Reebok 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

159

2011

03.4 Risk and Opportunity Report Strategic and operational opportunities

programmes for their students through the Carol M. White Physical

Education Program (PEP). Similar health-promoting programmes and

initiatives are being launched or expanded around the world. Given the

strong global market position the adidas brand enjoys, in particular in

categories considered suitable for weight loss such as training and

running, we expect to benefit from this trend. Furthermore, in associ-

ation with the London 2012 Olympic Games, adidas is also launching

multi-sport outdoor venues called ’adiZones’ in the UK, that are

designed to encourage people to participate in sport. The adiZones

will be free for the community to use and will help to break down the

barriers that prevent people from getting active, making sport partici-

pation accessible. In addition, Reebok is an official partner of ’Build

Our Kids’ Success’ (’BOKS’). Partnering with schools across the USA,

the collective mission of BOKS is to provide opportunities for children

to be physically active and create healthier habits to achieve lifelong

fitness.

Creating new social experiences to drive

sports participation

People increasingly aim to connect fitness with social experience.

Making fitness, that is seen by most to be a chore, into something fun

and enjoyable can therefore contribute significantly to drive sports

participation. Since Reebok entered the fitness world, it has always

been about making fitness a community experience. In 2011, Reebok

launched its partnership with CrossFit, a fitness and conditioning

movement which involves a fun and motivating community experience,

to help empower everyone to be fit for life. CrossFit is one of Reebok’s

key strategic programmes in establishing it as the fitness brand

SEE

REEBOK STRATEGY, P. 78

.

Ongoing fusion of sport and lifestyle

The border between pure athletics and lifestyle continues to blur as

sport becomes a more integral part in the lives of more and more

consumers. People want to be fashionable when engaging in sporting

activities without compromising on quality or the latest technological

advances. At the same time, performance features and styles are

finding their way into products meant for more leisure-oriented use.

We estimate the global sports lifestyle market to be at least three

times larger than the performance market. This development opens

up additional opportunities for our Group and our brands, which

already enjoy strong positions in this market. One example of this is

the further roll-out of the adidas NEO label as part of our Route 2015

strategic business plan. After the successful introduction in emerging

markets, mainly Greater China and Russia, in 2012, we will open

10 adidas NEO label pilot stores in Germany in order to test this fast-

fashion model in a mature market

SEE ADIDAS STRATEGY, P. 72

.

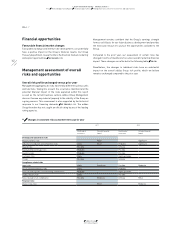

Emerging markets as long-term growth drivers

The global population has grown rapidly over the last decades and,

according to estimates by the United Nations, passed the 7 billion mark

in 2011. This development is projected to continue, with the global

population estimated to exceed 9 billion by 2050. A large portion of

this growth will be in emerging economies. Low unemployment rates,

rising real incomes as well as a growing middle class with increasing

spending power are fuelling these economies – and subsequently our

industry. Sports participation in countries such as China or India has

historically been lower than in industrialised countries. We expect

sports participation rates to increase over time with increasing leisure

time, investment in infrastructure and the broadening of awareness

of the benefits of physical activity. In addition, European and North

American sporting goods brands are often seen as highly desirable,

easily accessible, affordable luxury goods in emerging markets, which

presents an additional growth opportunity.

Women’s segment offers long-term potential

Our Group still generates the majority of its revenues in men’s and

unisex categories. However, with women accounting for more than a

third of total spending on athletic footwear, we believe the women’s

sports market is one of the most attractive segments in the sporting

goods industry. The adidas Group will therefore continue to invest in

developing women-specific product offerings in both performance and

lifestyle that emphasise female individuality, authenticity and style.

Examples today include the adidas by Stella McCartney collection,

toning footwear and apparel at Reebok, as well as a series of Burner

drivers and irons at TaylorMade specifically designed for women.

Furthermore, 2011 saw the opening of the first adidas Women’s stores

in Russia and South Korea. The stores are exclusive locations for

stylish and high-end adidas Women’s collections in two very attractive

markets for the adidas Group.