Sara Lee 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Foreign Earnings – The 2009 effective tax rate was 8 percentage

points lower than 2008 as a result of a $ 44 million change in the

corporation’s global mix of earnings, the tax characteristics of the

corporation’s income, and the benefit from certain foreign jurisdic-

tions that have lower tax rates.

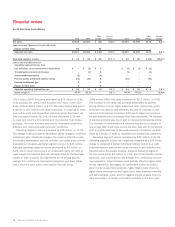

Income (Loss) from Continuing Operations and Diluted Earnings Per

Share (EPS) from Continuing Operations Income from continuing

operations in 2010 was $642 million, an increase of $417 million

over the prior year. The improvement was due to a $270 million

after tax decline in impairment charges and improved business

segment results. Income from continuing operations in 2009 was

$225 million, which was $501 million higher than 2008 due to a

$538 million after tax reduction in impairment charges.

The net income (loss) from continuing operations attributable

to Sara Lee, which excludes the results of noncontrolling interests,

was income of $635 million in 2010 and $220 million in 2009 and

a net loss of $280 million in 2008.

Diluted EPS from continuing operations was $0.92 in 2010 and

$0.31 in 2009 versus a loss of $0.39 in 2008. The diluted EPS

from continuing operations in each succeeding year was favorably

impacted by lower average shares outstanding as the corporation

has been repurchasing shares of its common stock as part of an

ongoing share repurchase program. The corporation repurchased

36.4 million shares in 2010, 11.4 million shares in 2009 and

19.7 million shares in 2008.

Discontinued Operations The results of the corporation’s household

and body care and Mexican meats businesses, which have been

classified as discontinued operations, are summarized below:

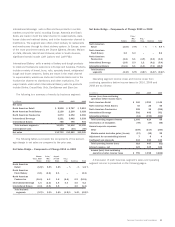

In millions 2010 2009 2008

Net sales $2,126 $2,000 $2,502

Income from discontinued

operations before income taxes $÷«254 $÷«245 $÷«317

Income tax expense on income

from discontinued operations (453) (90) (81)

Gain (loss) on disposition of

discontinued operations

before income taxes 158 – (23)

Income tax (expense) benefit on

disposition of discontinued operations (74) – (1)

Net income (loss) from

discontinued operations $÷(115) $÷«155 $÷«212

Sara Lee Corporation and Subsidiaries 27

•Receipt of Contingent Sales Proceeds – In 2010, the corporation

recognized a tax benefit of $47 million related to its receipt of non-

taxable contingent sales proceeds pursuant to the sale terms of its

European cut tobacco business in 1999, compared to a $53 million

benefit in 2009. The 2010 payment represented the final payment

under the sales agreement and, as a result, this is the final year

the corporation will recognize a tax rate reduction related to the

contingent sales proceeds.

•Foreign Earnings – The 2010 effective tax rate was 8 percentage

points higher than 2009 as a result of a change in the corporation’s

global mix of earnings, the tax characteristics of the corporation’s

income, and the benefit from certain foreign jurisdictions that have

lower tax rates. As specifically highlighted in Part I. Item 1A. Risk

Factors, of the corporations Form 10-K, the corporation expects that

its effective tax rate will be impacted in future fiscal years as a

result of its global mix of earnings.

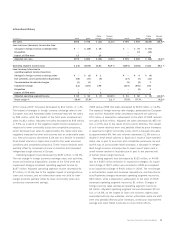

2009 vs. 2008

In 2009, the corporation recognized tax expense

on continuing operations of $133 million, or an effective tax rate of

37.3%, compared to tax expense of $120 million in 2008, or an

effective tax rate of 76.6%. The significant components impacting

the change in the corporation’s 2009 effective tax rate are as follows:

•Goodwill Impairment – The 2009 effective tax rate was 153

percentage points lower than the prior year as a result of a $548 mil-

lion reduction in non-deductible goodwill impairments recognized

during the year.

•Remittance of Foreign Earnings – The 2009 effective tax rate

was 56 percentage points lower than the prior year as a result of

a $63 million reduction in tax charges related to the repatriation

of earnings from certain foreign subsidiaries.

•Finalization of Tax Reviews and Audits and Changes in Estimate

on Tax Contingencies – The 2009 effective tax rate was 55 percent-

age points higher than the prior year as a result of an $74 million

reduction in benefits resulting from the resolution of tax audits,

the expiration of statutes of limitations, and changes in estimate

on tax contingencies, in various countries and various state and

local jurisdictions.

•Receipt of Contingent Sales Proceeds – The corporation

recognized a tax benefit of $53 million related to its receipt of non-

taxable contingent sales proceeds pursuant to the sale terms of its

European cut tobacco business in 1999, compared to a $46 million

benefit in 2008. The 2009 effective tax rate was 15% lower as a result

of this income. In 2008 the effective tax rate reduction was 29%.