Sara Lee 2010 Annual Report Download - page 41

Download and view the complete annual report

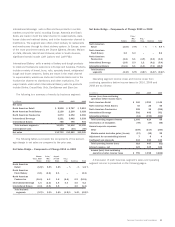

Please find page 41 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The corporation participates in various multi-employer pension

plans that provide retirement benefits to certain employees covered

by collective bargaining agreements (MEPP). Participating employers

in a MEPP are jointly responsible for any plan underfunding. MEPP

contributions are established by the applicable collective bargaining

agreements; however, the MEPPs may impose increased contribu-

tion rates and surcharges based on the funded status of the plan

and the provisions of the Pension Protection Act, which requires

substantially underfunded MEPPs to implement rehabilitation plans

to improve funded status. The corporation believes that its contribu-

tions to MEPPs may increase by approximately 12% to 15% through

2011 due to increased contribution rates and surcharges MEPPs are

expected to impose under the Pension Protection Act. Factors that

could impact funded status of a MEPP include investment perform-

ance, changes in the participant demographics, financial stability

of contributing employers and changes in actuarial assumptions.

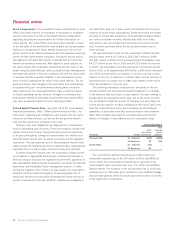

In addition to regular contributions, the corporation could be

obligated to pay additional contributions (known as a complete or

partial withdrawal liability) if a MEPP has unfunded vested benefits.

These withdrawal liabilities, which would be triggered if the corpora-

tion ceases to make contributions to a MEPP with respect to one

or more collective bargaining units, would equal the corporation’s

proportionate share of the unfunded vested benefits based on the

year in which liability is triggered. The corporation believes that

certain of the MEPPs in which it participates have unfunded vested

benefits, and some are significantly underfunded. Withdrawal liability

triggers could include the corporation’s decision to close a plant

or the dissolution of a collective bargaining unit. Due to uncertainty

regarding future withdrawal liability triggers, we are unable to deter-

mine the amount and timing of the corporation’s future withdrawal

liability, if any, or whether the corporation’s participation in these

MEPPs could have any material adverse impact on its financial

condition, results of operations or liquidity. Disagreements over

potential withdrawal liability may lead to legal disputes. The corpo -

ration currently is involved in litigation with one MEPP and it is

probable that the outcome of this litigation may result in a partial

withdrawal liability of approximately $22 million, of which the

corporation has established an accrual.

The corporation’s regular scheduled contributions to MEPPs

totaled $50 million in 2010, $49 million in 2009 and $48 million

in 2008. The corporation incurred withdrawal liabilities of approxi-

mately $23 million in 2010, $31 million in 2009 and an immaterial

amount in 2008.

Sara Lee Corporation and Subsidiaries 39

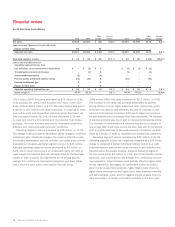

Repatriation of Foreign Earnings and Income Taxes The corporation

anticipates that it will continue to repatriate a portion of its foreign

subsidiary’s future earnings. The tax expense associated with any

return of foreign earnings will be recognized as such earnings are

realized. However, the corporation pays the liability upon completing

the repatriation action. The repatriation of foreign sourced earnings

is not the only source of liquidity for the corporation. In addition to

cash flow derived from operations, the corporation has access to

the commercial paper market, a $1.85 billion revolving credit facil-

ity, and access to public and private debt markets as a means to

generate liquidity sufficient to meet its U.S. cash flow needs.

In 2010 the tax expense for repatriating a portion of 2010 and

prior year earnings to the U.S. is $145 million, with the majority of

these taxes expected to be paid after 2010. This amount includes

a tax charge in connection with the corporation’s third quarter deci-

sion to no longer reinvest overseas earnings primarily attributable

to existing overseas cash and the book value of the household

and body care businesses.

Cash and Equivalents, Short-Term Investments and Cash Flow

The corporation’s cash balance of $955 million at the end of 2010

was invested in interest-bearing bank deposits that are redeemable

on demand by the corporation. A significant portion of cash and

equivalents are held by the corporation’s subsidiaries outside of the

U.S. A portion of these balances will be used to fund future working

capital and other funding requirements.

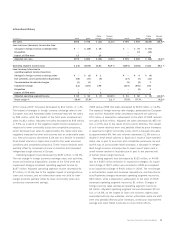

The corporation has also recognized amounts for transformation

and other restructuring charges and at the end of 2010 recognized

a liability of approximately $105 million that relates primarily to

future severance and other lease and contractual payments. These

amounts will be paid when the obligation becomes due, and the

corporation expects a significant portion of these amounts will be

paid in 2011. The anticipated 2011 payments of cash taxes and

severance associated with previously recognized exit activities will

have a significant negative impact on cash from operating activities.

Dividend The corporation’s annualized dividend amounts per

share were $0.44 in 2010 and 2009 and $0.42 in 2008. Future

dividends are determined by the corporation’s Board of Directors

and are not guaranteed.