Reebok 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

161

2011

03.4 Risk and Opportunity Report Strategic and operational opportunities

Personalised and customised products replacing

mass wear

Today’s consumers are looking for choice and variety that go beyond

choosing from a wide selection of products. We engage in developing

unique and relevant products that fit specific functional and aesthetic

requirements

SEE GROUP STRATEGY, P. 60

. For example, the adidas, Reebok

and TaylorMade brands all offer different personalisation and custom-

isation platforms reflecting each brand’s strategy. Key concepts

at adidas include mi adidas, miTeam and miCoach. For example,

miCoach is a personalised training concept that combines product

technologies with an intelligent web platform. It offers a personal

and real-time audible coaching system, enabling the consumer to

collect and visualise real-life performance data. In 2011, adidas

launched both the miCoach Football app as well as the miCoach

Running app and thus reached a new milestone in personalisation.

With mi adidas and “Your Reebok”, consumers can already design and

order completely customised adidas and Reebok footwear online and

therefore create their own unique style. At TaylorMade-adidas Golf,

the myTPball online platform offers customers the opportunity to

create and order their own golf balls. In addition, TaylorMade-adidas

Golf’s Centres of Excellence provide customised fitting sessions for

golfers with expert fitters and technicians. We expect the market for

personalised and customised footwear, apparel and hardware to grow

strongly and evolve further in the coming years and we will therefore

continue to invest in the space.

Exploiting potential of new and fast-growing

sports categories

Exploiting the potential of emerging, fast-growing sports categories is

another opportunity for our brands. Our brand teams conduct market

research and engage in trend marketing to detect changes in lifestyle

and consumer needs of our target audience as early as possible.

Changes in lifestyle, habits and attitudes can potentially result in the

emergence of new consumer needs that are not addressed by current

market product offerings. For example, we see a growing trend in the

move by athletes and sports enthusiasts towards more minimalistic

products that promote natural body movement. In order to tap into

this opportunity, we are expanding our efforts to bring to market more

lightweight and flexible products that support the athlete’s natural

course of motion. In April 2011, Reebok launched RealFlex, a running

and training shoe designed to promote natural movement. Also in 2011,

adidas unveiled its first barefoot training shoe designed specifically for

the gym, the adipure Trainer

SEE ADIDAS STRATEGY, P. 72

. Promoting pure

and natural movement by harnessing the body’s natural mechanics,

the adipure Trainer activates and strengthens muscles, builds balance

and promotes dexterity. Similarly, we see tremendous growth potential

in the outdoor and action sport categories and intend to become a

leading player in those categories over the next years. Complementing

this ambition, in November 2011, the adidas Group acquired Five Ten,

a leading brand in the technical outdoor market, which enjoys high

credibility within the outdoor action sport community.

Expanding distribution scope

The sporting goods retail environment is changing constantly. People

increasingly want to get involved with our brands. We therefore

continue to adapt our distribution strategy to cater for this change

and have made controlled space initiatives a strategic priority. This

includes retail space management with key retail partners as well

as the introduction of new own-retail store formats. For example, in

December 2011, adidas celebrated the opening of its first Style Centre

in Beijing. The 400m² store is the first one globally to house the three

sub-brands SLVR, Y-3 and Porsche Design Sport under one roof. The

three labels have individual retail environments representing their

unique identities. Throughout the year, we continued to roll out new

shop-in-shop concepts globally and also further invested in unique

point-of-sale activation. In February 2011, for example, all 680 Finish

Line stores in the USA were outfitted with ZigTech imagery. Through

initiatives like these, we believe we will be able to target our consumers

more effectively, involve them emotionally with our products and,

therefore, ultimately drive sell-through at our retail partners.

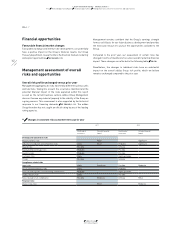

Cost optimisation drives profitability improvements

Continued optimisation of key business processes and strict cost

control are vital to achieving high profitability and return on invested

capital. We are confident that there is still significant opportunity to

further streamline cost structures throughout our Group. In order to

achieve our Route 2015 targets, we are working on various efficiency

projects to minimise costs and drive operational performance. For

example, we continuously search for ways to increase efficiency in

our supply chain and make it truly demand-driven. Furthermore,

by implementing end-to-end planning processes and improving our

replenishment capabilities, we see opportunities to not only better

serve our customers but also to reduce our operating working capital

needs

SEE GLOBAL OPERATIONS, P. 90

. Another example in this respect is

the reduction of the number of articles; this reduces workload in

the creation area and warehouse costs, and allows us to offer more

focused ranges to our retail partners.