Sara Lee 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

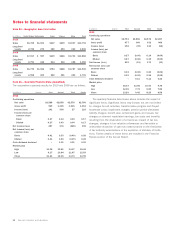

Notes to financial statements

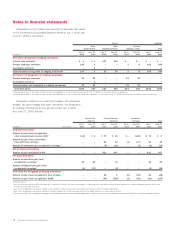

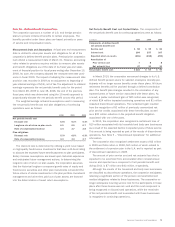

The net periodic benefit cost of the corporation’s defined benefit

pension plans in 2010 was $48 million higher than in 2009. The

increase was primarily due to a $36 million increase in amortization

of net actuarial losses due to net actuarial losses in the prior year,

which increased the amount subject to amortization; as well as the

increase in interest expense and a reduction in expected return on

assets due to the year-over-year change in projected benefit obliga-

tions and asset levels.

The net periodic benefit cost of the corporation’s defined benefit

pension plans in 2009 was $30 million lower than in 2008. The

decline was primarily due to a $23 million reduction in amortization of

net actuarial losses due to net actuarial gains in the prior year, which

reduced the amount subject to amortization; and a $22 million reduc-

tion in service cost due to headcount reductions versus the prior year.

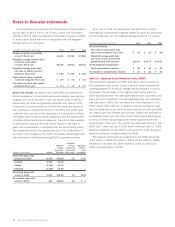

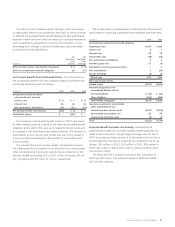

The funded status of defined benefit pension plans at the

respective year-ends was as follows:

In millions 2010 2009

Projected benefit obligation

Beginning of year $4,218 $4,744

Service cost 64 66

Interest cost 264 257

Plan amendments 12

Benefits paid (224) (225)

Elimination of early measurement date –32

Participant contributions 33

Actuarial (gain) loss 761 (179)

Settlement/curtailment (81) (2)

Foreign exchange (279) (480)

End of year 4,727 4,218

Fair value of plan assets

Beginning of year 3,752 4,423

Actual return on plan assets 628 (315)

Employer contributions 332 306

Participant contributions 33

Benefits paid (224) (225)

Settlement (30) (3)

Elimination of early measurement date –22

Foreign exchange (264) (459)

End of year 4,197 3,752

Funded status $÷(530) $÷(466)

Amounts recognized on the

consolidated balance sheets

Noncurrent asset $÷÷÷«7 $÷«133

Accrued liabilities (7) (4)

Pension obligation (530) (595)

Net liability recognized $÷(530) $÷(466)

Amounts recognized in accumulated

other comprehensive income

Unamortized prior service cost $÷÷«55 $÷÷«74

Unamortized actuarial loss, net 1,143 883

Total $1,198 $÷«957

The underfunded status of the plans increased from $466 million

in 2009 to $530 million in 2010, due to a $509 million increase in

the projected benefit obligation which was only partially offset by a

$445 million increase in plan assets. The increase in the projected

benefit obligation was due to actuarial losses resulting from a signif-

icant decrease in the discount rate used to determine the benefit

obligation. The increase in plan assets was the result of a significant

increase in the actual return on plan assets year-over-year due to

improved investment performance during the year.

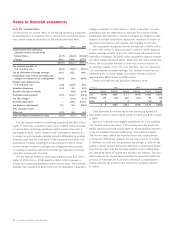

The accumulated benefit obligation is the present value of pension

benefits (whether vested or unvested) attributed to employee service

rendered before the measurement date and based on employee

service and compensation prior to that date. The accumulated ben -

efit obligation differs from the projected benefit obligation in that

it includes no assumption about future compensation levels. The

accumulated benefit obligations of the corporation’s pension plans

as of the measurement dates in 2010 and 2009 were $4,639 mil-

lion and $4,089 million, respectively.

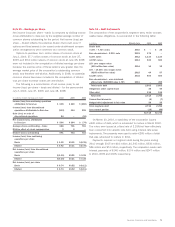

The projected benefit obligation, accumulated benefit obligation

and fair value of plan assets for pension plans with accumulated

benefit obligations in excess of plan assets were:

In millions 2010 2009

Projected benefit obligation $3,230 $2,878

Accumulated benefit obligation 3,203 2,809

Fair value of plan assets 2,705 2,283

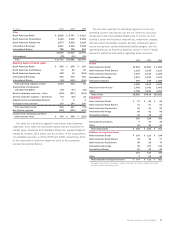

Plan Assets, Expected Benefit Payments and Funding The fair value

of pension plan assets as of July 3, 2010 was determined as follows:

Quoted

Prices in

Active Significant

Market for Other

Identical Observable

Total Fair Assets Inputs

In millions Value (Level 1) (Level 2)

Equity securities

Non-U.S. securities – pooled funds $÷«658 $÷«658 $÷÷–

Fixed income securities

Government bonds 588 588 –

Corporate bonds 715 715 –

U.S. pooled funds 493 493 –

Non-U.S. pooled funds 1,288 737 551

Total fixed income securities 3,084 2,533 551

Real estate 126 126 –

Cash and equivalents 109 109 –

Derivatives 48 73 (25)

Other 172 172 –

Total fair value of assets $4,197 $3,671 $526

80 Sara Lee Corporation and Subsidiaries