Sara Lee 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

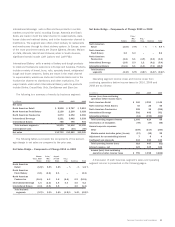

2010 versus 2009

The cash used in investment activities in

2010 declined by $234 million from the prior year due primarily to

a $151 million increase in cash proceeds received from the dispo-

sition of businesses and a $112 million reduction in cash used in

derivative transactions.

The corporation received $204 million in 2010, primarily related

to the sale of its insecticide business in India. In 2009, it received

$53 million, of which $42 million was related to the disposition of

its DSD foodservice operations.

In 2010, $26 million of cash was used for derivative transactions,

as compared to $138 million in 2009, primarily driven by hedges of

foreign currency exposures.

The corporation spent $385 million for the purchase of property,

equipment, computer software and intangibles in 2010 as compared

to $379 million in 2009. The slightly higher level of spending in 2010

was to expand meat production capacity in North American Retail and

to implement new software to improve North American operations.

The corporation expects capital expenditures for property and equip-

ment to be approximately $400 - $450 million in 2011, an increase

over 2010 due to an increase in projected expenditures related to

expanded meat production capacity in North American Retail.

The amount of contingent sale proceeds received in 2010, was

$17 million lower than the prior year due to the impact of foreign

currency exchange rates as the corporation received €95 million

in both years.

2009 versus 2008

The cash used in investment activities in 2009

increased by $90 million over the prior year due to a $234 million

increase in cash used for derivative transactions partially offset by

a $136 million reduction in capital expenditures for property, equip-

ment and software.

In 2009, $138 million of cash was used for derivative transactions,

as compared to $96 million of cash received from derivative trans-

actions in 2008. The increase in cash used was due in part to

an increase in the number of mark-to-market derivative transactions

and an increase in cash paid on the settlement of foreign exchange

contracts, the majority of which were related to hedges of foreign

currency balance sheet exposures.

In 2009, the corporation incurred $379 million of expenditures

for property, equipment and software as compared to $515 million

in 2008. The year-over-year decrease was due to reduced spending

for information technology assets.

In 2009, the corporation expended $10 million as part of the

consideration paid for the acquisition of a coffee business in Brazil.

In 2008, the corporation did not expend any funds to make any

business acquisitions.

36 Sara Lee Corporation and Subsidiaries

Financial Condition

The corporation’s cash flow statements include amounts related to

discontinued operations through the date of disposal. The discontinued

operations had a significant impact on the cash flows from operating,

investing and financing activities in each fiscal year.

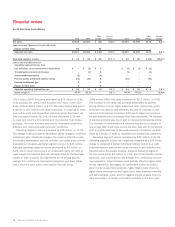

Cash from Operating Activities The cash from operating activities

generated by continuing and discontinued operations is summarized

in the following table:

2010 2009 2008

Cash from operating activities

Continuing operations $631 $640 $385

Discontinued operations 321 260 221

Total $952 $900 $606

2010 versus 2009

The increase in cash from operating activities

of $52 million in 2010 was due primarily to improved operating

results and better working capital management with respect to

accounts payable and accounts receivable, which were partially

offset by an increase in cash payments for restructuring actions

and taxes as well as higher contributions to pension plans as

compared to the prior year.

2009 versus 2008

The increase in cash from operating activities

of $294 million in 2009 was due to a $451 improvement in the

cash used to fund working capital needs. In 2009, $119 million of

cash was generated from lower working capital levels as opposed

to $332 million of cash used in the prior year to fund working

capital needs. The year-over-year improvements were in accounts

receivable, inventories, accrued liabilities as well as a reduction in

cash tax payments, partially offset by an increase in cash used for

accounts payable. The overall improvement in working capital was

due in part to a strong focus on minimizing working capital levels.

The benefits generated from lower working capital levels were par-

tially offset by a $131 million increase in cash contributions to

pension plans as compared to the prior year.

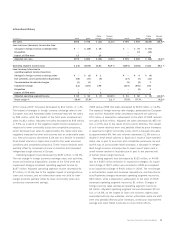

Cash used in Investment Activities Net cash used in investment

activities is split between continuing and discontinued operations

as follows:

2010 2009 2008

Cash used in investment activities

Continuing operations $(34) $(267) $(170)

Discontinued operations (18) (19) (26)

Total $(52) $(286) $(196)

Financial review