Reebok 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

154

2011

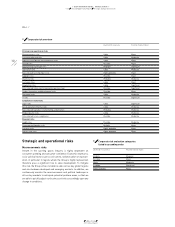

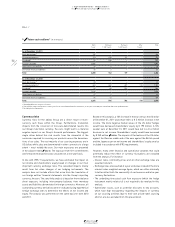

03.4 Risk and Opportunity Report Compliance-related risks Financial risks

03.4

Risks related to product counterfeiting and imitation

As popular consumer brands which rely on technological and design

innovation as defining characteristics, the Group’s brands are

frequent targets for counterfeiting and imitation. To reduce the loss

of sales and the potential damage to brand reputation resulting from

counterfeit products, the adidas Group makes use of extensive legal

protection (generally through registration) and works closely with law

enforcement authorities, investigators and external legal counsel.

Although we have stepped up measures such as product security

labelling with our authorised suppliers, the development of these

measures remains a key priority on an ongoing basis. In 2011, around

12 million counterfeit adidas Group products were seized worldwide.

As a result of our relentless and intensive efforts against counter-

feiting, we believe the risks related to counterfeiting and imitation

have decreased, and we now regard the likelihood of occurrence

as probable. However, we continue to assess the potential financial

impact related to counterfeiting and imitation as moderate.

Product quality risks

The adidas Group faces a risk of selling defective products, which may

result in injury to consumers and/or image impairment. We mitigate

this risk by employing dedicated teams that monitor the quality of our

products on all levels of the supply chain through rigorous testing

prior to production, close cooperation with suppliers throughout the

manufacturing process, random testing after retail delivery, open

communication about defective products and quick settlement of

product liability claims when necessary. In 2011, we did not recall any

products.

As product quality requirements are becoming increasingly stringent,

we believe the likelihood of occurrence of significant product liability

cases or having to conduct wide-scale product recalls has increased

to likely. However, we continue to assess the potential financial impact

as moderate.

Risks related to non-compliance

We face the risk that our employees breach rules and standards that

guide appropriate and responsible business behaviour. This includes

the risks of fraud and corruption. In order to successfully manage

these risks, the Group Policy Manual was launched at the end of 2006

to provide a framework for basic work procedures and processes. It

also includes a Code of Conduct which stipulates that every employee

shall act ethically in compliance with the laws and regulations of

the legal systems where they conduct Group business. All of our

employees have to participate in a special Code of Conduct training

as part of our Global Compliance Programme. Various mechanisms

are in place to monitor compliance. Whenever reasonable, we actively

investigate and, in case of unlawful conduct, we work with state

authorities to ensure rigorous enforcement of criminal law.

As a result of the substantial growth of our global workforce in recent

years, we believe that both the impact and likelihood of occurrence of

risks related to non-compliance have increased. We now regard the

likelihood of risks related to non-compliance as possible. In case they

should materialise, risks from non-compliance could have a moderate

financial impact.

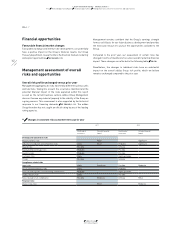

Financial risks

Credit risks

A credit risk arises if a customer or other counterparty to a financial

instrument fails to meet its contractual obligations. The adidas Group

is exposed to credit risks from its operating activities and from certain

financing activities. Credit risks arise principally from accounts

receivable and, to a lesser extent, from other third-party contractual

financial obligations such as other financial assets, short-term bank

deposits and derivative financial instruments

SEE NOTE 28, P. 202

. Without

taking into account any collateral, the carrying amount of financial

assets and accounts receivable represents the maximum exposure to

credit risk.

At the end of 2011, there was no relevant concentration of credit risk

by type of customer or geography. Our credit risk exposure is mainly

influenced by individual customer characteristics. Under the Group’s

credit policy, new customers are analysed for creditworthiness before

standard payment and delivery terms and conditions are offered.

Tolerance limits for accounts receivable are also established for

each customer. Both creditworthiness and accounts receivable limits

are monitored on an ongoing basis. Customers that fail to meet the

Group’s minimum creditworthiness are in general allowed to purchase

products only on a prepayment basis.