Reebok 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

124

2011

03.2 Group Business Performance Income Statement

03.2

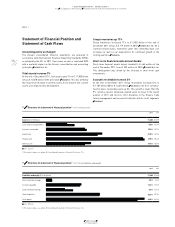

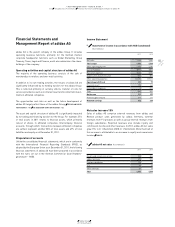

22 EBITDA (€ in millions)

2011 1,257

2010 1,159

2009 780

2008 1,280

2007 1,165

23 Operating profit (€ in millions)

2011 1,011

2010 894

2009 508

2008 1,070

2007 949

25 Operating margin (in %)

2011 7.6

2010 7.5

2009 4.9

2008 9.9

2007 9.2

26 Financial expenses (€ in millions)

2011 115

2010 113

2009 169

2008 203

2007 170

24 Operating profit by quarter (€ in millions)

Q4 2011 38

Q4 2010 28

Q3 2011 441

Q3 2010 411

Q2 2011 219

Q2 2010 195

Q1 2011 313

Q1 2010 260

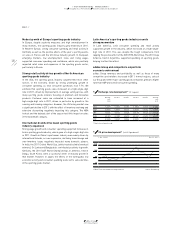

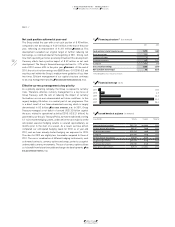

Marketing working budget down as a percentage

of sales

Marketing working budget consists of items such as expenses for

promotion partnerships, advertising and public relations to support

brand strength. As marketing working budget expenses are not

distribution channel specific, they are not allocated to the segments.

In absolute terms, marketing working budget increased 6% to

€ 1.361 billion in 2011 from € 1.288 billion in the prior year. This was

mainly due to higher expenditures at the adidas brand related to the

launch of the “all adidas” campaign. In addition, increased marketing

and promotion initiatives for new product concepts impacted this

development. By brand, the adidas marketing working budget

increased 9% to € 1.007 billion from € 927 million in 2010. Marketing

working budget of the Reebok brand was down 5% to € 235 million

(2010: € 247 million). The Group’s marketing working budget as

a percentage of sales decreased 0.5 percentage points to 10.2% (2010:

10.7%)

DIAGRAM 21

.

Operating overhead expenses decrease as a percentage

of sales

Group operating overheads include overhead costs related to

marketing, logistics, sales and R&D as well as central adminis-

tration. Almost half of the operating overhead expenses are related

to personnel costs. In absolute terms, operating overhead expenses

were up 11% to € 3.825 billion in 2011 versus € 3.450 billion in 2010.

This was primarily a result of the expansion of the Group’s own-retail

activities, as well as an increase in logistic and warehouse costs.

However, due to increasing retail sophistication as well as operational

leverage, operating overhead expenses as a percentage of sales

decreased 0.1 percentage points to 28.7% from 28.8% in the prior year.

Number of Group employees up 10%

At the end of December 2011, the Group employed 46,824 people.

This represents an increase of 10% versus the prior year level of

42,541. New hirings related to the expansion of the Group’s own-retail

store base were the main driver of this development. On a full-time

equivalent basis, the number of employees increased 12% to 40,637 at

the end of 2011 (2010: 36,444)

SEE EMPLOYEES, P. 101

.

EBITDA grows 8%

The Group’s earnings before interest, taxes, depreciation and

amortisation as well as impairment/reversal of impairment losses

on property, plant and equipment and intangible assets (EBITDA)

increased 8% to € 1.257 billion in 2011 (2010: € 1.159 billion)

DIAGRAM 22

. Depreciation and amortisation expense for tangible and

intangible assets with limited useful lives declined 4% to € 252 million

in 2011 (2010: € 263 million). This development was mainly a result

of lower impairment charges in 2011 compared to the prior year. In

accordance with IFRS, intangible assets with indefinite useful lives

(goodwill and trademarks) are tested annually and additionally when

there are indications of potential impairment. In this connection,

no impairment of intangible assets with unlimited useful lives was

incurred in 2011 and 2010.