Reebok 2011 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

CONSOLIDATED FINANCIAL STATEMENTS

207

2011

207

2011

04.8 Notes Notes to the Consolidated Statement of Financial Position

Net gains or losses on loans and receivables comprise mainly impair-

ment losses and reversals.

Net gains or losses on financial liabilities measured at amortised

cost include effects from early settlement and reversals of accrued

liabilities.

The disclosures required by IFRS 7 “Financial Instruments:

Disclosures”, paragraphs 31 – 42 (“Nature and Extent of Risks arising

from Financial Instruments”) can be found in

NOTE 06

and the Group

Management Report

SEE RISK AND OPPORTUNITY REPORT, P. 145

.

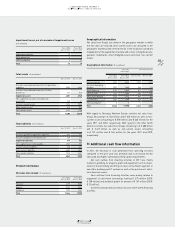

Financial instruments for the hedging of foreign

exchange risk

The adidas Group uses natural hedges and arranges forward

contracts, currency options and currency swaps to protect against

foreign exchange risk. As at December 31, 2011, the Group had

outstanding currency options with premiums paid totalling an amount

of € 5 million (December 31, 2010: € 7 million). The effective part of

the currency hedges is directly recognised in hedging reserves and as

part of the acquisition costs of inventories, respectively, and posted

into the income statement at the same time as the underlying secured

transaction is recorded. An amount of € 17 million (2010: € 16 million)

for currency options and an amount of € 101 million (2010: negative

€ 25 million) for forward contracts were recorded in hedging reserves.

Currency option premiums impacted net income in the amount of

€ 6 million in 2011 (2010: € 4 million).

The total time value of the currency options not being part of a

hedge in an amount of € 2 million (2010: € 1 million) was recorded in

the income statement in 2011. Due to a change in the exposure, some

of the currency hedges were terminated and consequently an amount

of € 2 million was reclassified from hedging reserves to the income

statement.

In the years ending December 31, 2011 and 2010, hedging instru-

ments related to product sourcing were bought to hedge a total net

amount of US $ 4.8 billion and US $ 3.7 billion, respectively.

The notional amounts of all outstanding currency hedging instru-

ments, which are mainly related to cash flow hedges, are summarised

in the following table:

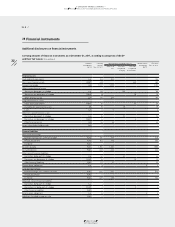

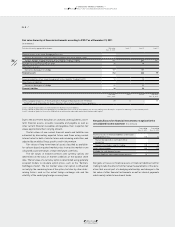

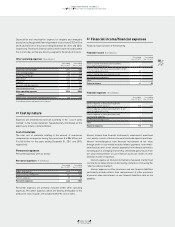

Notional amounts of all outstanding currency hedging

instruments (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Forward contracts 4,051 3,100

Currency options 376 617

Total 4,427 3,717

The comparatively high amount of forward contracts is primarily due

to currency swaps for liquidity management purposes and hedging

transactions.

Of the total amount of outstanding hedges, the following contracts

related to the US dollar (i.e. the biggest single exposure of product

sourcing):

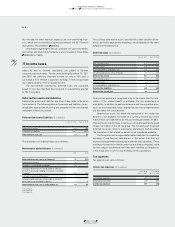

Notional amounts of outstanding US dollar hedging

instruments (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Forward contracts 2,816 2,248

Currency options 365 576

Total 3,181 2,824

The fair value of all outstanding currency hedging instruments is as

follows:

Fair values (€ in millions)

Dec. 31, 2011 Dec. 31, 2010

Positive

fair

value

Negative

fair

value

Positive

fair

value

Negative

fair

value

Forward contracts 147 (22) 40 (86)

Currency options 34 (6) 38 (15)

Total 181 (28) 78 (101)

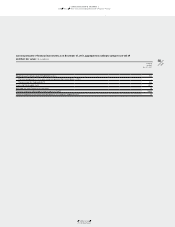

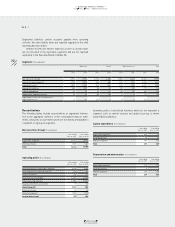

A total net fair value of € 115 million (2010: negative € 35 million) for

forward contracts related to hedging instruments falling under hedge

accounting as per definition of IAS 39 “Financial Instruments: Recog-

nition and Measurement” was recorded in the hedging reserve. The

remaining net fair value of € 10 million (2010: negative €11 million)

mainly related to liquidity swaps for cash management purposes

and to forward contracts hedging intercompany dividend receivables

and was recorded in the income statement. The total fair value of

€ 28 million (2010: € 23 million) for outstanding currency options

related to cash flow hedges.

The fair value adjustments of outstanding cash flow hedges

for forecasted sales is reported in the income statement when the

forecasted sales transactions are recorded. The vast majority of these

transactions are forecasted to occur in 2012. As at December 31,

2011, inventories were adjusted by negative € 5 million (2010: positive

€ 6 million) which will be recognised in the income statement in 2012.

In the hedging reserve, an amount of negative € 8 million (2010:

negative € 3 million) is included for hedges of net investments in

foreign entities. This reserve will remain until the investment in the

foreign entity has been sold or the loan has been paid back.