Sara Lee 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

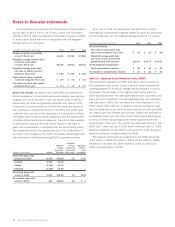

The corporation uses either hedge accounting or mark-to-market

accounting for its derivative instruments. Under hedge accounting,

the corporation formally documents its hedge relationships, including

identification of the hedging instruments and the hedged items, as

well as its risk management objectives and strategies for undertaking

the hedge transaction. This process includes linking derivatives that

are designated as hedges of specific assets, liabilities, firm commit-

ments or forecasted transactions. The corporation also formally

assesses, both at inception and at least quarterly thereafter, whether

the derivatives that are used in hedging transactions are highly

effective in offsetting changes in either the fair value or cash flows

of the hedged item. If it is determined that a derivative ceases to

be a highly effective hedge, or if the anticipated transaction is no

longer likely to occur, the corporation discontinues hedge account-

ing and any deferred gains or losses are recorded in the “Selling,

general and administrative expenses” line in the Consolidated

Statements of Income. Derivatives are recorded in the Consolidated

Balance Sheets at fair value in other assets and other liabilities.

For more information about accounting for derivatives see Note 15,

“Financial Instruments”.

Self-Insurance Reserves The corporation purchases third-party

insurance for workers’ compensation, automobile and product and

general liability claims that exceed a certain level. The corporation

is responsible for the payment of claims under these insured limits.

The undiscounted obligation associated with these claims is accrued

based on estimates obtained from consulting actuaries. Historical

loss development factors are utilized to project the future develop-

ment of incurred losses, and these amounts are adjusted based

upon actual claim experience and settlements. Accrued reserves,

excluding any amounts covered by insurance, were $187 million

as of July 3, 2010 and $201 million as of June 27, 2009.

Business Acquisitions In 2010, the corporation adopted new

accounting guidance related to business combinations, which requires

changes in the accounting and reporting of business acquisitions.

This guidance requires an acquirer to recognize and measure the

identifiable assets acquired, liabilities assumed, contractual contin-

gencies, contingent consideration and any noncontrolling interest

in an acquired business at fair value on the acquisition date. In

addition, it also requires expensing acquisition costs when incurred,

restructuring costs in periods subsequent to the acquisition date

and any adjustments to deferred tax asset valuation allowances

and acquired uncertain tax positions after the measurement period

to be reflected in income tax expense. The adoption of this guidance

has not impacted the consolidated financial statements.

Variable Interest Entities The corporation consolidates variable

interest entities (“VIEs”) of which it is the primary beneficiary. Legal

entities with which the corporation becomes involved are assessed to

determine whether such entities are VIEs and, if so, whether or not

the corporation is the primary beneficiary. In general, the corporation

determines whether it is the primary beneficiary of a VIE through a

qualitative analysis of risk, which identifies which variable interest

holder absorbs the majority of the financial risk or rewards and

variability of the VIE. In performing this analysis, we consider all

relevant facts and circumstances, including: the design and activities

of the VIE, terms of VIE contracts, identification of other variable

interest holders, our explicit arrangements and our implicit

variable interests.

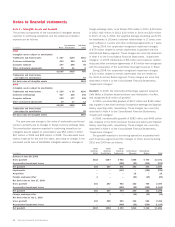

The corporation enters into franchise agreements with

independent third party contractors (“Independent Operators”)

representing distribution rights to sell and distribute fresh bakery

products via direct-store-delivery to retail outlets in defined sales

territories. The corporation does not hold equity interests in any of

the Independent Operator entities. Independent Operators generally

finance the purchase of distribution rights through note agreements

with a financial institution, which, in the aggregate, are partially

guaranteed by Sara Lee. In addition, the corporation maintains

explicit and implicit commitments to maintain the function of routes

to ensure product delivery to customers. The corporation determined

that all Independent Operators are variable interest entities of which

it is the primary beneficiary, primarily as a result of Sara Lee’s debt

guarantee and other route maintenance obligations.

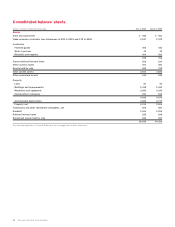

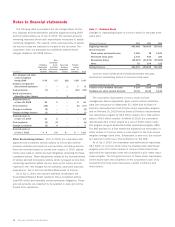

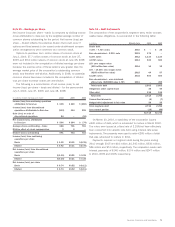

As a result of consolidating these Independent Operator

variable interest entities, the corporation reflected the following

in its balance sheets:

In millions 2010 2009

Inventories – finished goods $÷2 $÷1

Property – machinery and equipment 22 25

Total assets $24 $26

Current portion of long-term debt $12 $11

Long-term debt excluding current portion 58 66

Total liabilities $70 $77

Noncontrolling interests $23 $12

Lease obligations presented within long-term debt captions

on the balance sheet are secured by the vehicles subject to lease

and do not represent additional claims on the corporation’s general

assets. The corporation’s maximum exposure for loss associated

with the Independent Operator entities is limited to $52 million of

long-term debt of the Independent Operators as of July 3, 2010.

Sara Lee Corporation and Subsidiaries 61