Reebok 2011 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

CONSOLIDATED FINANCIAL STATEMENTS

197

2011

197

2011

04.8 Notes Notes to the Consolidated Statement of Financial Position

The asset ceiling effect arises from the German funded defined benefit

plan and is recognised in the consolidated statement of comprehen-

sive income.

The determination of assets and liabilities for defined benefit

plans is based upon statistical and actuarial valuations. In particular,

the present value of the defined benefit obligation is driven by financial

variables (such as the discount rates or future increases in salaries)

and demographic variables (such as mortality and employee turnover).

The actuarial assumptions may differ significantly from the actual

results, i.e. the present value of the actual future performance may

differ from the reported present value.

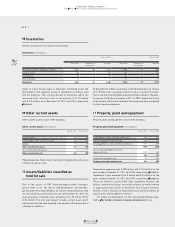

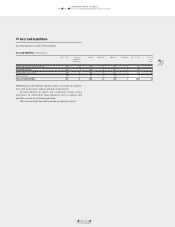

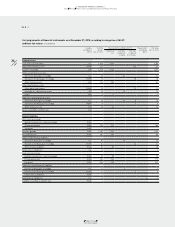

Actuarial assumptions (in %)

Dec. 31, 2011 Dec. 31, 2010

Discount rate 4.3 4.6

Expected rate of salary increases 3.3 3.3

Expected pension increases 2.1 2.0

Expected return on plan assets 4.8 5.3

The actuarial assumptions as at the balance sheet date are used to

determine the defined benefit liability at that date and the pension

expense for the upcoming financial year.

The actuarial assumptions for withdrawal and mortality rates are

based on statistical information available in the various countries, the

latter for Germany on the Heubeck 2005 G mortality tables.

The Group recognises actuarial gains or losses arising in defined

benefit plans during the financial year immediately outside the income

statement in the consolidated statement of comprehensive income.

The actuarial losses recognised in this statement for 2011 amount to

€ 13 million (2010: € 13 million). The accumulated actuarial losses

recognised amount to € 51 million (2010: € 38 million).

The expected return on plan assets assumption is set separately

for the various benefit plans. Around 90% of the plan assets are

related to plan assets in the UK, Germany and Switzerland. The

overall expected rate of return on assets is derived by aggregating the

expected rate of return for each asset class over the underlying asset

allocation. Historical markets are studied and expected returns are

based on widely accepted capital market principles.

In the UK, the assumed long-term rate of return on each asset

class is assumed to be in line with long-term government bonds, with

an additional investment return of 3.5% for equity securities and 1.0%

for corporate bonds.

In Germany, the plan assets are invested in insurance contracts

and in a pension fund, and the expected return on assets is set equal

to the expected return on the underlying insurance contracts.

The plan assets in Switzerland are held by a pension foundation

and the expected rate of return is calculated as a weighted average

per asset class, based on the investment strategy and the expected

return on the varying asset categories.

In the rest of the world, the plan assets consist predominantly of

insurance contracts, with the expected return based on the expected

return on these insurance contracts.

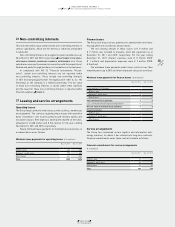

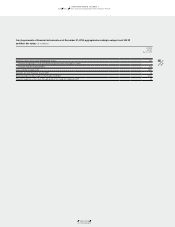

Pension expenses for defined benefit plans (€ in millions)

Year ending

Dec. 31, 2011

Year ending

Dec. 31, 2010

Current service cost 12 11

Interest cost 11 10

Expected return on plan assets (4) (4)

Pension expenses for defined benefit plans 19 17

Of the total pension expenses, an amount of € 13 million (2010:

€ 13 million) relates to employees of adidas AG. The pension expense

is recorded within the other operating expenses whereas the

production-related part thereof is recognised within the cost of sales.

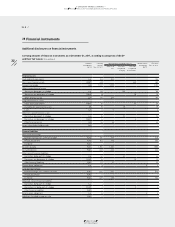

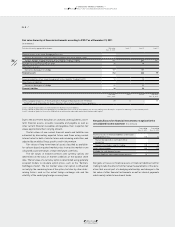

Present value of the defined benefit obligation (€ in millions)

2011 2010

Present value of the defined benefit obligation

as at January 1 237 207

Currency translation differences 3 7

Current service cost 12 11

Interest cost 11 10

Contribution by plan participants 0 0

Pensions paid (10) (12)

Actuarial loss 10 14

Plan settlements (3) –

Present value of the defined benefit obligation

as at December 31 260 237

Fair value of plan assets (€ in millions)

2011 2010

Fair value of plan assets at January 1 67 61

Currency translation differences 2 3

Pensions paid (3) (5)

Contributions by the employer 4 3

Contributions paid by plan participants 0 0

Actuarial (loss)/gain (4) 1

Expected return on plan assets 4 4

Plan settlements (3) –

Fair value of plan assets at December 31 67 67