weighted

Weighted Average Aggregate

Average Remaining Intrinsic

Grant Date Contractual Value

Shares in thousands Shares Fair Value Term (Years) (in millions)

Nonvested share units

at June 27, 2009 8,578 $14.83 1.2 $÷82

Granted 4,048 10.06 – –

Vested (2,376) 14.70 – –

Forfeited (1,236) 13.89 – –

Nonvested share units

at July 3, 2010 9,014 $12.86 1.2 $126

Exercisable share units

at July 3, 2010 153 $16.29 4.2 $÷÷2

70 Sara Lee Corporation and Subsidiaries