Sara Lee 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sara Lee Corporation and Subsidiaries 23

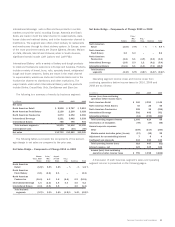

2009 versus 2008

Dollar Percent

In millions 2009 2008 Change Change

Net sales $10,882 $10,949 $÷(67) (0.6) %

Less: Increase/(decrease)

in net sales from

Changes in currency rates $÷÷÷÷«– $÷÷«361 $(361)

Acquisitions/dispositions 45 130 (85)

Adjusted net sales $10,837 $10,458 $«379 3.6 %

Operating income (loss) $÷÷«487 $÷÷÷(51) $«538 NM

Less: Increase/(decrease)

in operating income from

Contingent sale proceeds $÷÷«150 $÷÷«130 $÷«20

Changes in currency rates – 34 (34)

Exit activities, asset and

business dispositions (103) (39) (64)

Transformation/Accelerate

charges (21) (29) 8

Impairment charges (314) (851) 537

Curtailment gain 12 – 12

Pension partial withdrawal

liability charge (31) – (31)

Gain on property disposition 14 – 14

Balance sheet corrections 11 – 11

Accelerated depreciation – (1) 1

Acquisitions/dispositions 211

Adjusted operating income $÷÷«767 $÷÷«704 $÷«63 8.9 %

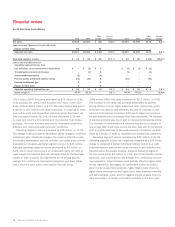

Net Sales Net sales in 2010 were $10,793 million, a decrease

of $89 million, or 0.8% versus 2009. Net sales were impacted by

changes in foreign currency exchange rates, particularly the European

euro, Brazilian real and Australian dollar, which increased reported

net sales by $152 million; dispositions net of acquisition after the

beginning of 2009, which reduced net sales by $131 million; and

the impact of the 53rd week, which increased net sales by $197 mil-

lion. Adjusted net sales decreased $307 million, or 2.8% due to lower

unit volumes and price reductions in response to lower commodity

costs and competitive pressures partially offset by an improved

sales mix.

Net sales were $10,882 million in 2009, a decrease of $67 mil-

lion, or 0.6% versus 2008. Changes in foreign currency exchange

rates, particularly the European euro, British pound, Brazilian real

and Australian dollar, decreased reported net sales by $361 mil-

lion. Dispositions net of acquisitions after the beginning of 2008

reduced net sales by $85 million. Adjusted net sales increased

$379 million, or 3.6% driven by price increases to offset higher

commodity costs and an improved sales mix, partially offset by

lower unit volumes.

Review of Consolidated Results

The following tables summarize net sales and operating income for

2010 versus 2009, and 2009 versus 2008 and certain items that

affected the comparability of these amounts:

2010 versus 2009

Dollar Percent

In millions 2010 2009 Change Change

Net sales $10,793 $10,882 $÷(89) (0.8) %

Less: Increase/(decrease)

in net sales from

Changes in currency rates $÷÷÷÷«– $÷÷(152) $«152

Acquisitions/dispositions 12 143 (131)

Impact of 53rd week 197 – 197

Adjusted net sales $10,584 $10,891 $(307) (2.8) %

Operating income $÷÷«918 $÷÷«487 $«431 88.6 %

Less: Increase/(decrease)

in operating income from

Contingent sale proceeds $÷÷«133 $÷÷«150 $÷(17)

Changes in currency rates – (17) 17

Exit activities, asset and

business dispositions (84) (103) 19

Transformation/Accelerate

charges (23) (21) (2)

Accelerated depreciation (13) – (13)

Impairment charges (28) (314) 286

Curtailment gain 24 12 12

Pension partial withdrawal

liability charge (23) (31) 8

Gain on property disposition – 14 (14)

Mexican tax indemnification (26) – (26)

Balance sheet corrections – 11 (11)

Acquisitions/dispositions 1 11 (10)

Impact of 53rd week 25 – 25

Adjusted operating income $÷÷«932 $÷÷«775 $«157 20.2 %