Sara Lee 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.seeking to reinstate the original arbitrator’s judgment against the

defendants, including the corporation. The respective motions for

reconsideration have been fully briefed and the parties await the

NLRC’s rulings.

In response to the arbitrator’s original ruling, the Court of

Appeals required the corporation to post a bond of approximately

$25 million. However, the corporation has appealed the decision to

the Supreme Court and, as a result, no bond posting is required

until all allowable appeals have been exhausted. The corporation

continues to believe that the plaintiffs’ claims are without merit;

however, it is reasonably possible that this case will be ruled against

the corporation and have a material adverse impact on the corpo -

ration’s results of operations or cash flows.

Hanesbrands Inc.

In September 2006, the corporation spun off

its branded apparel business into an independent publicly-traded

company named Hanesbrands Inc. (“HBI”). In connection with the

spin off, the corporation and HBI entered into a tax sharing agree-

ment that governs the allocation of tax assets and liabilities between

the parties. HBI has initiated binding arbitration claiming that it is

owed $72 million from the corporation under the tax sharing agree-

ment. The corporation believes HBI’s claims are without merit and

is vigorously contesting the matter. Hearings are scheduled to begin

in August 2010.

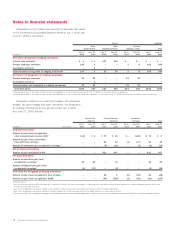

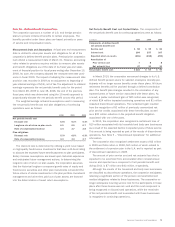

Multi-Employer Pension Plans

The corporation participates in

various multi-employer pension plans that provide retirement benefits

to certain employees covered by collective bargaining agreements

(MEPP). Participating employers in a MEPP are jointly responsible

for any plan underfunding. MEPP contributions are established by

the applicable collective bargaining agreements; however, the MEPPs

may impose increased contribution rates and surcharges based

on the funded status of the plan and the provisions of the Pension

Protection Act, which requires substantially underfunded MEPPs to

implement rehabilitation plans to improve funded status. Factors

that could impact funded status of a MEPP include investment per-

formance, changes in the participant demographics, financial stability

of contributing employers and changes in actuarial assumptions.

In addition to regular contributions, the corporation could be

obligated to pay additional contributions (known as a complete or

partial withdrawal liability) if a MEPP has unfunded vested benefits.

These withdrawal liabilities, which would be triggered if the corpora-

tion ceases to make contributions to a MEPP with respect to one or

more collective bargaining units, would equal the corporation’s pro-

portionate share of the unfunded vested benefits based on the year

in which the liability is triggered. The corporation believes that certain

of the MEPPs in which it participates have unfunded vested bene-

fits, and some are significantly underfunded. Withdrawal liability

triggers could include the corporation’s decision to close a plant

or the dissolution of a collective bargaining unit. Due to uncertainty

regarding future withdrawal liability triggers, we are unable to deter-

mine the amount and timing of the corporation’s future withdrawal

liability, if any, or whether the corporation’s participation in these

MEPPs could have any material adverse impact on its financial condi-

tion, results of operations or liquidity. Disagreements over potential

withdrawal liability may lead to legal disputes. The corporation

currently is involved in litigation with one MEPP and it is probable

that the outcome of this litigation may result in a partial withdrawal

liability of approximately $22 million.

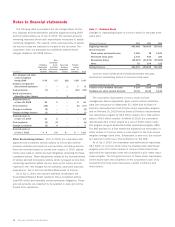

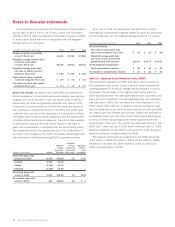

The corporation’s regular scheduled contributions to MEPPs

totaled $50 million in 2010, $49 million in 2009 and $48 million

in 2008. The corporation recognized charges for partial withdrawal

liabilities of approximately $23 million in 2010, $31 million in

2009, and an immaterial amount in 2008.

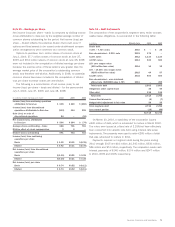

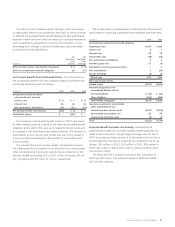

Competition Law

During the past few years, competition authorities

in various European countries and the European Commission have

initiated investigations into the conduct of consumer products com-

panies. These investigations usually continue for several years and,

if violations are found, may result in substantial fines. In connection

with these investigations, Sara Lee’s household and body care busi-

ness operating in Europe has received requests for information, made

employees available for interviews, and been subjected to unan-

nounced inspections by various competition authorities. Sara Lee

has been imposed fines in two instances (a €3.7 million fine imposed

by the Spanish Competition Authorities in the second quarter of

2010 related to claims that the corporation engaged in inappropriate

activities to indirectly increase prices of its shower gel products,

and a €5.5 million fine imposed by the German cartel authorities in

February 2008), but no formal charges have been brought against

Sara Lee concerning the substantive conduct that is the subject of

these other investigations. Our practice is to comply with all laws

and regulations applicable to our business, including the antitrust

laws, and to cooperate with relevant regulatory authorities.

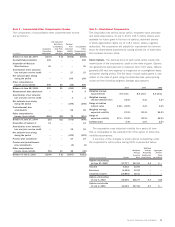

Charges for fines that already have been imposed against the

corporation, as noted above, have been reflected in the Consolidated

Statements of Income in the period we were notified of the fine. The

corporation also recognized a charge of €20 million in the fourth

quarter of 2010 which reflects an estimate of additional fines that

are probable of being imposed and brings the total amount accrued

for remaining competition matters to €28 million. Based on currently

available information, it is reasonably possible the corporation may be

subject to additional fines related to several of these investigations.

Except for fines previously assessed or accrued by the corporation,

we are unable to estimate the impact on our financial statements of

additional fines, if any, that may be imposed against the corporation.

Sara Lee Corporation and Subsidiaries 73