Reebok 2011 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

CONSOLIDATED FINANCIAL STATEMENTS

192

2011

192

2011

04.8

04.8 Notes Notes to the Consolidated Statement of Financial Position

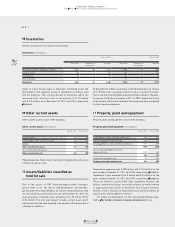

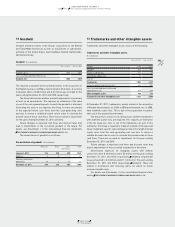

14 Long-term financial assets

Long-term financial assets include a 9.1% investment in FC Bayern

München AG (2010: 9.7%) of € 79 million (2010: € 79 million). The

percentage share held in the investment has decreased due to the

issuance of new shares which have been bought by another share-

holder. This investment is classified as “fair value through profit or

loss” and recorded at fair value. This equity security does not have a

quoted market price in an active market. Therefore, existing contrac-

tual settlements were used in order to calculate the fair value as

at December 31, 2011. Dividends are distributed by FC Bayern

München AG instead of regular interest payments.

Additionally, long-term financial assets include investments

which are mainly invested in insurance products and are measured at

fair value, as well as other financial assets.

Long-term financial assets (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Investment in FC Bayern München AG 79 79

Investments and other financial assets 18 14

Long-term financial assets 97 93

15 Other non-current financial assets

Other non-current financial assets consist of the following:

Other non-current financial assets (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Interest rate derivatives – 8

Currency options 8 12

Forward contracts 10 10

Security deposits 22 24

Other financial assets 2 –

Other non-current financial assets 42 54

Information regarding interest rate derivatives, currency options and

forward contracts is also included in these Notes

SEE ALSO NOTE 28

.

16 Other non-current assets

Other non-current assets consist of the following:

Other non-current assets (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Prepaid expenses 105 98

Sundry 2 2

Other non-current assets 107 100

Prepaid expenses mainly include prepayments for long-term promo-

tional contracts and service contracts

SEE NOTES 37 AND 27

.

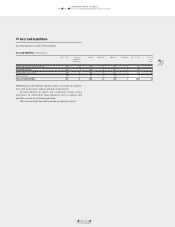

17 Borrowings and credit lines

Borrowings are denominated in a variety of currencies in which the

Group conducts its business. The largest portions of effective gross

borrowings (before liquidity swaps for cash management purposes)

as at December 31, 2011 are denominated in euros (2011: 56%; 2010:

55%) and US dollars (2011: 35%; 2010: 40%).

The weighted average interest rate on the Group’s gross

borrowings decreased to 4.9% in 2011 (2010: 5.1%).

As at December 31, 2011, the Group had cash credit lines and

other long-term financing arrangements totalling € 5.2 billion (2010:

€ 5.5 billion); thereof unused credit lines accounted for € 3.9 billion

(2010: € 3.9 billion). In addition, the Group had separate lines for the

issuance of letters of credit and guarantees in an amount of approxi-

mately € 0.2 billion (2010: € 0.3 billion).

The Group’s outstanding financings are unsecured and may include

standard financial covenants, which are reviewed on a quarterly basis.

These covenants may include limits on the disposal of fixed assets, the

maximum amount of debt secured by liens, cross default provisions

and change of control. In addition, certain financial arrangements

contain equity ratio covenants, minimum equity covenants as well as

net loss covenants.

As at December 31, 2011, and December 31, 2010, actual share-

holders’ equity was well above the amount of the minimum equity

covenant. Likewise, the relevant amount of net income clearly

exceeded net loss covenants.