Reebok 2011 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

CONSOLIDATED FINANCIAL STATEMENTS

210

2011

210

2011

04.8

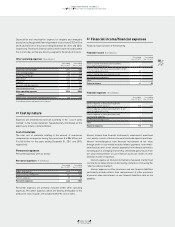

04.8 Notes Notes to the Consolidated Income Statement

Also included in other financial expenses are non-controlling inter-

ests, which are not recorded in equity according to IAS 32 “Financial

Instruments: Presentation”

SEE NOTE 26

.

Information regarding the Group’s available-for-sale investments,

borrowings and financial instruments is also included in these Notes

SEE NOTES 05, 14, 17 AND 28

.

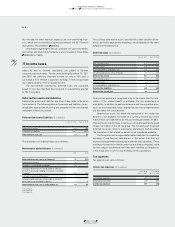

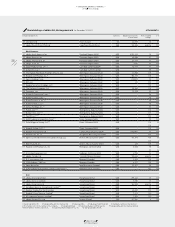

33 Income taxes

adidas AG and its German subsidiaries are subject to German

corporate and trade taxes. For the years ending December 31, 2011

and 2010, the statutory corporate income tax rate of 15% plus a

surcharge of 5.5% thereon is applied to earnings. The municipal trade

tax is approximately 11.6% of taxable income.

For non-German subsidiaries, deferred taxes are calculated

based on tax rates that have been enacted or substantively enacted

by the closing date.

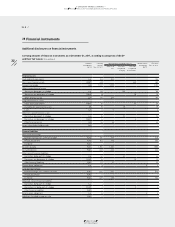

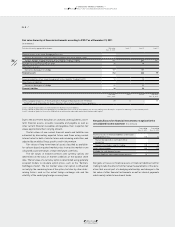

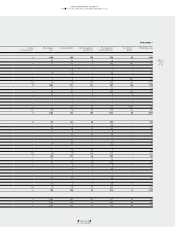

Deferred tax assets and liabilities

Deferred tax assets and liabilities are offset if they relate to the same

fiscal authority. The following deferred tax assets and liabilities, deter-

mined after appropriate offsetting, are presented in the consolidated

statement of financial position:

Deferred tax assets/liabilities (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Deferred tax assets 493 508

Deferred tax liabilities (430) (451)

Deferred tax assets, net 63 57

The movements of deferred taxes are as follows:

Movement of deferred taxes (€ in millions)

2011 2010

Deferred tax assets, net as at January 1 57 (21)

Deferred tax income 32 76

Change in consolidated companies 1) (9) –

Change in deferred taxes attributable to effective

portion of qualifying hedging instruments recorded

in equity 2) (21) (12)

Currency translation differences 0 11

Change in deferred taxes attributable to actuarial

gains and losses recorded in equity 3) 4 3

Deferred tax assets, net as at December 31 63 57

1) See Note 03.

2) See Note 28.

3) See Note 23.

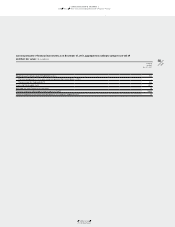

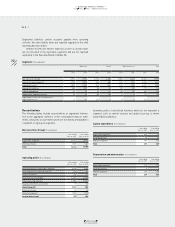

Gross Group deferred tax assets and liabilities after valuation allow-

ances, but before appropriate offsettings, are attributable to the items

detailed in the table below:

Deferred taxes (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Non-current assets 121 127

Current assets 125 111

Accrued liabilities and provisions 209 203

Accumulated tax loss carry-forwards 76 101

Deferred tax assets 531 542

Non-current assets 393 443

Current assets 49 19

Accrued liabilities and provisions 26 23

Deferred tax liabilities 468 485

Deferred tax assets, net 63 57

Deferred tax assets are recognised only to the extent that the real-

isation of the related benefit is probable. For the assessment of

probability, in addition to past performance and the respective pros-

pects for the foreseeable future, appropriate tax structuring measures

are also taken into consideration.

Deferred tax assets for which the realisation of the related tax

benefits is not probable increased on a currency-neutral basis from

€ 325 million to € 328 million for the year ending December 31, 2011.

These amounts mainly relate to tax losses carried forward and unused

foreign tax credits of the US tax group. The remaining unrecognised

deferred tax assets relate to subsidiaries operating in markets where

the realisation of the related tax benefit is not considered probable.

The Group does not recognise deferred tax liabilities for unremitted

earnings of non-German subsidiaries to the extent that they are

expected to be permanently invested in international operations. These

earnings, the amount of which cannot be practicably computed, could

become subject to additional tax if they were remitted as dividends or

if the Group were to sell its shareholdings in the subsidiaries.

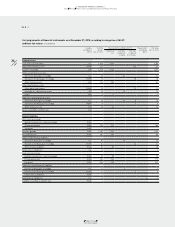

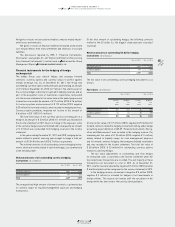

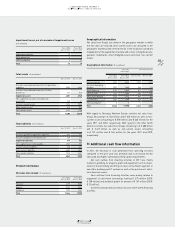

Tax expenses

Tax expenses are split as follows:

Income tax expenses (€ in millions)

Year ending

Dec. 31, 2011

Year ending

Dec. 31, 2010

Current tax expenses 289 314

Deferred tax (income) (32) (76)

Income tax expenses 257 238