Sara Lee 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20 Sara Lee Corporation and Subsidiaries

three performance measures under Sara Lee’s annual incentive

plan are net sales and operating income, which are the reported

amounts as adjusted for significant items and possibly other items.

Operating income, as adjusted for significant items, also may be used

as a component of Sara Lee’s long-term incentive plans. Many of

the significant items will recur in future periods; however, the amount

and frequency of each significant item varies from period to period.

See

Non-GAAP Measures Definitions

on page 35 of this report for

additional information regarding these financial measures.

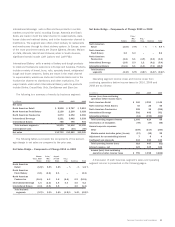

Summary of Results

The business highlights for 2010 include the following:

•Net sales for the year were $10.8 billion, virtually unchanged

from the prior year, as the favorable impact of the 53rd week and

changes in foreign currency exchange rates were offset by the

negative impact of business dispositions, lower unit volumes and

lower prices due to competitive pressures and a difficult economic

environment. Adjusted net sales declined 2.8%.

•Reported operating income for the year was $918 million,

an increase of $431 million, which resulted from a $286 million

reduction in impairment charges, improved operating results for

the North American Retail and International Beverage business

segments and the favorable impact of the 53rd week. Adjusted

operating income increased $157 million, or 20.2%.

•Operating segment income was favorably impacted by the

year-over-year reduction in impairment charges as well as lower

commodity costs net of pricing actions and cost savings achieved

from Project Accelerate and continuous improvement initiatives.

These improvements were partially offset by higher spending on

media advertising and promotions (MAP) and the negative impact

of lower unit volumes.

•Income from continuing operations attributable to Sara Lee

was $635 million, or $0.92 per share on a diluted basis, while

net income attributable to Sara Lee was $506 million or $0.73 per

share on a diluted basis. The year-over-year improvement reflects

improved results for the business segments, which includes the

favorable impact of lower impairment charges noted above.

•Cash from operating activities increased by $52 million due to

improved operating results and improved working capital manage-

ment partially offset by higher cash payments for restructuring

actions, taxes and pensions.

•The corporation announced a revised capital plan that will focus

on share repurchases, dividend payouts and pension plan funding

while maintaining a solid investment grade credit profile. The com-

pany expended $500 million to repurchase 36.4 million shares of

its common stock under an accelerated share repurchase program

and voluntarily contributed an additional $200 million into its U.S.

defined benefit pension plans.

The company’s international operations provide a significant

portion of the company’s cash flow from operating activities, which

has required and is expected to continue to require the company

to repatriate a greater portion of cash generated outside of the U.S.

The repatriation of these funds has resulted in higher income tax

expense and cash tax payments.

As previously noted, the corporation is currently in the process

of divesting the operations that comprise the household and body

care business and more than $100 million of related overhead is

expected to remain after these businesses have been sold. The

corporation estimates that it will recognize charges of approximately

$150 million to $200 million, the majority of which is expected to be

incurred in 2011, to eliminate this stranded overhead and to expand

the business process outsourcing initiative announced in 2009.

Non-GAAP Measures Management measures and reports Sara Lee’s

financial results in accordance with U.S. generally accepted accounting

principles (“GAAP”). In this report, Sara Lee highlights certain items

that have significantly impacted the corporation’s financial results

and uses several non-GAAP financial measures to help investors

understand the financial impact of these significant items. The non-

GAAP financial measures used by Sara Lee in this annual report are

adjusted net sales, adjusted operating segment income, and adjusted

operating income, which exclude from a financial measure computed

in accordance with GAAP the impact of significant items, the receipt

of contingent sale proceeds, the impact of acquisitions and disposi-

tions, the impact of the 53rd week and changes in foreign currency

exchange rates. Management believes that these non-GAAP financial

measures reflect an additional way of viewing aspects of Sara Lee’s

business that, when viewed together with Sara Lee’s financial results

computed in accordance with GAAP, provide a more complete under-

standing of factors and trends affecting Sara Lee’s historical financial

performance and projected future operating results, greater transparency

of underlying profit trends and greater comparability of results across

periods. These non-GAAP financial measures are not intended to be

a substitute for the comparable GAAP measures and should be read

only in conjunction with our consolidated financial statements prepared

in accordance with GAAP.

In addition, investors frequently have requested information

from management regarding significant items and the impact of

the contingent sale proceeds. Management believes, based on

feedback it has received during earnings calls and discussions with

investors, that these non-GAAP measures enhance investors’ ability

to assess Sara Lee’s historical and project future financial perform-

ance. Management also uses certain of these non-GAAP financial

measures, in conjunction with the GAAP financial measures, to

understand, manage and evaluate our businesses, in planning for

and forecasting financial results for future periods, and as one factor

in determining achievement of incentive compensation. Two of the

Financial review