Sara Lee 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to financial statements

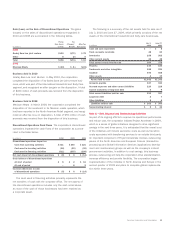

Severance

Severance actions initiated by the corporation are

generally covered under previously communicated benefit arrange-

ments under GAAP, which provides for termination benefits in the event

that an employee is involuntarily terminated. Liabilities are recorded

under these arrangements when it is probable that employees will

be entitled to benefits and the amount can be reasonably estimated.

This generally occurs when management with the appropriate level

of authority approves an action to terminate employees who have

been identified and targeted for termination within one year.

Noncancelable Lease and Contractual Obligations

Liabilities are

incurred for noncancelable lease and other contractual obligations

when the corporation terminates the contract in accordance with

contract terms or when the corporation ceases using the right

conveyed by the contract or exits the leased space. The charge for

these items is determined based on the fair value of remaining lease

rentals reduced by the fair value of estimated sublease rentals that

could reasonably be obtained for the property, estimated using an

expected present value technique.

Other

For other costs associated with exit and disposal activities,

a charge is recognized at its fair value in the period in which the

liability is incurred, estimated using an expected present value

technique, generally when the services are rendered.

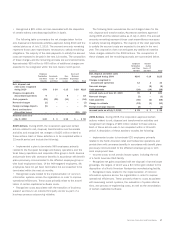

Stock-Based Compensation The corporation recognizes the cost

of employee services received in exchange for awards of equity

instruments based upon the grant date fair value of those awards.

Income Taxes As a global commercial enterprise, the corporation’s

tax rate from period to period is affected by many factors. The most

significant of these factors includes changes in tax legislation, the

global mix of earnings, the tax characteristics of the corporation’s

income, the timing and recognition of goodwill impairments, acqui -

sitions and dispositions and the portion of the income of foreign

subsidiaries that is expected to be repatriated to the U.S. and be

taxable. In addition, the corporation’s tax returns are routinely audited

and finalization of issues raised in these audits sometimes affects

the tax provision. It is reasonably possible that tax legislation in the

jurisdictions in which the corporation does business may change in

future periods. While such changes cannot be predicted, if they occur,

the impact on the corporation’s tax assets and obligations will need

to be measured and recognized in the financial statements.

Deferred taxes are recognized for the future tax effects of

temporary differences between financial and income tax reporting

using tax rates for the years in which the differences are expected

to reverse. Federal income taxes are provided on that portion of

the income of foreign subsidiaries that are expected to be remitted

to the U.S. and be taxable.

The management of the corporation periodically estimates the

probable tax obligations of the corporation using historical experi-

ence in tax jurisdictions and informed judgments in accordance with

GAAP. For a tax benefit to be recognized, a tax position must be

more-likely-than-not to be sustained upon examination by the taxing

authority. The corporation adjusts these reserves in light of changing

facts and circumstances; however, due to the complexity of some of

these situations, the ultimate payment may be materially different

from the estimated recorded amounts. Any adjustment to a tax

reserve impacts the corporation’s tax expense in the period in

which the adjustment is made.

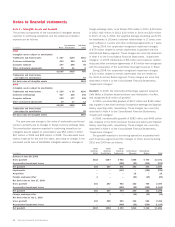

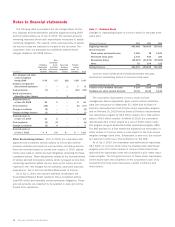

Defined Benefit, Postretirement and Life-Insurance Plans

The corporation recognizes the funded status of defined pension

and postretirement plans in the Consolidated Balance Sheet.

The funded status is measured as the difference between the fair

market value of the plan assets and the benefit obligation. Beginning

in 2009, the corporation measures its plan assets and liabilities as

of its fiscal year end. For a defined benefit pension plan, the benefit

obligation is the projected benefit obligation; for any other defined

benefit postretirement plan, such as a retiree health care plan, the

benefit obligation is the accumulated postretirement benefit obliga-

tion. Any overfunded status should be recognized as an asset and

any underfunded status should be recognized as a liability. As part

of the initial recognition of the funded status, any transitional asset/

(liability), prior service cost (credit) or actuarial (gain)/loss that had

not yet been recognized as a component of net periodic cost was

recognized in the accumulated other comprehensive income section

of the Consolidated Statements of Equity, net of tax. Accumulated

other comprehensive income will be adjusted as these amounts are

subsequently recognized as a component of net periodic benefit

costs in future periods.

In 2010 the corporation adopted new accounting guidance

regarding an employer’s disclosure of plan assets of defined bene-

fit pension and other postretirement benefit plans. The amended

guidance requires disclosures about plan assets including how

investment allocation decisions are made, the major categories of

plans assets, the inputs and valuation techniques used to measure

the fair value of plan assets, the effect of fair value measurements

using significant unobservable inputs on changes in plan assets for

the period and significant concentrations of risk within plan assets.

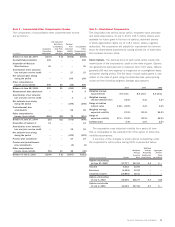

Financial Instruments The corporation uses financial instruments,

including forward exchange, options, futures and swap contracts,

to manage its exposures to movements in interest rates, foreign

exchange rates and commodity prices. The use of these financial

instruments modifies the exposure of these risks with the intent

to reduce the risk or cost to the corporation. The corporation does

not use derivatives for trading purposes and is not a party to

leveraged derivatives.

60 Sara Lee Corporation and Subsidiaries