Sara Lee 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

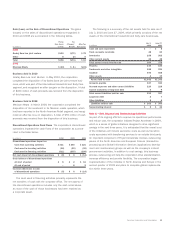

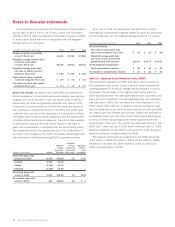

Gain (Loss) on the Sale of Discontinued Operations The gains

(losses) on the sales of discontinued operations recognized in

2010 and 2008 are summarized in the following tables.

Pretax Tax

Gain (Loss) (Charge)/ After Tax

In millions on Sale Benefit Gain (Loss)

2010

Godrej Sara Lee joint venture $150 $(72) $«78

Other 8 (2) 6

Total $158 $(74) $«84

2008

Mexican Meats $«(23) $÷(1) $(24)

Business Sold in 2010

Godrej Sara Lee Joint Venture

In May 2010, the corporation

completed the disposition of its Godrej Sara Lee joint venture busi-

ness, which was part of the International Household and Body Care

segment, and recognized an after tax gain on the disposition. A total

of $230 million of cash proceeds was received from the disposition

of this business.

Business Sold in 2008

Mexican Meats

In March 2008, the corporation completed the

disposition of its investment in its Mexican meats operation, which

had been reported in the North American Retail segment, and recog-

nized an after tax loss on disposition. A total of $55 million of cash

proceeds was received from the disposition of this business.

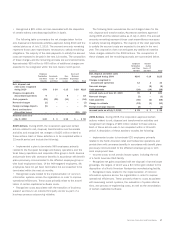

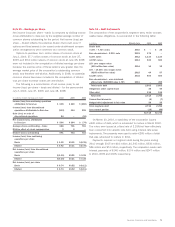

Discontinued Operations Cash Flows The corporation’s discontinued

operations impacted the cash flows of the corporation as summa-

rized in the table below.

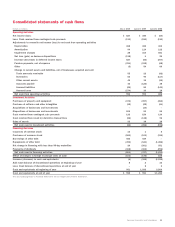

In millions 2010 2009 2008

Discontinued operations impact on

Cash from operating activities $«321 $«260 $«221

Cash used in investing activities (18) (19) (26)

Cash used in financing activities (311) (235) (209)

Net cash impact of discontinued operations $÷÷(8) $÷÷«6 $««(14)

Cash balance of discontinued operations

At start of period $÷÷«8 $÷÷«2 $«««16

At end of period –82

Increase/(decrease) in cash

of discontinued operations $÷÷(8) $÷÷«6 $««(14)

The cash used in financing activities primarily represents the

net transfers of cash with the corporate office. The net assets of

the discontinued operations includes only the cash noted above

as most of the cash of those businesses has been retained as

a corporate asset.

Sara Lee Corporation and Subsidiaries 65

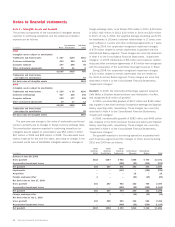

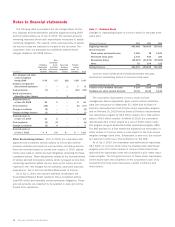

The following is a summary of the net assets held for sale as of

July 3, 2010 and June 27, 2009, which primarily consists of the net

assets of the international household and body care businesses.

July 3, June 27,

In millions 2010 2009

Cash and cash equivalents $÷÷÷«– $÷÷÷«8

Trade accounts receivable 48 60

Inventories 188 262

Other current assets 24 48

Total current assets held for sale 260 378

Property 144 156

Trademarks and other intangibles 188 221

Goodwill 496 568

Other assets 419

Assets held for sale $1,092 $1,342

Accounts payable $27 $50

Accrued expenses and other current liabilities 220 228

Current maturities of long-term debt 69

Total current liabilities held for sale 253 287

Long-term debt 27

Other liabilities 86

Liabilities held for sale $÷«263 $÷«300

Noncontrolling interest $÷÷÷«5 $÷÷«22

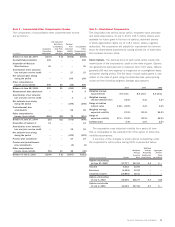

Note 6 – Exit, Disposal and Restructuring Activities

As part of its ongoing efforts to improve its operational performance

and reduce cost, the corporation initiated Project Accelerate in 2009,

which is a series of global initiatives designed to drive significant

savings in the next three years. It is anticipated that the overall cost

of the initiatives will include severance costs as well as transition

costs associated with transferring services to an outside third party.

An important component of Project Accelerate involves outsourcing

pieces of the North American and European Finance (transaction

processing) and Global Information Services (applications develop-

ment and maintenance) groups as well as the company’s indirect

procurement activities. In addition to cost savings, this business

process outsourcing will help the corporation drive standardization,

increase efficiency and provide flexibility. The corporation began

implementation of the initiative in North America and Europe in the

second quarter of 2009 and plans to complete global implementa-

tion within three years.