Sara Lee 2010 Annual Report Download - page 58

Download and view the complete annual report

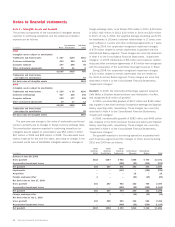

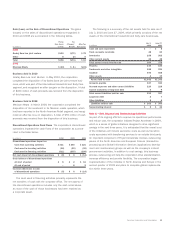

Please find page 58 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to financial statements

Note 1 – Nature of Operations and Basis of Presentation

Nature of Operations Sara Lee Corporation (the corporation or

Sara Lee) is a U.S.-based multinational corporation. The corpora-

tion’s principal product lines are branded packaged meat products,

fresh and frozen bakery products, and roast and ground coffee. The

relative importance of each operation over the past three years, as

measured by sales and operating segment income, is presented in

Note 19, “Business Segment Information,” of these financial state-

ments. Food and beverage sales are made in both the retail channel,

to supermarkets, warehouse clubs and national chains, and the

foodservice channel.

Basis of Presentation The Consolidated Financial Statements

include the accounts of the corporation and all subsidiaries where

we have a controlling financial interest. The consolidated financial

statements include the accounts of variable interest entities (VIEs)

for which the corporation is deemed the primary beneficiary. The

results of companies acquired or disposed of during the year are

included in the consolidated financial statements from the effective

date of acquisition, or up to the date of disposal. All significant

intercompany balances and transactions have been eliminated

in consolidation.

The corporation’s fiscal year ends on the Saturday closest to

June 30. Fiscal 2010 was a 53-week year. Fiscal years 2009 and

2008 were 52-week years. Unless otherwise stated, references to

years relate to fiscal years.

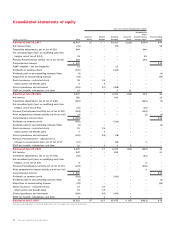

In 2010, the corporation retrospectively adopted new accounting

guidance related to noncontrolling interests in its consolidated

financial statements. This guidance requires noncontrolling interests,

formerly referred to as minority interest, to be shown as a separate

component of equity and the changes in ownership interest must

be accounted for as equity transactions. It also requires that the

amount of consolidated net income attributable to the parent and

to the noncontrolling interest be clearly identified and presented

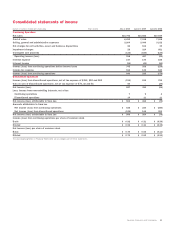

on the face of the Consolidated Statements of Income. As a result,

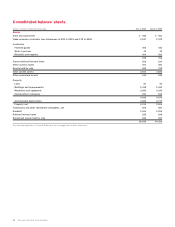

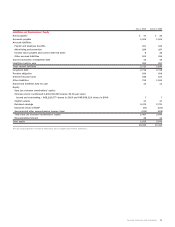

the Consolidated Balance Sheets, Consolidated Statements of

Income, Consolidated Statements of Equity and Consolidated

Statements of Cash Flows present the impact of noncontrolling

interests on equity, net income, comprehensive income and cash

flow. Net income now includes earnings attrib utable to both

Sara Lee and noncontrolling interests.

In the fourth quarter of 2010, the corporation began to reflect

its franchise agreements with independent third party contractors

that distribute North American fresh bakery products as VIE’s with

a noncontrolling interest. The corporation previously had consolidated

the results of these independent operators, but did not reflect the

noncontrolling interest for these entities as these amounts were not

material to the consolidated quarterly and annual financial state-

ments. The consolidated financial statements have been revised,

for all periods presented, to reflect these independent third party

contractors as noncontrolling interests. Additional information on

this can be found under Note 2, Variable Interest Entities.

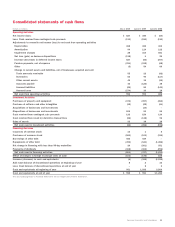

Discontinued Operations

Beginning in 2010, the results of the

Household and Body Care operations are being reported as discon-

tinued operations. The results of the corporation’s Mexican Meats,

business had previously been reported as discontinued operations

in the corporation’s 2009 annual report. The results of operations

of these businesses through the date of sale are presented as

discontinued operations in the Consolidated Statements of Income.

Prior to disposition, the assets and liabilities of discontinued

operations are aggregated and reported on separate lines of the

Consolidated Balance Sheets.

Financial Statement Corrections

During the fourth quarter of 2010,

the corporation corrected two errors which reduced net income by

$10 million in 2010. One adjustment related to a true-up of vaca-

tion accruals for certain North American hourly employees, which

reduced net income by $7 million. A second adjustment related to

a change in the accounting related to third party contractors who

distribute North American fresh bakery products, which reduced net

income by $3 million. The impact of correcting these errors in the

quarters of 2010 and full year 2008 and 2009 would have been

insignificant while the impact on years prior to 2008 would have

reduced net income by $7 million. We evaluated these errors in

relation to the current period, which is when they were corrected,

as well as the periods in which they originated. Management

believes these errors are immaterial to both the consolidated

quarterly and annual financial statements.

Note 2 – Summary of Significant Accounting Policies

The Consolidated Financial Statements have been prepared

in accordance with generally accepted accounting principles in

the U.S. (GAAP).

The preparation of the Consolidated Financial Statements in

conformity with GAAP requires management to make use of estimates

and assumptions that affect the reported amount of assets and

liabilities, revenues and expenses and certain financial statement

disclosures. Significant estimates in these Consolidated Financial

Statements include allowances for doubtful accounts receivable, net

realizable value of inventories, the cost of sales incentives, useful

lives of property and identifiable intangible assets, the evaluation

of the recoverability of property, identifiable intangible assets and

goodwill, self-insurance reserves, income tax and valuation reserves,

the valuation of assets and liabilities acquired in business combina-

tions, assumptions used in the determination of the funded status

and annual expense of pension and postretirement employee benefit

plans, and the volatility, expected lives and forfeiture rates for stock

compensation instruments granted to employees. Actual results

could differ from these estimates.

56 Sara Lee Corporation and Subsidiaries