Sara Lee 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

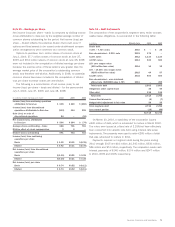

Notes to financial statements

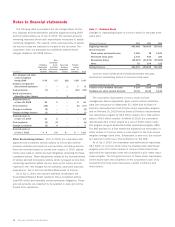

The corporation has a $1.85 billion five-year revolving credit

facility expiring in December 2011 that had an annual fee of 0.08%

as of July 3, 2010. Pricing under this facility is based on the corpo-

ration’s current credit rating. As of July 3, 2010, the corporation did

not have any borrowings outstanding under the credit facility. This

agreement supports commercial paper borrowings and other financial

instruments. The corporation had $150 million of letters of credit

outstanding as of July 3, 2010. The corporation’s credit facility and

debt agreements contain customary representations, warranties

and events of default, as well as, affirmative, negative and financial

covenants with which the corporation is in compliance. One financial

covenant includes a requirement to maintain an interest coverage

ratio of not less than 2.0 to 1.0. The interest coverage ratio is based

on the ratio of EBIT to consolidated net interest expense with con-

solidated EBIT equal to net income plus interest expense, income

tax expense, and extraordinary or non-recurring non-cash charges

and gains. For the 12 months ended July 3, 2010, the corporation’s

interest coverage ratio was 7.8 to 1.0.

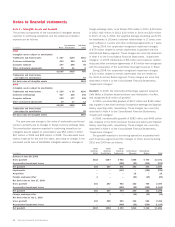

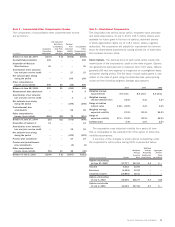

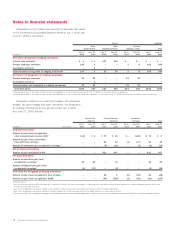

Selected data on the corporation’s short-term obligations follow:

In millions 2010 2009 2008

Maximum month-end borrowings $132 $461 $280

Average borrowings during the year 69 289 54

Year-end borrowings 47 20 274

Weighted average interest rate

during the year 2.67% 3.60% 3.46%

Weighted average interest rate

at year-end 2.69 6.68 2.91

Note 13 – Leases

The corporation leases certain facilities, equipment and vehicles

under agreements that are classified as either operating or capital

leases. The building leases have original terms that range from 10

to 15 years, while the equipment and vehicle leases have terms of

generally less than seven years.

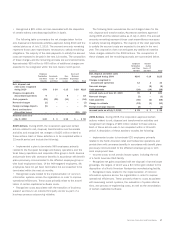

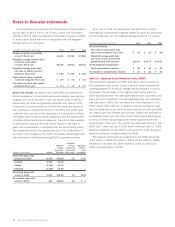

July 3, June 27,

In millions 2010 2009

Gross book value of capital lease assets

included in property $66 $72

Net book value of capital lease assets

included in property 38 44

72 Sara Lee Corporation and Subsidiaries

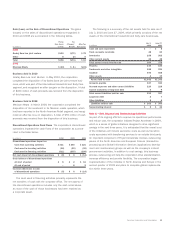

Future minimum payments, by year and in the aggregate, under

capital leases and noncancelable operating leases having an original

term greater than one year at July 3, 2010 were as follows:

Capital Operating

In millions Leases Leases

2011 $13 $÷80

2012 13 57

2013 742

2014 428

2015 221

Thereafter 369

Total minimum lease payments 42 $297

Amounts representing interest (7)

Present value of net minimum payments 35

Current portion 10

Noncurrent portion $25

In millions 2010 2009 2008

Depreciation of capital lease assets $÷÷8 $÷10 $÷11

Rental expense under operating leases 123 125 128

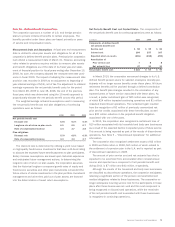

Note 14 – Contingencies and Commitments

Contingent Liabilities The corporation is a party to various pending

legal proceedings, claims and environmental actions by government

agencies. The corporation records a provision with respect to a

claim, suit, investigation or proceeding when it is probable that a

liability has been incurred and the amount of the loss can reason-

ably be estimated. Any provisions are reviewed at least quarterly

and are adjusted to reflect the impact and status of settlements,

rulings, advice of counsel and other information pertinent to the

particular matter.

Aris

This is a consolidation of cases filed by individual complainants

with the Republic of the Philippines, Department of Labor and

Employment and the National Labor Relations Commission (NLRC)

from 1998 through July 1999. The complaint alleges unfair labor

practices due to the termination of manufacturing operations in

the Philippines by Aris Philippines, Inc. (Aris), a former subsidiary

of the corporation. The complaint names the corporation as a party

defendant. In 2006, the arbitrator ruled against the corporation and

awarded the plaintiffs $60 million in damages and fees, and the

corporation appealed this ruling. In December 2006, the NLRC set

aside the arbitrator’s ruling, and remanded the case to the arbitra-

tor for further proceedings. The complainants and the corporation

have filed motions for reconsideration – the corporation seeking a

final judgment and outright dismissal of the case, and complainants