Reebok 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

129

2011

Net cash position of € 90 million

Net cash at December 31, 2011 amounted to € 90 million, compared

to net borrowings of € 221 million at the end of December 2010,

reflecting an improvement of € 311 million. This development was

mainly driven by the cash flow generated from operating activities

over the past twelve months. Currency translation had a positive effect

in an amount of € 59 million. The Group’s ratio of net borrowings over

EBITDA amounted to –0.1 at the end of December 2011 (2010: 0.2).

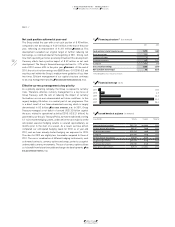

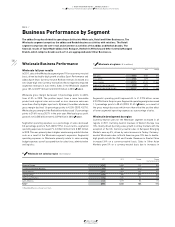

Capital expenditure grows 39%

Capital expenditure is the total cash expenditure for the purchase

of tangible and intangible assets (excluding acquisitions). Group

capital expenditure increased 39% to € 376 million in 2011 (2010:

€ 269 million). The Retail segment accounted for 26% of Group

capital expenditure (2010: 23%). Investments primarily related to the

expansion of our store base for the adidas and Reebok brands. Expend-

iture in the Wholesale segment accounted for 17% of total capital

expenditure (2010: 12%). Capital expenditure in Other Businesses

accounted for 7% of total expenditure (2010: 10%). The remaining 50%

of Group capital expenditure was recorded in HQ/Consolidation (2010:

55%) and was mainly related to investments into new office buildings

and IT infrastructure

DIAGRAM 41

.

03.2 Group Business Performance Statement of Financial Position and Statement of Cash Flows Treasur y

41 Capital expenditure by segment

42 Capital expenditure by type

2011

2011

1 50% HQ/Consolidation

2 26% Retail

3 17% Wholesale

4 7% Other Businesses

1 43% Other

2 26% Own retail

3 17% IT

4 14% Retailer support

1

1

2

2

3

3

4

4

Treasury

Group financing policy

In order to be able to meet the Group’s payment commitments at all

times, the major goal of our financing policy is to ensure sufficient

liquidity reserves, while minimising the Group’s financial expenses.

The operating activities of our Group segments and markets and the

resulting cash inflows represent the Group’s main source of liquidity.

Liquidity is planned on a rolling monthly basis under a multi-year

financial and liquidity plan. This comprises all consolidated Group

companies. Our in-house bank concept takes advantage of any

surplus funds of individual Group companies to cover the financial

requirements of others, thus reducing external financing needs

and optimising our net interest expenses. By settling intercompany

transactions via intercompany financial accounts, we are able to

reduce external bank account transactions and thus bank charges.

Effective management of our currency exposure and interest rate

risks are additional goals and responsibilities of our Group Treasury

department.

Treasury system and responsibilities

Our Group’s Treasury Policy governs all treasury-related issues,

including banking policy and approval of bank relationships, global

financing arrangements and liquidity/asset management, currency

and interest risk management as well as the management of inter-

company cash flows. Responsibilities are arranged in a three-tiered

approach:

– The Treasury Committee consists of members of the Executive Board

and other senior executives who decide on the Group’s Treasury

Policy and provide strategic guidance for managing treasury-related

topics. Major changes to our Treasury Policy are subject to the prior

approval of the Treasury Committee.

– The Group Treasury department is responsible for specific

centralised treasury transactions and for the global implementation

of our Group’s Treasury Policy.

– On a subsidiary level, where applicable and economically reasonable,

local managing directors and financial controllers are responsible

for managing treasury matters in their respective subsidiaries.

Controlling functions on a Group level ensure that the transactions

of the individual business units are in compliance with the Group’s

Treasury Policy.