Reebok 2011 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

CONSOLIDATED FINANCIAL STATEMENTS

04.8 Notes

186

2011

186

2011

04.8

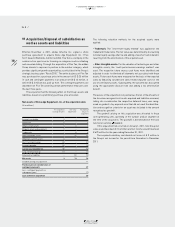

Discount rates are based on a weighted average cost of capital calcu-

lation considering a five-year average market-weighted debt/equity

structure and financing costs referencing the Group’s major competi-

tors for each cash-generating unit (or groups of units). The discount

rates used are after-tax rates and reflect the specific equity and

country risk of the relevant cash-generating unit.

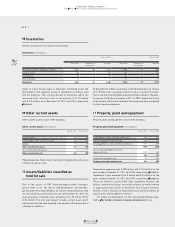

The carrying amounts of acquired goodwill as well as of intangible

assets allocated to the respective groups of cash-generating units and

the respective discount rates applied to the cash flow projections are

as follows:

Allocation of goodwill

Goodwill

(€ in millions)

Intangible

assets with

indefinite

useful lives

(€ in millions)

Discount

rate

Wholesale 940 816 7.0 – 10.5%

Retail 234 390 7.0 – 10.5%

Other Businesses 406 297 6.5 – 7.5%

Total 1,580 1,503

The goodwill shown in the table under Wholesale, Retail and Other Busi-

nesses is an aggregation of several cash-generating units. The cash-

generating units with the highest goodwill of the respective segment

are Greater China (€ 162 million), Central Europe (€ 155 million),

Northern Europe (€ 134 million) and North America (€ 105 million)

within the Wholesale segment as well as CIS (€ 79 million), North

America (€ 30 million) and Central Europe (€ 29 million) within the

Retail segment. In the Other Businesses segment, the most signifi-

cant goodwill amount represents the TaylorMade-adidas Golf segment

goodwill in an amount of € 284 million.

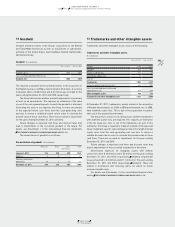

Research and development

Research costs are expensed in full as incurred. Development costs

are also expensed as incurred if they do not meet the recognition

criteria of IAS 38 “Intangible Assets”.

The Group spent € 115 million and € 102 million on product

research and development for the years ending December 31, 2011

and 2010, respectively.

Financial assets

All purchases and sales of financial assets are recognised on the

trade date. Costs of purchases include transaction costs. If the fair

value of available-for-sale financial assets (i.e. non-derivative finan-

cial assets which are not allocable under another category of IAS 39)

can be measured reliably, they are subsequently carried at fair value.

Realised and unrealised gains and losses arising from changes in the

fair value of financial assets are included in the income statement for

the period in which they arise, except for available-for-sale financial

assets where unrealised gains and losses are recognised in equity

unless they are impaired.

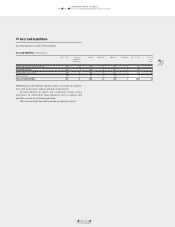

Borrowings and other liabilities

Borrowings and other liabilities are recognised at fair value using

the “effective interest method”, net of transaction costs incurred. In

subsequent periods, long-term borrowings are stated at amortised

cost using the “effective interest method”. Any difference between

proceeds (net of transaction costs) and the redemption value is recog-

nised in the income statement over the term of the borrowing.

Other provisions and accrued liabilities

Other provisions are recognised where a present obligation (legal or

constructive) to third parties has been incurred as a result of a past

event which can be estimated reliably and is likely to lead to an outflow

of resources, and where the timing or amount is uncertain. Other

non-current provisions are discounted if the effect of discounting is

material.

Accrued liabilities are liabilities to pay for goods or services

that have been received or supplied but have not been paid, invoiced

or formally agreed with the supplier, including amounts due to

employees. Here, however, the timing and amount of an outflow of

resources is not uncertain.