Reebok 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

119

2011

03.2 Group Business Performance Economic and Sector Development

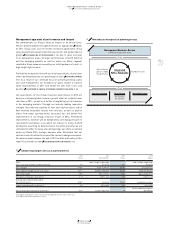

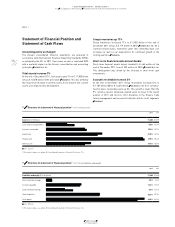

02 Quarterly unemployment rate by region

(in % of total active population)

Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

USA 1) 9.6 9.0 9.1 9.1 8.7

Euro area 2) 10.0 10.0 10.0 10.3 10.4

Japan 3) 4.9 4.6 4.6 4.1 4.6

China 4) 4.1 4.1 4.1 4.1 4.1

Russia 5) 7.2 7.1 6.1 6.0 6.1

1) Source: US Bureau of Labor Statistics.

2) Source: Eurostat.

3) Source: Japan Ministry of Internal Affairs and Communications.

4) Source: China National Bureau of Statistics.

5) Source: Russia Federal Service of State Statistics.

03 Quarterly development of Consumer Price Index 1)

(by region)

Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

USA 2) 1.5 2.7 3.6 3.9 3.0

Euro area 3) 2.2 2.7 2.7 3.0 2.7

Japan 4) 0.0 (0.5) (0.4) 0.0 (0.2)

China 5) 4.6 5.4 6.4 6.1 4.1

Russia 6) 8.8 9.5 9.4 7.2 6.1

1) Quarter-end figures.

2) Source: US Bureau of Labor Statistics.

3) Source: Eurostat.

4) Source: Japan Ministry of Internal Affairs and Communications.

5) Source: China National Bureau of Statistics.

6) Source: Russia Federal Service of State Statistics.

04 Quarterly consumer confidence development 1)

(by region)

Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

USA 2) 63.4 63.8 57.6 46.4 64.8

Euro area 3) (11.0) (11.0) (10.0) (19.3) (21.3)

Japan 4) 40.2 38.3 36.3 38.5 38.1

China 5) 100.4 107.6 108.1 103.4 97.0

Russia 6) (10.0) (13.0) (9.0) (7.0) (7.0)

1) Quarter-end figures.

2) Source: Conference Board.

3) Source: European Commission.

4) Source: Economic and Social Research Institute, Government of Japan.

5) Source: China National Bureau of Statistics.

6) Source: Russia Federal Service of State Statistics.

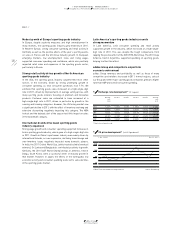

In 2011, Asian economies, excluding Japan, continued to post the

highest global GDP growth rates, increasing 7.2% (2010: 9.0%).

Including Japan, Asian GDP growth was approximately 3.9% (2010:

6.7%). In China, GDP grew 8.9%, supported by rising incomes and

strong domestic demand. India’s GDP grew 7.5%, with the falling

value of the rupee supporting healthy export activity. Japan’s economy

rebounded in the second half of 2011, as industrial output swiftly

recouped lost ground and the government introduced generous public

reconstruction programmes. However, a strengthened yen weakened

exports, which constrained private investment and weighed negatively

on domestic demand, resulting in an overall GDP contraction of 0.7%.

In Latin America, full year GDP increased 4.2% (2010: 6.7%).

Relatively low unemployment levels and wage growth helped support

consumption and domestic demand in the region. However, falling

demand from the USA and Europe began to impact growth in exports

and production as the year progressed.

Positive growth in the global sporting goods industry

In 2011, the global sporting goods industry outperformed overall

economic development. Growth was driven in particular by robust

consumer spending in the emerging markets, which offset subdued

consumer confidence and private spending in some Western

European markets and in Japan. A number of regional sporting events

also contributed to the industry’s development in certain markets,

including the Rugby World Cup in New Zealand, the Copa América

in Argentina, the IAAF World Championships in South Korea and the

Cricket World Cup in India, Sri Lanka and Bangladesh. While high

commodity prices negatively impacted the industry, many suppliers

and retailers focused on premium and innovative products to protect

profitability and support margins.

From a category perspective, running was the biggest growth driver,

supported by the popularity of lightweight running footwear and high-

performance apparel products. The minimalist and barefoot footwear

categories also recorded strong growth. Additionally, the outdoor

category (especially performance fleece and base layer products) and

training posted robust sales increases.

Another major highlight for the industry in 2011 was the rapid rise

in sales via e-commerce platforms and the expansion of activities in

digital, mobile and social media. In addition, the pace of consolidation

in the industry increased in 2011, with several acquisitions, both on a

manufacturer and a retailer level, during the year.