Reebok 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

156

2011

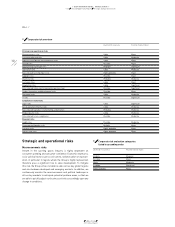

03.4 Risk and Opportunity Report Financial risks

03.4

Currency risks

Currency risks for the adidas Group are a direct result of multi-

currency cash flows within the Group. Furthermore, translation

impacts from the conversion of non-euro-denominated results into

our Group’s functional currency, the euro, might lead to a material

negative impact on our Group’s financial performance. The biggest

single driver behind this risk results from the mismatch of the

currencies required for sourcing our products versus the denomina-

tions of our sales. The vast majority of our sourcing expenses are in

US dollars while sales are denominated in other currencies to a large

extent – most notably the euro. Our main exposures are presented

in the adjacent table

TABLE 05

. The exposure from firm commitments

and forecasted transactions was calculated on a one-year basis.

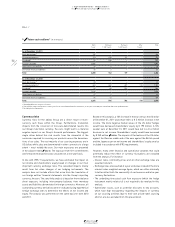

In line with IFRS 7 requirements, we have estimated the impact on

net income and shareholders’ equity based on changes in our most

important currency exchange rates. The calculated impacts mainly

result from fair value changes of our hedging instruments. The

analysis does not include effects that arise from the translation of

our foreign entities’ financial statements into the Group’s reporting

currency, the euro. The sensitivity analysis is based on the net balance

sheet exposure, including intercompany balances from monetary

assets and liabilities denominated in foreign currencies. Moreover, all

outstanding currency derivatives were re-evaluated using hypothetical

foreign exchange rates to determine the effects on net income and

equity. The analysis was performed on the same basis for both 2010

and 2011.

Based on this analysis, a 10% increase in the euro versus the US dollar

at December 31, 2011 would have led to a € 5 million increase in net

income. The more negative market values of the US dollar hedges

would have decreased shareholders’ equity by € 195 million. A 10%

weaker euro at December 31, 2011 would have led to a € 6 million

decrease in net income. Shareholders’ equity would have increased

by € 243 million

TABLE 06

. The impacts of fluctuations of the US dollar

against the Russian rouble and of the euro against the British pound

and the Japanese yen on net income and shareholders’ equity are also

included in accordance with IFRS requirements.

However, many other financial and operational variables that could

potentially reduce the effect of currency fluctuations are excluded

from the analysis. For instance:

− Interest rates, commodity prices and all other exchange rates are

assumed constant.

− Exchange rates are assumed at a year-end value instead of the more

relevant sales-weighted average figure, which we utilise internally

to better reflect both the seasonality of our business and intra-year

currency fluctuations.

− The underlying forecasted cash flow exposure (which the hedge

instrument mainly relates to) is not required to be revalued in this

analysis.

− Operational issues, such as potential discounts to key accounts,

which have high transparency regarding the impacts of currency

on our sourcing activities (due to their own private label sourcing

efforts), are also excluded from this presentation.

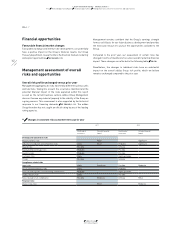

04 Future cash outflows 1) (€ in millions)

Up to

1 year

Between

1 and 3 years

Between

3 and 5 years

After

5 years

Total

As at December 31, 2011

Bank borrowings 2) 126 126

Private placements 3) 193 418 119 – 730

Eurobond 3) 24 538 – – 562

Accounts payable 1,886 – – – 1,886

Other financial liabilities 24 4 – – 28

Derivative financial liabilities 32 2 – – 34

Total 2,285 962 119 – 3,366

As at December 31, 2010

Bank borrowings 2) 95 – – – 95

Private placements 3) 320 482 237 118 1,157

Eurobond 3) 24 48 514 586

Accounts payable 1,694 – – – 1,694

Other financial liabilities 27 2 1 – 30

Derivative financial liabilities 96 12 – 108

Total 2,256 544 752 118 3,670

1) Rounding difference may arise in totals.

2) Classified as long-term (between 1 and 3 years) in the consolidated financial statements, as they are covered by the committed mid-term syndicated loan.

3) Including interest payments.