Reebok 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

135

2011

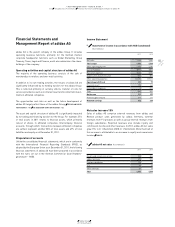

03.2 Group Business Performance Financial Statements and Management Report of adidas AG

Disclosures pursuant to § 315 Section 4 and § 289 Section 4 of the German Commercial Code

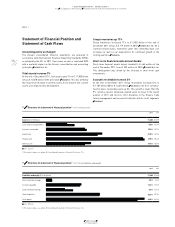

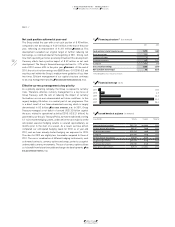

Liabilities decline 10%

Liabilities decreased € 187 million to € 3.385 billion (2010:

€ 3.572 billion). This includes a reduction of € 156 million in bank

borrowings.

Cash outflow reflects dividend distribution and reduction

in bank borrowings

adidas AG generated a positive cash flow from operating activities in

the amount of € 157 million compared to € 790 million in the prior

year. The positive cash flow was primarily a result of the net income

of € 111 million generated during the period. Net cash outflow from

investment activities was € 132 million (2010: € 108 million). This is

largely attributable to capital expenditure for tangible and intangible

fixed assets of € 98 million. Financing activities resulted in a negative

cash flow of € 323 million (2010: cash outflow of € 232 million). The

cash outflow from financing activities relates to cash outflows for the

dividend payment of € 167 million and the reduction in bank borrowings

totalling € 156 million. As a result of all these developments, cash and

cash equivalents of adidas AG decreased € 299 million to € 383 million

at the end of December 2011 compared to € 682 million at the end of

December 2010.

adidas AG has a revolving credit line of € 1.860 billion, which was

unutilised as at the balance sheet date

SEE TREASURY, P. 129

.

adidas AG is able to meet its financial commitments at all times.

Disclosures pursuant to § 315 Section 4

and § 289 Section 4 of the German

Commercial Code

Composition of subscribed capital

The nominal capital of adidas AG amounts to € 209,216,186 (as at

December 31, 2011) and is divided into the same number of registered

no-par-value shares with a pro-rata amount in the nominal capital of

€ 1 each (“shares”). As at December 31, 2011, adidas AG does not

hold any treasury shares

SEE NOTE 25, P. 198

. Pursuant to § 4 section 8

of the Articles of Association, shareholders’ claims to the issuance

of individual share certificates are in principle excluded. Each share

grants one vote at the Annual General Meeting. All shares carry the

same rights and obligations.

In the USA, we have issued American Depositary Receipts (ADRs).

ADRs are deposit certificates of non-US shares that are traded instead

of the original shares on US stock exchanges. Two ADRs equal one

share.

Restrictions on voting rights or transfer of shares

We are not aware of any contractual agreements with adidas AG or

other agreements restricting voting rights or the transfer of shares.

Based on the Code of Conduct of adidas AG, however, particular

lock-up periods do exist for members of the Executive Board with

regard to the purchase and sale of adidas AG shares. These lock-up

periods are connected with the publication of quarterly and full year

results. Such lock-up periods also exist for employees who have

access to yet unpublished financial results. In addition, restrictions of

voting rights pursuant, inter alia, to § 136 German Stock Corporation

Act (Aktiengesetz – AktG) or for treasury shares pursuant to § 71b AktG

may exist.

Shareholdings in share capital exceeding 10% of

voting rights

We have not been notified of, and are not aware of, any direct or

indirect shareholdings in the share capital of adidas AG exceeding 10%

of the voting rights.

Shares with special rights

There are no shares bearing special rights, in particular there are no

shares with rights conferring powers of control.

Voting right control if employees have a share in

the capital

Like all other shareholders, employees who hold adidas AG shares

exercise their control rights directly in accordance with statutory

provisions and the Articles of Association.