Sara Lee 2010 Annual Report Download - page 79

Download and view the complete annual report

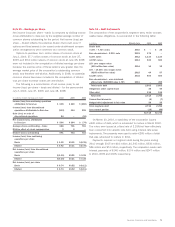

Please find page 79 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of interest expense and therefore are reported in cash flow from

operating activities similar to how cash interest payments are

reported. The portion of the gain or loss on a cross currency swap

that offsets the change in the value of interest expense is recog-

nized in cash flow from operations, while the gain or loss on the

swap that is offsetting the change in value of the debt is classified

as a financing activity in the Consolidated Statement of Cash Flows.

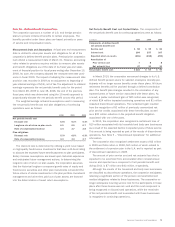

Contingent Features/Concentration of Credit Risk

All of the

corporation’s derivative instruments are governed by International

Swaps and Derivatives Association (i.e. ISDA) master agreements,

requiring the corporation to maintain an investment grade credit

rating from both Moody’s and Standard & Poor’s credit rating agen-

cies. If the corporation’s debt were to fall below investment grade,

it would be in violation of these provisions, and the counterparties

to the derivative instruments could request immediate payment or

demand immediate collateralization on the derivative instruments

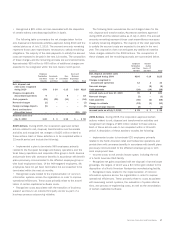

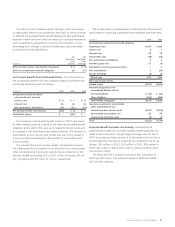

in net liability positions. The aggregate fair value of all derivative

instruments with credit-risk-related contingent features that are in a

liability position was $197 million on July 3, 2010 and $291 million

on June 27, 2009, for which the corporation has posted no collateral.

If the credit-risk-related contingent features underlying these agree-

ments had been triggered on July 3, 2010 and June 27, 2009, the

corporation would have been required to post collateral of, at most,

$197 million and $291 million, respectively, with its counterparties.

A large number of major international financial institutions are

counterparties to the corporation’s financial instruments including

cross currency swaps, interest rate swaps, and currency exchange

forwards and swaps. The corporation enters into financial instrument

agreements only with counterparties meeting very stringent credit

standards (a credit rating of A-/A3 or better), limiting the amount of

agreements or contracts it enters into with any one party and, where

legally available, executing master netting agreements. These positions

are continually monitored. While the corporation may be exposed to

credit losses in the event of nonperformance by individual counter-

parties of the entire group of counterparties, it has not recognized

any losses with these counterparties in the past and does not

anticipate material losses in the future.

Trade accounts receivable due from customers that the corporation

considers highly leveraged were $103 million at July 3, 2010 and

$138 million at June 27, 2009.

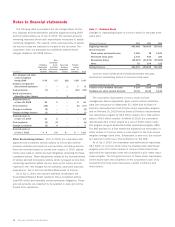

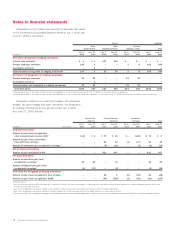

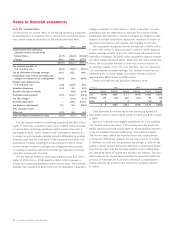

Fair Value Measurements Effective the beginning of 2009, the

corporation implemented new accounting guidance related to the

fair value of financial assets and liabilities, while in 2010 new fair

value accounting rules were adopted for non-financial assets and

liabilities. The adoption of these rules did not have a significant

impact on the measurement of the corporation’s assets and liabilities.

Fair value is defined as the price that would be received to sell

an asset or paid to transfer a liability (i.e., exit price) in an orderly

transaction between market participants at the measurement date.

Assets and liabilities measured at fair value must be categorized

into one of three different levels depending on the assumptions

(i.e., inputs) used in the valuation. Level 1 provides the most reliable

measure of fair value while level 3 generally requires significant

management judgment. Assets and liabilities are classified in their

entirety based on the lowest level of input significant to the fair

value measurement. The fair value hierarchy is defined as follows:

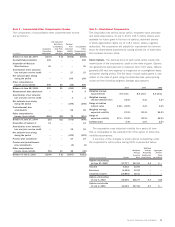

Level 1 – Unadjusted Quoted Prices

Valuations are based on

unadjusted quoted prices in active markets for identical assets or

liabilities. An example would be a marketable equity security that

is traded on a major stock exchange.

Level 2 – Pricing Models with Significant Observable Inputs

Valuations are based on information derived from either an active

market quoted price, which may require further adjustment based

on the attributes of the asset or liability being measured, or an

inactive market transaction. Circumstances when adjustments to

market quoted prices may be appropriate include (i) a quoted price

for an actively traded equity investment that is adjusted for a con-

tractual trading restriction, or (ii) the fair value derived from a trade

of an identical or similar security in an inactive market. An interest

rate swap derivative valued based on a LIBOR swap curve is an

example of a level 2 asset or liability.

Level 3 – Pricing Models with Significant Unobservable Inputs

Valuations are based on internally derived assumptions surrounding

the timing and amount of expected cash flows for the financial

instrument, which are significant to the overall fair value measure-

ment. These assumptions are unobservable in either an active or

inactive market. The inputs reflect management’s best estimate of

what market participants would use in valuing the asset or liability

at the measurement date. A goodwill impairment test that utilizes

an internally developed discounted cash flow model is an example

of a level 3 asset or liability.

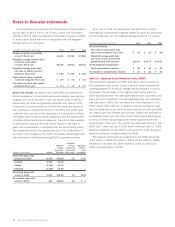

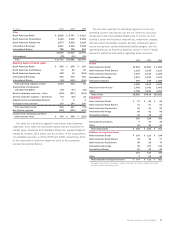

The carrying amounts of cash and equivalents, trade accounts

receivables, accounts payable, derivative instruments and notes

payable approximate fair values.

The fair values and carrying amounts of long-term debt, including

the current portion, at July 3, 2010 were $2,886 million and

$2,734 million, and at June 27, 2009 were $2,780 million and

$2,784 million, respectively. The fair value of the corporation’s long-

term debt, including the current portion, is estimated using

discounted cash flows based on the corporation’s current incremen-

tal borrowing rates for similar types of borrowing arrangements.

Sara Lee Corporation and Subsidiaries 77