Reebok 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

125

2011

Operating margin improves 0.1 percentage points

Group operating profit increased 13% to € 1.011 billion in 2011 versus

€ 894 million in 2010

DIAGRAM 23

. As a result, the operating margin of

the adidas Group improved 0.1 percentage points to 7.6% (2010: 7.5%)

DIAGRAM 25

. This development was primarily due to the positive effects

from lower other operating expenses as a percentage of sales, which

more than offset the decrease in gross margin and in other operating

income.

Financial income up 25%

Financial income increased 25% to € 31 million in 2011 from

€ 25 million in the prior year, due to an increase in interest income

SEE NOTE 32, P. 209

.

Financial expenses increase 2%

Financial expenses increased 2% to € 115 million in 2011 (2010:

€ 113 million)

DIAGRAM 26

, mainly as a result of negative exchange rate

effects, which more than offset the positive effect of lower interest

expenses. Excluding the negative exchange rate effects, financial

expenses decreased 4%

SEE NOTE 32, P. 209

.

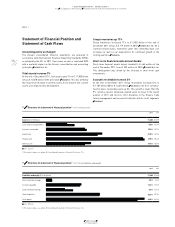

Income before taxes as a percentage of sales increases

0.2 percentage points

Income before taxes (IBT) for the adidas Group increased 15%

to € 927 million from € 806 million in 2010

DIAGRAM 27

. IBT as

a percentage of sales improved 0.2 percentage points to 6.9% in 2011

from 6.7% in 2010, primarily as a result of the Group’s operating

margin increase.

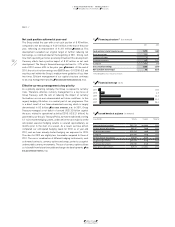

Net income attributable to shareholders up 18%

The Group’s net income attributable to shareholders increased to

€ 671 million in 2011 from € 567 million in 2010

DIAGRAM 29

. This

represents an increase of 18% versus the prior year level. The Group’s

tax rate decreased 1.8 percentage points to 27.7% in 2011 (2010:

29.5%), mainly due to one-time tax benefits related to the favourable

resolution of tax disputes for prior years.

Earnings per share reach € 3.20

In 2011, basic and diluted earnings per share amounted to € 3.20 (2010:

€ 2.71)

DIAGRAM 31

, representing an increase of 18%. The weighted

average number of shares used in the calculation was 209,216,186.

03.2 Group Business Performance Income Statement

27 Income before taxes (€ in millions)

2011 927

2010 806

2009 358

2008 904

2007 815

29 Net income attributable to shareholders (€ in millions)

2011 671

2010 567

2009 245

2008 642

2007 551

31 Diluted earnings per share (in €)

2011 3.20

2010 2.71

2009 1.22

2008 3.07

2007 2.57

28 Income before taxes by quarter (€ in millions)

Q4 2011 27

Q4 2010 7

Q3 2011 418

Q3 2010 380

Q2 2011 197

Q2 2010 176

Q1 2011 285

Q1 2010 243

30 Net income attributable to shareholders by quarter

(€ in millions)

Q4 2011 18

Q4 2010 7

Q3 2011 303

Q3 2010 266

Q2 2011 140

Q2 2010 126

Q1 2011 209

Q1 2010 168

32 Diluted earnings per share by quarter (in €)

Q4 2011 0.09

Q4 2010 0.03

Q3 2011 1.45

Q3 2010 1.27

Q2 2011 0.67

Q2 2010 0.60

Q1 2011 1.00

Q1 2010 0.80