Sara Lee 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

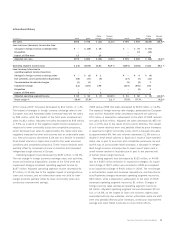

ance-covariance statistical modeling technique and includes all

interest rate-sensitive debt and swaps, foreign exchange hedges

and their corresponding underlying exposures. Foreign exchange

value at risk includes the net assets invested in foreign locations.

The estimated value at risk amounts shown below represent the

potential loss the corporation could incur from adverse changes

in either interest rates or foreign currency exchange rates for a

one-day period. The average value at risk amount represents the

simple average of the quarterly amounts for the past year. These

amounts are not significant compared with the equity, historical

earnings trend or daily change in market capitalization of

the corporation.

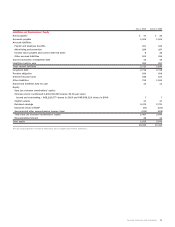

Time Confidence

In millions Amounts Average Interval Level

Value at risk amounts

2010

Interest rates $11 $12 1 day 95%

Foreign exchange 21 23 1 day 95%

2009

Interest rates $26 $29 1 day 95%

Foreign exchange 29 43 1 day 95%

Interest rate value at risk decreased from 2009 due to the

general decrease in short-term rate volatilities as the financial

markets have stabilized over the course of 2010. Interest rate value

at risk has become more weighted to short-term rates as a signifi-

cant portion of the corporation’s long-term debt is due within two

years. Foreign exchange value at risk amounts are down primarily

due to decreased levels of volatilities in exchange rates between

the U.S. dollar and the euro, the Brazilian real and British

pound sterling.

Sensitivity Analysis

For commodity derivative instruments held,

the corporation utilizes a sensitivity analysis technique to evaluate

the effect that changes in the market value of commodities will

have on the corporation’s commodity derivative instruments. This

analysis includes the commodity derivative instruments and, thereby,

does not consider the underlying exposure. At the end of 2010 and

2009, the potential change in fair value of commodity derivative

instruments, assuming a 10% change in the underlying commodity

price, was $2 million and $13 million, respectively. This amount is not

significant compared with the earnings and equity of the corporation.

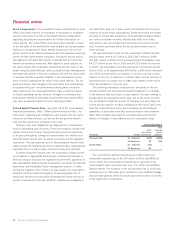

Non-GAAP Financial Measures Definitions

The following is an explanation of the non-GAAP financial measures

presented in this annual report. “Adjusted net sales” excludes from

net sales the impact of businesses acquired or divested after the

start of the fiscal period and excludes the impact of an additional

week in those fiscal years with 53 weeks versus 52 weeks. It also

adjusts the previous year’s sales for the impact of any changes in

foreign currency exchange rates. “Adjusted operating segment

income” for a specified business segment or discontinued operation

excludes from operating segment income the impact of significant

items recognized by that portion of the business during the fiscal

period and businesses acquired or divested after the start of the

fiscal period. It also adjusts for the impact of an additional week

in those fiscal years that include a 53rd week. It also adjusts the

previous year’s operating segment income for the impact of any

changes in foreign currency exchange rates. “Adjusted operating

income” excludes from operating income the impact of significant

items recognized during the fiscal period, contingent sale proceeds,

if any, and businesses acquired or divested after the start of the

fiscal period. It also adjusts for the impact of an additional week

in those fiscal years that include a 53rd week. It also adjusts the

previous year’s operating segment income for the impact of any

changes in foreign currency exchange rates.

Critical Accounting Estimates

The corporation’s summary of significant accounting policies is

discussed in Note 2 to the Consolidated Financial Statements.

The application of certain of these policies requires significant

judgments or a complex estimation process that can affect the

results of operations and financial position of the corporation, as

well as the related footnote disclosures. The corporation bases its

estimates on historical experience and other assumptions that it

believes are most likely to occur. If actual amounts are ultimately

different from previous estimates, the revisions are included in the

corporation’s results of operations for the period in which the actual

amounts become known, and, if material, are disclosed in the finan-

cial statements. The disclosures below also note situations in

which it is reasonably likely that future financial results could be

impacted by changes in these estimates and assumptions. The

term “reasonably likely” refers to an occurrence that is more than

remote but less than probable in the judgment of management.

Sara Lee Corporation and Subsidiaries 43