Reebok 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

117

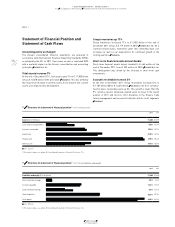

2011

03.1 Internal Group Management System

03 adidas Group targets versus actual key metrics

2010

Actual

2011

Initial outlook 1)

2011

Actual

2012

Targets

Sales

(year-over-year change, currency-neutral) 9%

mid- to high-single-digit

increase 13%

mid- to high-single-digit

increase

Gross margin 47.8% 47.5% to 48.0% 47.5% around 47.5%

Other operating expenses (in % of sales) 42.1% moderate decline 41.4% moderate decline

Operating margin 7.5% 7.5% to 8.0% 7.6% approaching 8.0%

(Diluted) earnings per share (in €) 2.71 2.98 to 3.12 3.20 3.52 to 3.68

Average operating working capital

(in % of net sales) 20.8% increase 20.8% moderate increase

Capital expenditure (€ in millions) 2) 269 350 to 400 376 400 to 450

Net cash/(net borrowings) (€ in millions) (221) further reduction 90

further reduction of gross

borrowings

1) As published on March 2, 2011. The outlook was updated over the course of the year.

2) Excluding acquisitions and finance leases.

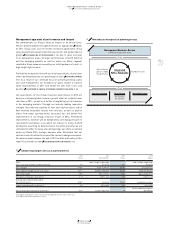

Management appraisal of performance and targets

We communicate our Group’s financial targets on an annual basis.

We also provide updates throughout the year as appropriate

TABLE 03

.

In 2011, Group sales and net income increased significantly. Group

sales development outperformed macroeconomic and global industry

growth

SEE ECONOMIC AND SECTOR DEVELOPMENT, P. 118

, due to sales increases

in all geographical areas. Stronger performances in North America

and the emerging markets as well as within our Retail segment

resulted in Group revenues exceeding our initial guidance of a mid- to

high-single-digit increase.

Profitability increased in line with our initial expectations, due to lower

other operating expenses as a percentage of sales

SEE INCOME STATEMENT,

P. 121

. As a result of our continued focus on operating working capital

and cash management, we exceeded our goals related to balance

sheet improvements in 2011 and ended the year with a net cash

position

SEE STATEMENT OF FINANCIAL POSITION AND STATEMENT OF CASH FLOWS, P. 126

.

Our expectations for the Group’s business performance in 2012 are

based on continued global economic growth, albeit at a slightly lower

rate than in 2011, as well as a further strengthening of our business

in the emerging markets. Through our industry-leading innovation

strength, the extensive pipeline of new and fresh products, which

have received favourable reviews from retailers, as well as positive

effects from major sporting events, we project top- and bottom-line

improvements in our Group’s financial results in 2012. Profitability

improvements, however, will be dampened by continuing pressure on

raw material and labour costs which our industry is facing. In 2013

and beyond, assuming no deterioration in the global economy, we are

confident to further increase sales and earnings per share as outlined

under our Route 2015 strategic business plan. We believe that our

outlook is realistic within the scope of the current trading environment.

No material event between the end of 2011 and the publication of this

report has altered our view

SEE SUBSEQUENT EVENTS AND OUTLOOK, P. 163

.

Management Business Review

Commercial Executive Team

Operations Review Sales Review

All channels

All markets

Marketing Review

Feedback results

Reconciliation

process led by

Group Finance

Integrated

KPIs + Financials

04 New industry best practice planning process