Reebok 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

118

2011

In the USA, GDP increased 1.8% compared to 3.0% in the prior year.

High fuel prices and the uncertainties created by the deficit reduction

debate were both negatives on consumer confidence and business

sentiment in the first half of the year. However, consumer spending

and business hiring revived, albeit somewhat modestly, in the second

half of the year, driven by a decline in energy prices, pent-up demand

and further monetary easing. Despite evidence that the residential

real estate market had begun to stabilise, imbalances in the mortgage

market and relatively high unemployment levels continued to limit

spending in many households.

03.2 Group Business Performance Economic and Sector Development

Group Business Performance

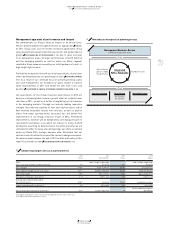

In 2011, the adidas Group delivered a strong financial performance. Currency-neutral Group sales

increased 13% as a result of double-digit growth in the Wholesale and Retail segments as well as in Other

Businesses. In euro terms, adidas Group revenues grew 11% to € 13.344 billion from € 11.990 billion in

2010. The Group’s gross margin decreased 0.3 percentage points to 47.5% (2010: 47.8%), as the increase in

input costs more than offset the positive impact from a more favourable product and regional sales mix as

well as a larger share of higher-margin Retail sales. The Group’s gross profit rose 11% to € 6.344 billion

in 2011 versus € 5.730 billion in 2010. The Group’s operating margin was up 0.1 percentage points to 7.6%

from 7.5% in 2010. This was primarily due to the positive effects from lower other operating expenses as

a percentage of sales, which more than offset a decrease in gross margin and in other operating income.

The Group’s operating profit grew 13% to € 1.011 billion in 2011 versus € 894 million in 2010. The Group’s

net income attributable to shareholders increased 18% to € 671 million from € 567 million in 2010. Basic

and diluted earnings per share grew 18% to € 3.20 in 2011 versus € 2.71 in 2010.

03.2

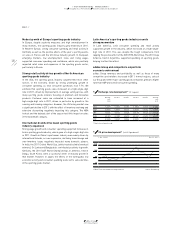

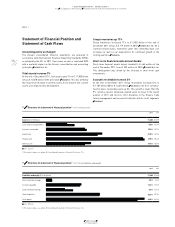

01 Regional GDP development 1) (in %)

Global Western

Europe

European

emerging

markets

USA Asia 2) Latin

America

9

6

3

0

(3)

■ 2009 ■ 2010 ■ 2011 Source: World Bank, HSBC.

1) Real, percentage change versus prior year;

2009 and 2010 figures restated compared to prior year.

2) Asia also includes Japan and Area Pacific.

Economic and Sector Development

Global economy expands 2.7% in 2011

In 2011, global GDP growth moderated to 2.7%, compared to 4.1% in

the prior year. The emerging markets grew significantly faster than

the developed economies, expanding 6.0% and 1.6% respectively.

Economic expansion was mainly driven by industrial activity and

domestic consumption in the emerging markets, particularly in China

and India. However, the European debt crisis, the downgrade of the

sovereign ratings of many major economies, the effect of the earth-

quake and tsunami in Japan, as well as political revolutions in many

Arab countries were all major challenges for and disruptions to global

economic activity during the year.

In Western Europe, GDP increased 1.5% (2010: 1.9%), driven in

particular by Germany’s domestic consumption and exports. The euro

debt crisis remained a key challenge for the region, as political uncer-

tainty on finding a resolution, acute austerity measures and fiscal

tightening inhibited confidence and economic activity.

European emerging markets’ GDP growth kept pace with the prior

year at around 4.5% (2010: 4.4%). Despite the negative effects from

the euro debt crisis and high unemployment levels in many markets,

strong domestic demand and exports positively impacted economic

growth. Russia in particular benefited from high oil prices and

increased output.