Sara Lee 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sara Lee Corporation and Subsidiaries 19

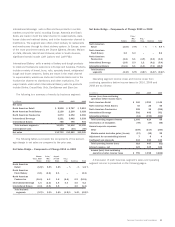

This Financial Review discusses the corporation’s results of operations,

financial condition and liquidity, risk management activities, and

significant accounting policies and critical estimates. This discussion

should be read in conjunction with the Consolidated Financial

Statements and related notes thereto contained elsewhere in this

annual report. The corporation’s fiscal year ends on the Saturday

closest to June 30. Fiscal 2010 was a 53-week year, while fiscal

years 2009 and 2008 were 52-week years. Unless otherwise stated,

references to years relate to fiscal years. The following is an outline

of the analysis included herein:

•Business Overview

•Summary of Results

•Review of Consolidated Results

•Operating Results by Business Segment

•Financial Condition

•Liquidity

•Risk Management

•Non-GAAP Financial Measures

•Critical Accounting Estimates

•Issued But Not Yet Effective Accounting Standards

•Forward-Looking Information

Business Overview

Our Business Sara Lee is a global manufacturer and marketer of

high-quality, brand name products for consumers throughout the

world focused primarily in the meats, bakery and beverage categories.

Our major brands include

Ball Park, Douwe Egberts, Hillshire Farm,

Jimmy Dean, Senseo

and our namesake,

Sara Lee

.

In North America, the company sells a variety of packaged meat

products that include hot dogs, corn dogs, breakfast sausages,

dinner sausages and deli meats as well as a variety of fresh and

frozen baked products and specialty items that include bread, buns,

bagels, cakes and cheesecakes. These products are sold through

the retail channel to supermarkets, warehouse clubs and national

chains. The company also sells a variety of meat, bakery and beverage

products to foodservice customers in North America. Internationally,

the company sells coffee and tea products in Europe, Brazil, Australia

and Asia through the retail and foodservice channels as well as

a variety of bakery and dough products to retail and foodservice

customers in Europe and Australia.

During fiscal 2010, the corporation received binding offers for

the sale of its global body care and European detergents businesses

for €1.275 billion, its air care business for €320 million, and its

non-Indian insecticides business for €154 million. In addition, it

completed the sale of its 51% stake in its Godrej Sara Lee joint

venture, an insecticide business in India, for €185 million. Together

these businesses represent over 70% of the net sales of the inter-

national household and body care businesses. The corporation is

also actively marketing for sale its remaining household and body

care businesses and, as a result, the businesses that formerly

comprised the International Household and Body Care segment –

air care, body care, shoe care and insecticides – are classified as

discontinued operations and are presented in a separate line in

the Consolidated Statements of Income for all periods presented.

The company is focused on building sustainable, profitable

growth over the long term by achieving share leadership in its core

categories; innovating around its core products and product cate-

gories; expanding into high opportunity geographic markets and

strategic joint ventures/partnerships; delivering superior quality

and value to our customers; and driving operating efficiencies.

Challenges and Risks As an international consumer products

company, we face certain risks and challenges that impact our busi-

ness and financial performance. The risks and challenges described

below have impacted our performance and are likely to impact our

future results as well.

The food and consumer products businesses are highly

competitive. In many product categories, we compete not only with

widely advertised branded products, but also with private label prod-

ucts that are generally sold at lower prices. As a result, from time to

time, we may need to reduce the prices for some of our products to

respond to competitive pressures. In addition, the general economic

weakness has negatively impacted our business. The continued

economic uncertainty may also result in increased pressure to reduce

the prices for some of our products, limit our ability to increase or

maintain prices or lead to a continued shift toward private label

products. Any reduction in prices or our inability to increase prices

when raw material costs increase could negatively impact profit

margins and the overall profitability of our reporting units, which

could potentially trigger a goodwill impairment.

Commodity prices directly impact our business because of their

effect on the cost of raw materials used to make our products and

the cost of inputs to manufacture, package and ship our products.

Many of the commodities we use, including beef, pork, coffee, wheat,

corn, corn syrup, soybean and corn oils, butter, sugar and energy,

have experienced price volatility due to factors beyond our control.

The company’s objective is to offset commodity price increases with

pricing actions and to offset any operating costs increases with

continuous improvement savings.

The company’s business results are also heavily influenced by

changes in foreign currency exchange rates. For the most recently

completed fiscal year, approximately 40% of net sales and approxi-

mately 50% of operating segment income were generated outside

of the U.S. As a result, changes in foreign currency exchange rates,

particularly the European euro, can have a significant impact on the

reported results. A three cent movement in the euro exchange rate

is expected to have approximately a one cent impact on the corpo-

ration’s diluted earnings per share.

Financial review