Reebok 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

116

2011

Cost of capital metric used to measure investment

potential

Creating value for our shareholders by earning a return on invested

capital above the cost of that capital is a guiding principle of our Group

strategy. We source capital from equity and debt markets. Therefore,

we have a responsibility that our return on capital meets the expec-

tations of both equity shareholders and creditors. We calculate the

cost of capital utilising the weighted average cost of capital (WACC)

formula. This metric allows us to calculate the minimum required

financial returns of planned capital investments. The cost of equity is

computed utilising the risk-free rate, market risk premium and beta

factor. Cost of debt is calculated using the risk-free rate, credit spread

and average tax rate.

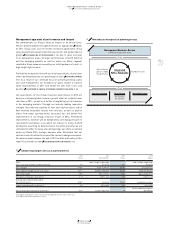

Structured performance measurement system

We have developed an extensive performance measurement system,

which utilises a variety of tools to measure the performance of the

adidas Group. The Group’s key financial metrics are monitored

and compared against budget as well as a rolling forecast on a

monthly basis. The focus is on operating cash flow, CACC, sales,

operating margin, operating working capital and net debt develop-

ment

DIAGRAM 02

. When negative deviations exist between actual

and target numbers, we perform a detailed analysis to identify and

address the cause. If necessary, action plans are implemented to

optimise the develop ment of the Group’s operating performance. We

also benchmark the Group’s financial results with those of our major

competitors on a quarterly basis. To assess current sales and profit-

ability development, Management analyses sell-through information

from our own-retail activities as well as short-term replenishment

orders from retailers.

Taking into account year-to-date performance as well as opportunities

and risks, the Group’s full year financial performance is forecasted

on a monthly basis. In this respect, backlogs comprising orders

received up to nine months in advance of the actual sale are also used

as an indicator. However, due to the growing share of own retail in

our business mix as well as fluctuating order patterns among our

wholesale partners, our order books are less indicative of anticipated

revenues compared to the past. Therefore, qualitative feedback from

our retail partners on the success of our collections at the point of sale

as well as data received from our own retail are becoming even more

important. Finally, as a further early indicator for future performance,

we also conduct market research to better measure brand appeal,

brand awareness and resulting purchase intent.

Enhanced integrated planning and management

approach

In order to further improve profitability and working capital efficiency

as well as operating cash flow development, in 2011 we started to

introduce an enhanced forecasting approach around full integration of

the major business functions such as marketing, sales and operations

at a market and global level. The centre-point of this approach is

improving the accuracy of future business planning, leading to a new

efficiency level of order book building and conversion. We connect

all relevant financial KPIs with the corresponding operational KPIs,

resulting in a comprehensive understanding of all interdependencies.

The whole process is set up in a rhythm and timeframe to facilitate

full management alignment and forecasting clarity in advance of

important business decision processes – in particular those related

to product pricing, range building, material purchasing or production

capacities. To create a seamless flow between achieving our strategic

objectives and implementing operational plans, we follow a rolling

two-year time horizon. All target-setting is fully embedded into the

integrated planning process and communicated in advance of all

relevant business decision processes.

03.1 Internal Group Management System

03.1

02 Key financial metrics

1) Excluding acquisitions and finance leases.

Gross margin Gross profit

= × 100

Net sales

Operating margin Operating profit

= × 100

Net sales

Average operating

working capital

Sum of operating working

capital at quarter-end

=

4

Operating working capital

in % of net sales

Average operating

working capital

= × 100

Net sales

Capital expenditure 1) =

Additions of property,

plant and equipment plus

intangible assets