Sara Lee 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

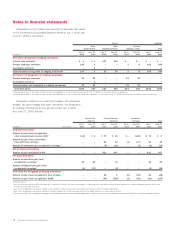

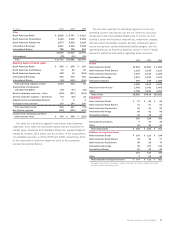

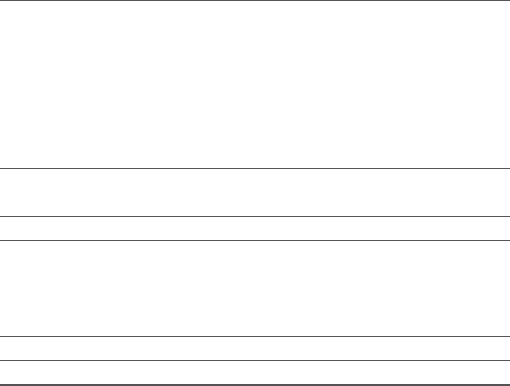

The deferred tax liabilities (assets) at the respective year-ends

were as follows:

In millions 2010 2009

Deferred tax (assets)

Pension liability $(194) $÷«(306)

Employee benefits (219) (19)

Unrealized foreign exchange (49) (158)

Nondeductible reserves (90) (74)

Net operating loss and other tax carryforwards (365) (334)

Other (82) (149)

Gross deferred tax (assets) (999) (1,040)

Less valuation allowances 219 207

Net deferred tax (assets) (780) (833)

Deferred tax liabilities

Property, plant and equipment $«131 $÷««176

Intangibles 218 245

Unrepatriated earnings 501 10

Deferred tax liabilities 850 431

Total net deferred tax (assets) liabilities $÷«70 $«÷(402)

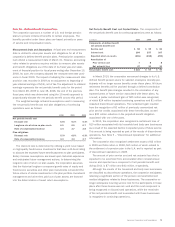

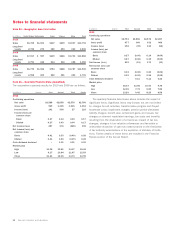

Tax-effected net operating loss and other tax carryforwards expire

as follows: $12 million in 2011, $1 million in 2012, $1 million in

2013, $2 million in 2014, $1 million in 2015, $4 million in 2017,

$6 million in 2018, $3 million in 2019, and $27 million in 2021 and

beyond. There is no expiration date on $252 million of net operating

loss carryforwards. Separately, there are state net operating losses

of $56 million that begin to expire in 2011 through 2029.

Valuation allowances have been established on net operating

losses and other deferred tax assets in the United Kingdom, Belgium,

Russia, and other foreign and U.S. state jurisdictions as a result

of the corporation’s determination that there is less than a 50%

likelihood that these assets will be realized.

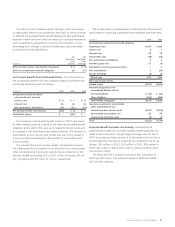

The corporation records tax reserves for uncertain tax positions

taken, or expected to be taken, on a tax return. For those tax benefits

to be recognized, a tax position must be more-likely-than-not to be

sustained upon examination by the tax authorities. The amount

recognized is measured as the largest amount of benefit that is

greater than 50% likely of being realized upon audit settlement.

Due to the inherent complexities arising from the nature of the

company’s businesses, and from conducting business and being

taxed in a substantial number of jurisdictions, significant judgments

and estimates are required to be made. Agreement of tax liabilities

between Sara Lee Corporation and the many tax jurisdictions in

which the company files tax returns may not be finalized for several

years. Thus, the company’s final tax-related assets and liabilities

may ultimately be different from those currently reported.

Our total unrecognized tax benefits that, if recognized, would

affect our effective tax rate were $279 million as of July 3, 2010.

This amount differs from the balance of unrecognized tax benefits

as of July 3, 2010 primarily due to uncertain tax positions that

created deferred tax assets in jurisdictions which have not been

realized due to a lack of profitability in the respective jurisdictions.

At this time, the corporation estimates that it is reasonably possible

that the liability for unrecognized tax benefits will decrease by approxi-

mately nil to $25 million in the next 12 months from a variety of

uncertain tax positions as a result of the completion of various

worldwide tax audits currently in process and the expiration of the

statute of limitations in several jurisdictions.

The company recognizes interest and penalties related to

unrecognized tax benefits in tax expense. During the years ended

July 3, 2010, June 27, 2009 and June 28, 2008, the corporation

recognized a benefit of $43 million, expense of $15 million and

expense of $2 million, respectively, of interest and penalties in tax

expense. The tax benefit in 2010 was the result of the finalization of

tax reviews and audits and changes in estimates of tax contingencies.

As of July 3, 2010, June 27, 2009 and June 28, 2008, the corpora-

tion had accrued interest and accrued penalties of approximately

$61 million, $111 million and $96 million, respectively.

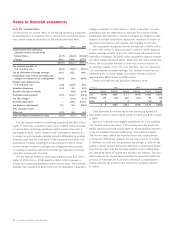

The corporation’s tax returns are routinely audited by federal, state

and foreign tax authorities and these audits are at various stages of

completion at any given time. The Internal Revenue Service (IRS) has

completed examinations of the company’s U.S. income tax returns

through July 1, 2006. Fiscal years remaining open to examination in

the Netherlands include 2003 and forward. Other foreign jurisdictions

remain open to audits ranging from 1999 forward. With few excep-

tions, the company is no longer subject to state and local income

tax examinations by tax authorities for years before June 28, 2003.

Sara Lee Corporation and Subsidiaries 85