Sara Lee 2010 Annual Report Download - page 76

Download and view the complete annual report

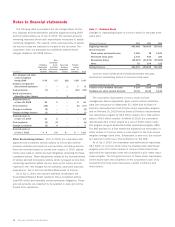

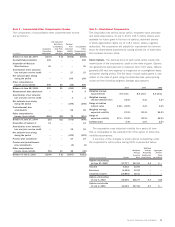

Please find page 76 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to financial statements

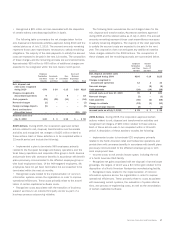

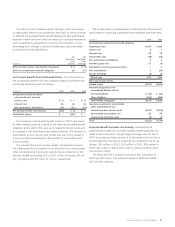

Belgian Tax Matter

In 1997, the corporation sold a Belgian subsidiary

to an unrelated third party. At the time of the sale, the Belgian sub-

sidiary owed a Belgian tax liability of approximately €30 million

(resulting from an intercompany restructuring completed before the

1997 sale) and the third party buyer assumed all assets and liabili-

ties of the subsidiary. In 1999, the former Belgian subsidiary, then

owned by the third party buyer, declared bankruptcy and did not pay

the outstanding Belgian tax liability. In 2001, the Belgian Ministry of

Finance launched an investigation into the 1997 sale. In November

2009, the corporation received from the Belgian state prosecutor

a notice of intent to indict the third party buyer as well as several

of the corporation’s international subsidiaries and several current

and former directors and officers of such subsidiaries, in connection

with the 1997 sale. The notice alleges various tax-related legal vio-

lations, some of which carry criminal penalties. The corporation has

agreed to a settlement with the Belgian authorities, which is subject

to final approval by the Belgian Judiciary, and accrued $40 million

for Belgian taxes, interest and penalties.

Nestec/Nespresso

In June 2010, Nestec/Nespresso (Nestle) filed

a suit against Sara Lee Coffee and Tea France (SLCTF), a subsidiary

of the corporation, alleging patent infringement for two of their

European patents related to SLCTF’s use of espresso capsules.

Nestle claims that damages could be as high as €50 million.

The corporation believes Nestle’s claims are without merit and

is vigorously contesting the matter.

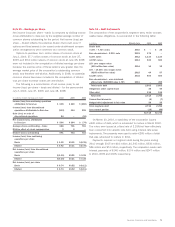

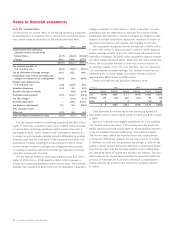

Purchase Commitments During 2007, the corporation exited a

U.S. meat production plant that included a hog slaughtering opera-

tion. Certain purchase contracts for the purchase of live hogs at

this facility were not exited or transferred after the closure of the

facility. However, the corporation has entered into a hog sales

contract under which these hogs will be sold to another slaughter

operator. These purchase commitments expire by June 2012 and,

using hog pricing at July 3, 2010, the corporation has approximately

$55 million of commitments remaining under these contracts.

Guarantees The corporation is a party to a variety of agreements

under which it may be obligated to indemnify a third party with

respect to certain matters. Typically, these obligations arise as a

result of contracts entered into by the corporation under which the

corporation agrees to indemnify a third party against losses arising

from a breach of representations and covenants related to matters

such as title to assets sold, the collectibility of receivables, speci-

fied environmental matters, lease obligations assumed and certain

tax matters. In each of these circumstances, payment by the corpo-

ration is conditioned on the other party making a claim pursuant to

the procedures specified in the contract. These procedures allow

the corporation to challenge the other party’s claims. In addition,

the corporation’s obligations under these agreements may be

limited in terms of time and/or amount, and in some cases the

corporation may have recourse against third parties for certain

payments made by the corporation. It is not possible to predict

the maximum potential amount of future payments under certain

of these agreements, due to the conditional nature of the corpora-

tion’s obligations and the unique facts and circumstances involved

in each particular agreement. Historically, payments made by the

corporation under these agreements have not had a material effect

on the corporation’s business, financial condition or results of oper-

ations. The corporation believes that if it were to incur a loss in any

of these matters, such loss would not have a material effect on the

corporation’s business, financial condition or results of operations.

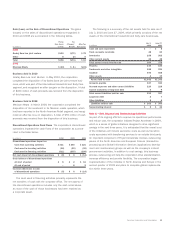

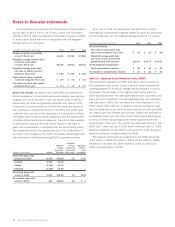

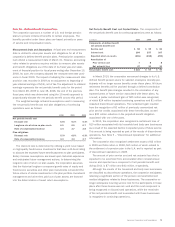

The material guarantees for which the maximum potential

amount of future payments can be determined, are as follows:

Contingent Lease Obligations

The corporation is contingently

liable for leases on property operated by others. At July 3, 2010,

the maximum potential amount of future payments the corporation

could be required to make, if all of the current operators default

on the rental arrangements, is $105 million. The minimum annual

rentals under these leases are $22 million in 2011, $17 million

in 2012, $14 million in 2013, $12 million in 2014, $12 million in

2015 and $28 million thereafter. The two largest components of

these amounts relate to a number of retail store leases operated

by Coach, Inc. and certain leases related to the corporation’s U.K.

Apparel operations that have been sold. Coach, Inc. is contractually

obligated to provide the corporation, on an annual basis, with a

standby letter of credit approximately equal to the next year’s rental

obligations. The letter of credit in place at the close of 2010 was

$10 million. This obligation to provide a letter of credit expires

when the corporation’s contingent lease obligation is substantially

extinguished. The corporation has not recognized a liability for

the contingent obligation on either the Coach, Inc. leases or the

U.K. Apparel leases.

Contingent Debt Obligations and Other

The corporation has

guaranteed the payment of certain third-party debt. The maximum

potential amount of future payments that the corporation could be

required to make, in the event that these third parties default on

their debt obligations, is $14 million. At the present time, the corpo-

ration does not believe it is probable that any of these third parties

will default on the amount subject to guarantee.

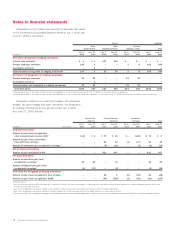

Additionally, the corporation has pledged as collateral, a

manufacturing facility in Brazil in connection with a tax dispute in

that country, which has been released subsequent to year end.

In 2010, the corporation recognized a $26 million charge for

a Mexican tax indemnification related to the corporation’s direct

selling business that was sold in 2006.

74 Sara Lee Corporation and Subsidiaries