Sara Lee 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to financial statements

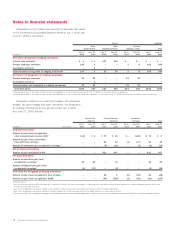

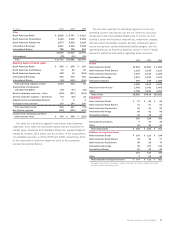

Note 18 – Income Taxes

The provisions for income taxes on continuing operations computed

by applying the U.S. statutory rate to income from continuing opera-

tions before taxes as reconciled to the actual provisions were:

2010 2009 2008

Income (loss) from continuing

operations before income taxes

United States 11.9% (65.6) % (357.8) %

Foreign 88.1 165.6 257.8

100.0% 100.0 % (100.0) %

Tax expense (benefit) at

U.S. statutory rate 35.0% 35.0 % (35.0) %

Tax on remittance of foreign earnings 19.5 12.2 68.0

Finalization of tax reviews and audits and

changes in estimate on tax contingencies (22.3) (5.9) (60.8)

Foreign taxes different than

U.S. statutory rate (7.5) (15.9) (8.3)

Valuation allowances (0.6) 2.4 (6.6)

Benefit of foreign tax credits – (4.5) (13.8)

Contingent sale proceeds (5.9) (14.7) (29.1)

Tax rate changes – (0.2) (0.1)

Goodwill impairment – 23.6 176.5

Tax provision adjustments 2.3 2.4 (12.8)

Sale of capital assets –––

Other, net (1.2) 2.9 (1.4)

Taxes at effective worldwide tax rates 19.3% 37.3 % 76.6 %

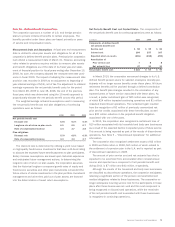

The tax expense related to continuing operations was $20 million

higher in 2010 than in 2009 primarily due to a $437 million increase

in income from continuing operations before income taxes and a

tax charge of $121 million related to the corporation’s decision to

no longer reinvest overseas earnings primarily attributable to existing

overseas cash and the book value of the household and body care

businesses. Partially offsetting this was a benefit of $177 million

for the release of certain contingent tax obligations after statutes

in multiple jurisdictions lapsed and certain tax regulatory examina-

tions and reviews were resolved.

The tax expense related to continuing operations was $13 million

higher in 2009 than in 2008 despite a $514 million increase in

income from continuing operations before income taxes. The 2009 tax

expense was impacted by $242 million of non-deductible impairment

charges compared to $790 million in 2008, a reduction in costs

associated with the repatriation of earnings from certain foreign

subsidiaries, the reduction in certain contingent tax obligations after

statutes in multiple jurisdictions lapsed, the resolution of certain tax

regulatory examinations and reviews, and changes in estimate.

The corporation recognized income tax expense of $145 million

in 2010, $44 million in 2009 and $107 million in 2008 related to

certain earnings outside of the U.S. which were not deemed to be

indefinitely reinvested. The $145 million repatriation expense includes

the $121 charge explained above. Aside from the items mentioned

above, the corporation intends to continue to invest a portion of

its earnings outside of the U.S. and, therefore, has not recognized

U.S. tax expense on these earnings. U.S. federal income tax and

withholding tax on these foreign unremitted earnings would be

approximately $200 million to $225 million.

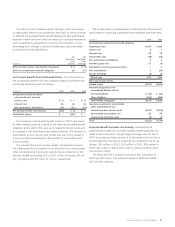

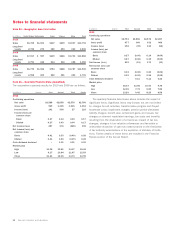

Current and deferred tax provisions (benefits) were:

In millions 2010 2009 2008

Current Deferred Current Deferred Current Deferred

U.S. $(176) $182 $÷77 $(65) $«282 $(237)

Foreign 176 (33) 130 (13) 98 (25)

State 4–4–(10) 12

$÷÷«4 $149 $211 $(78) $«370 $(250)

Cash payments for income taxes from continuing operations

were $305 million in 2010, $218 million in 2009 and $337 million

in 2008.

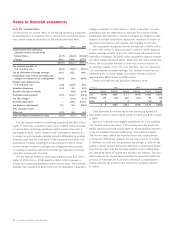

Sara Lee Corporation and eligible subsidiaries file a consolidated

U.S. federal income tax return. The company uses the asset-and-

liability method to provide income taxes on all transactions recorded

in the consolidated financial statements. This method requires

that income taxes reflect the expected future tax consequences

of temporary differences between the carrying amounts of assets

or liabilities for book and tax purposes. Accordingly, a deferred tax

liability or asset for each temporary difference is determined based

upon the tax rates that the company expects to be in effect when

the underlying items of income and expense are realized. The com-

pany’s expense for income taxes includes the current and deferred

portions of that expense. A valuation allowance is established to

reduce deferred tax assets to the amount the company expects

to realize.

84 Sara Lee Corporation and Subsidiaries