Sara Lee 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

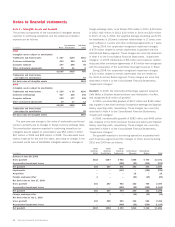

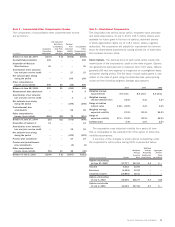

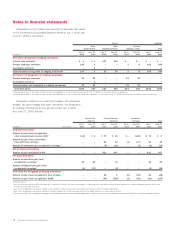

Note 11 – Earnings per Share

Net income (loss) per share – basic is computed by dividing income

(loss) attributable to Sara Lee by the weighted average number of

common shares outstanding for the period. Net income (loss) per

share – diluted reflects the potential dilution that could occur if

options and fixed awards to be issued under stock-based compen-

sation arrangements were converted into common stock.

Options to purchase 16.1 million shares of common stock at

July 3, 2010, 27.7 million shares of common stock at June 27,

2009, and 28.2 million shares of common stock at June 28, 2008

were not included in the computation of diluted earnings per share

because the exercise price of these options was greater than the

average market price of the corporation’s outstanding common

stock, and therefore anti-dilutive. Additionally, in 2008, no potential

common shares have been included in the computation of diluted

loss per share as these shares are anti-dilutive.

The following is a reconciliation of net income (loss) to net

income (loss) per share – basic and diluted – for the years ended

July 3, 2010, June 27, 2009, and June 28, 2008:

In millions except earnings per share 2010 2009 2008

Income (loss) from continuing operations

attributable to Sara Lee $÷635 $«220 $«(280)

Income (loss) from discontinued

operations attributable to Sara Lee (213) 144 225

Gain (loss) on sale of

discontinued operations 84 – (24)

Net income (loss) attributable

to Sara Lee $÷506 $«364 $÷«(79)

Average shares outstanding – basic 688 701 715

Dilutive effect of stock compensation 32–

Diluted shares outstanding 691 703 715

Income (loss) from continuing

operations per share

Basic $«0.92 $0.31 $(0.39)

Diluted $«0.92 $0.31 $(0.39)

Net income (loss) from discontinued

operations per share

Basic $(0.19) $0.21 $«0.28

Diluted $(0.19) $0.21 $«0.28

Net income (loss) per share

Basic $«0.74 $0.52 $(0.11)

Diluted $«0.73 $0.52 $(0.11)

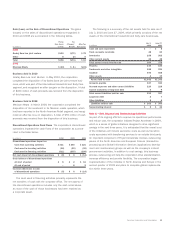

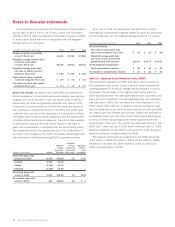

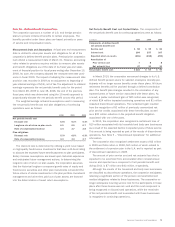

Note 12 – Debt Instruments

The composition of the corporation’s long-term debt, which includes

capital lease obligations, is summarized in the following table:

In millions Maturity Date 2010 2009

Senior debt

7.26% – 7.71% notes 2010 $÷÷÷«– $÷÷«25

Euro denominated – 2.25% note 2012 375 –

6.25% notes 2012 1,110 1,110

3.875% notes 2013 500 500

10% zero coupon notes

($19 million face value) 2014 14 12

10% – 14.25% zero coupon notes

($105 million face value) 2015 64 57

6.125% notes 2033 500 500

Euro denominated – euro interbank

offered rate (EURIBOR) plus 1.75% 2011 – 399

Total senior debt 2,563 2,603

Obligations under capital lease 35 44

Other debt 116 119

Total debt 2,714 2,766

Unamortized discounts (6) (7)

Hedged debt adjustment to fair value 26 25

Total long-term debt 2,734 2,784

Less current portion (16) (46)

$2,718 $2,738

On March 30, 2010, a subsidiary of the corporation issued

€300 million of debt, which is scheduled to mature in March 2012.

The notes were issued at a fixed rate of 2.25% but have effectively

been converted into variable rate debt using interest rate swap

instruments. The proceeds were used to retire €285 million of debt

that was scheduled to mature in 2011.

Payments required on long-term debt during the years ending

2011 through 2015 are $16 million, $1,545 million, $532 million,

$26 million and $74 million, respectively. The corporation made cash

interest payments of $140 million, $174 million and $247 million

in 2010, 2009 and 2008, respectively.

Sara Lee Corporation and Subsidiaries 71